We have provided CBSE Class 12 Accountancy Sample Paper with solutions below. These Sample guess papers have been prepared as per the latest examination guidelines and paper pattern issued by CBSE. Students of Class 12 should practice all practice papers for Class 12 Accountancy given below as it will help them top improve their understanding of the subject. Please click on the links below to access free sample paper for Accountancy Class 12.

Sample Papers for Class 12 Accountancy

| CBSE Class 12 Accountancy Sample Paper Set A |

| CBSE Class 12 Accountancy Term 1 Sample Paper |

| CBSE Class 12 Accountancy Term 1 Sample Paper Set A |

| CBSE Class 12 Accountancy Term 1 Sample Paper Set B |

| CBSE Class 12 Accountancy Term 2 Sample Paper |

| CBSE Class 12 Accountancy Term 2 Sample Paper Set A |

| CBSE Class 12 Accountancy Term 2 Sample Paper Set B |

CBSE Class 12 Accountancy Term 2 Sample Paper Set A

Part – A

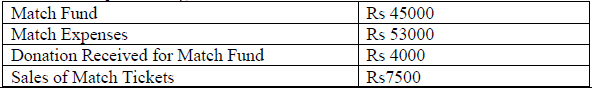

1. How will you deal with the following Items while preparing final accounts of a school for the year ending 31st March 2017:

Ans. Match fund 45000

+Donation received for Match Fund 4000

+ Sales of Match Tickets 7500

-Match Expenses 53000

Amount to be shown in balance sheet 3500

2. In case of dissolution of firm, which liabilities are to be paid first?

Ans. Outside liabilities are to be paid first.

3. Kriti, Asma and Ayyar are partners sharing profits in the ratio 4:3:3. On Ayyar’s retirement, the value of firm’s goodwill was agreed at Rs.30,000. Kriti and Asma agreed to share profits and losses in future in the ratio of 7:3 respectively. Give necessary journal entry in relation to goodwill, without opening its accounts.

Ans. (i) Kriti’s Gain 3/10

(ii) Ayyar’s Share of Goodwill 9,000

(iii) Kriti’s Capital A/c Dr. 9,000

To Ayyar’s Capital A/c Dr. 9,000

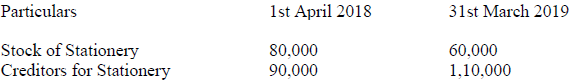

4. On the basis of the information mentioned below, calculated the stationery amount to be debited to income and expenditure account of a Good Health Sports Club for the year end 31st March 2019. Amount paid for Stationery during the year is 4,70,000

Ans.

OR

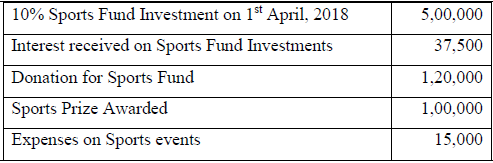

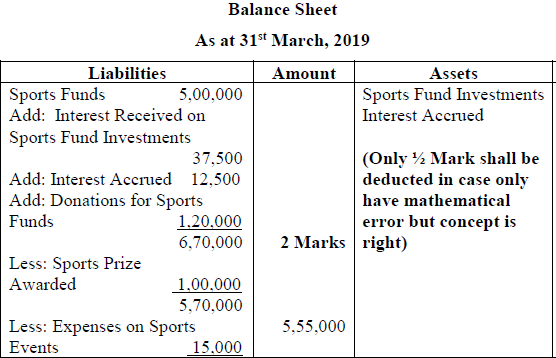

Show how would you deal with the following items while preparing the Balance Sheet of a Club as at 31st March 2019.

Ans.

5 Ramesh, Toni and Roni are partners sharing profits in the ratio 3:2:1. Ramesh died on 10 April, 2021. The sales and profit of 2020-21 were Rs.3,00,000 and Rs.45,000 respectively. Sales from 1st January, 2021 to April 10 was Rs.1,20,000. Find share of Ramesh’s profit and pass necessary journal entry if:

(i)There is no change in profit sharing ratio of Toni and Roni.

(ii)Toni and Roni decided to share future profits in ratio 3:2.

Ans. Ramesh’s share of profit 9,000

(i)Profit and Loss Suspense A/c Dr. 9,000

To Ramesh’s Capital A/c 9,000

(ii)Toni’s Capital A/c Dr. 4,800

Roni’s Capital A/c Dr. 4,200

To Ramesh’s Capital A/c 9,000

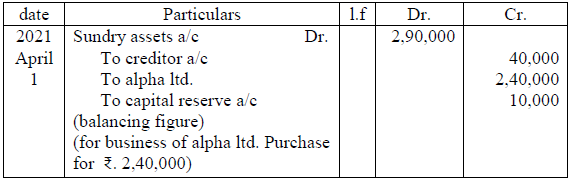

6. CNC Ltd. Acquired assets worth ₹ 2,90,000 and liabilities worth ₹ 40,000 of Alpha ltd. For ₹ 2,40,000 and issued 10% debentures at a premium of 20% to vendor on 1st April 2021. On 1st June 2021 it took bank loan for ₹ 1,30,000 from Dena bank and issued debentures worth ₹ 1,50,000 as collateral security. Record these transactions in the books of CNC ltd.

Ans. Journal

OR

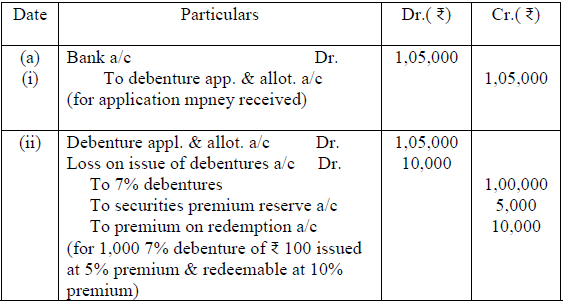

Pass journal entries for issue of 1,000, 7% debentures of ₹ 100 each in the following case:

a) Issued at 5% premium redeemable at a premium of 10%.

Ans. Journal

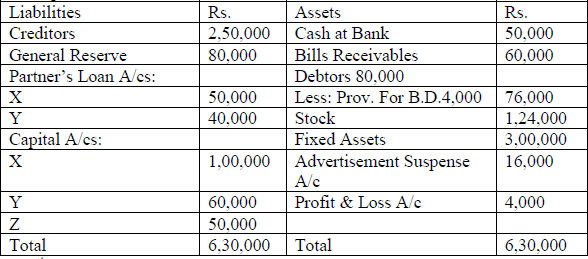

7. Following in the Balance Sheet of X, Y and Z as on 31st March, 2020. They shared profits in the ratio of 3:3:2.

On 1st April, 2020, Y decided to retire from the firm on the following terms:

(a) Stock to be depreciated by Rs.12,000

(b) Advertisement Suspense A/c to be written off

(c) Provision for Bad and doubtful debts to be increased to Rs.6,000

(d) Fixed Assets be appreciated by 10%

(e) Goodwill of the firm be valued at Rs.80,000 and amount due to retiring partner be adjusted in X’s and Z’s capital A/cs

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet to give effect to the above.

Ans. a. Profit on Revaluation will be

X 6,000

Y 6,000

Z 4,000

b. Balance of Partners’ Capital A/cs

X 1,10,500

Z 57,000

c. Amount transferred to Y’s Loan A/c 1,18,500

Total of Balance Sheet 6,26,000

Or

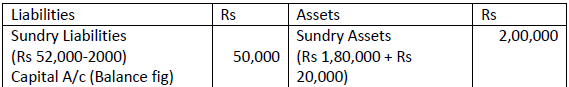

P, Q and R are partners in a firm sharing profit in the ratio of 2:2:1. On 31st December, 2021, the firm was dissolved. On dissolution, the following particulars are available:

(i) Assets realized Rs 1,80,000 after a loss of Rs 20,000.

(ii) Liabilities were paid Rs 52,000 including an unrecorded liability of Rs 2,000.

(iii) Realization expenses paid Rs 3,000.

(iv) On the date of dissolution, partners’ capital was in the ratio of 2:2:1. Prepare Realization Account

Ans. Memorandum Balance Sheet

8. i. Meghnath Ltd. took a loan of ₹ 1,20,000 from the bank and deposited 1,400, 8% Debentures of ₹ 100 each as collateral security along with primary security worth ₹ 2 lakh. Record necessary journal entries.

How would you show the issue of Debentures and Bank loan in the Balance Sheet of the Company?

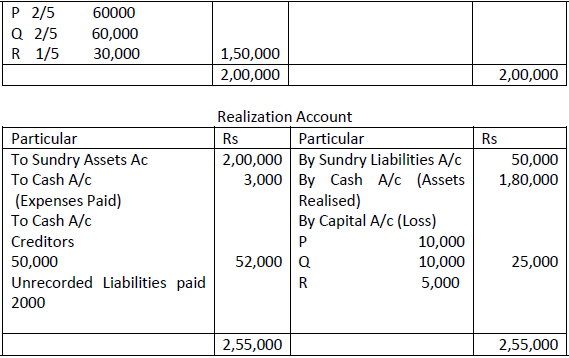

ii. Give journal entries for the issue of debentures in the following conditions:

a. Issued 2,000, 12% Debentures of ₹ 100 each at a discount of 2%, redeemable at par.

b. Issued 2,000, 12% Debentures of ₹ 100 each at a premium of 5%, redeemable at a premium of 10%.

Ans. i. Journal of Meghnath Ltd.

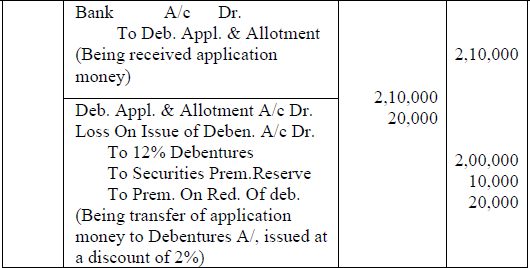

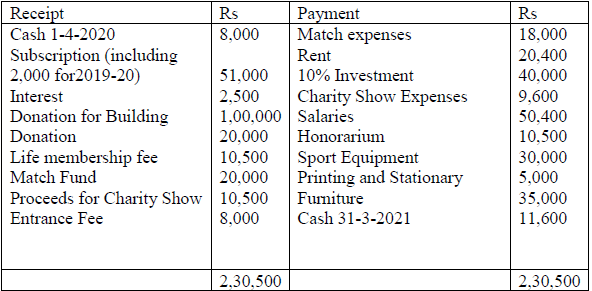

9. Following is the Receipt and Payment Account of St Sofia club for the Year ended 31st March 2021

On 1-4-2020, Club owned Land and Building valued Rs 1,10,000 and Sports Equipment Rs 20,000. Subscription due on 31-3-2020 were Rs 3,000 and subscription unpaid on 31-3-2021 was Rs 6000.

Prepare Income and Expenditure account and Balance sheet assuming that 50% entrance fees and donation be capitalised and sports equipment as on 31-3-2021 valued at Rs 42,000.

Ans. Deficit 21400:Capital Fund 1,41,000 Total of balance sheet 2,46,100

Part – B

10. Cash advances and loans made by financial enterprises will be shown under which type of activity while preparing cash flow statement? Give reason in support of your answer.

Ans. Operating activity. Reasons: Advances and Loan made by financial enterprises is their main operating activity

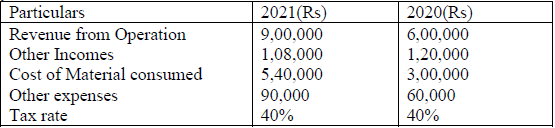

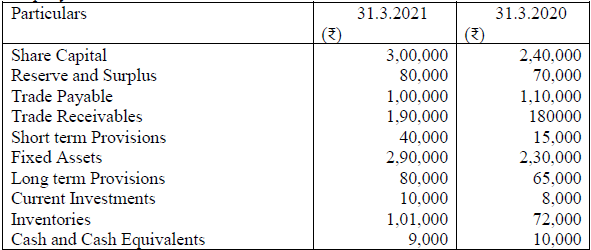

11. From the following information, prepare comparative income statement for the year ended 2020 and 2021

Ans.

OR

Ramanuja ltd decided to set up a charitable dispensary to provide free medical facilities to weaker sections of the society. Following data is derived from the company books:

Ans.

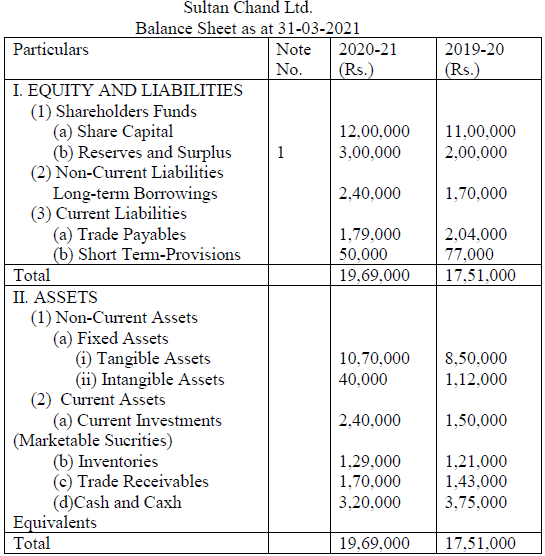

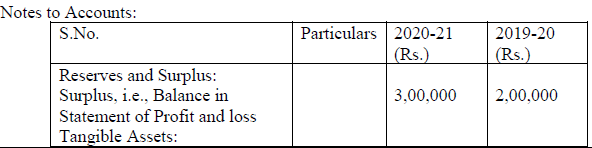

12. Following is the Balance Sheet of Sultan Chand Ltd as at 31-03-2021

Ans. Cash flow from operating activity = Rs.1,53,000

Cash flow from Investing activity = Rs.(2,88,000)

Cash flow from Financing activity = Rs1,70,000

Net increase in Cash and cash equivalent =

Rs.35,000

Opening Balance Of cash and cash Equivalent:-

Current Investments = 1,50,000 Rs.5,25,000

Cash and Cash equivalents = 3,75,000

Closing balance of cash and cash equivalents:

Current Investments 2,40,000

Cash and Cash equivalents 3,20,000

Rs.5,60,000

Machinery Account