See below CBSE Class 12 Accountancy Term 1 Sample Paper Set A with solutions. We have provided CBSE Sample Papers for Class 12 Accountancy as per the latest paper pattern issued by CBSE for the current academic year. All sample papers provided by our Class 12 Accountancy teachers are with answers. You can see the sample paper given below and use them for more practice for Class 12 Accountancy examination.

CBSE Sample Paper for Class 12 Accountancy Term 1 Set A

Part – I

Section – A

1. At the time of change in profit sharing ratio, workmen compensation reserve existing in the balance sheet against which no liabilities exist, is transferred to capital account of partners in their ……… .

(a) old profit sharing ratio

(b) new profit sharing ratio

(c) sacrificing ratio

(d) gaining ratio

Answer

A

2. …………… interest is allowed by the company on the amount of calls-in-advance.

(a) 12% p.a.

(b) 6% p.a.

(c) 8% p.a.

(d) 15% p.a.

Answer

A

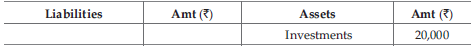

3. X and Y are partners in a firm sharing profits in the ratio of 3 : 2. An extract of their Balance Sheet is as follows

If half of the investments are taken over by X and Y in their profit sharing ratio at book value, what amount of investments will be shown in revised balance sheet?

(a) ₹ 20,000

(b) ₹ 10,000

(c) ₹ 5,000

(d) ₹ 40,000

Answer

B

4. X and Y are partners sharing profits in the ratio of 10 : 2. Z is admitted and the new profit sharing ratio is now 10 : 6 : 4. At the date of admission, general reserve appears in the books at ₹ 24,000. Y’s share in the reserve will be

(a) ₹ 4,000

(b) ₹ 20,000

(c) ₹ 7,200

(d) None of these

Answer

A

5. ……… shares confer voting rights on its holders.

(a) Equity

(b) Redeemable preference

(c) Participatory preference

(d) None of these

Answer

A

6. Match the column.

Codes

A B C

(a) (iii) (i) (ii)

(b) (ii) (i) (iii)

(c) (iii) (ii) (i)

(d) (i) (ii) (iii)

Answer

A

7. P , Q and R are partners sharing profits in the ratio of 3 : 2 : 1. They agree to admit Z into the firm. P , Q and R agreed to give 1/3 rd, 1/6 th and 1/9 th share of their profit. The share of profit of Z will be

(a) 11/54

(b) 13/54

(c) 1/10

(d) 12/54

Answer

B

8. When share application amount is received in lumpsum, ……… is credited while bank account is debited.

(a) share application and allotment account

(b) share capital account

(c) share allotment account

(d) None of these

Answer

A

9. Which of the following appears in profit and loss appropriation account?

(i) Interest on partner’s capital.

(ii) Interest on the partner’s loan.

(ii) Manager’s commission on net profit.

(a) (i), (ii), (iii)

(b) (ii), (iii), (i)

(c) (iii), (ii), (i)

(d) Only (i)

Answer

D

10. XYZ Ltd. called first callmoney of ₹3 per share on its 50,000 shares.Ashareholder holding 2,750 shares failed to pay the amount. How much amount will be due on first call?

(a) ₹ 1,41,750

(b) ₹ 1,57,000

(c) ₹ 1,50,000

(d) ₹ 1,47,750

Answer

C

11. Sonu and Monu are partners sharing profits and losses in the ratio of 3 : 2. Tonu is admitted for 1/5th share in profits of the firm which he gets entirely from Sonu. Find out the new profit sharing ratio.

(a) 12 : 8 : 5

(b) 8 : 12 : 5

(c) 2 : 2 : 1

(d) 2 : 2 : 2

Answer

C

12. Amount payable on shares can be received in installments by the company. What is the first installment called?

(a) Application money

(b) Allotment money

(c) First call money

(d) Second call money

Answer

A

13. X, Y and Z are partners in a firm sharing profits in the ratio of 5 : 3 : 2. As per partnership deed, Z is to get a minimum amount of ₹ 1,000 as profit. Net profit for the year is ₹ 4,000. Calculate deficiency (if any) to Z.

(a) ₹ 75

(b) ₹ 200

(c) ₹ 150

(d) None of these

Answer

B

14. Tia , Pia and Sia are partners sharing profits equally. Tia drew regularly ₹ 2,000 in the beginning of every month for the six months ended 30th September, 2020. Calculate interest on Tia’s drawings @ 5% p.a.

(a) ₹ 100

(b) ₹ 600

(c) ₹ 175

(d) ₹ 350

Answer

C

15. A and B are partners sharing profits in the ratio of 5 : 1. C is admitted and the new profit sharing ratio is now 5 : 3 : 2. Upon admission, general reserve appears in the books at ₹ 48,000. B’s share in the reserve will be ……… .

(a) ₹ 8,000

(b) ₹ 40,000

(c) ₹ 14,400

(d) None of these

Answer

A

16. Issue and allotment of shares to a selected group of persons privately and not to public in general through public issue is known as ……… of shares.

(a) right issue

(b) employees stock option plan

(c) private placement

(d) All of these

Answer

C

17. A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. They have admitted Z into the partnership for 1/6th share. Investment Fluctuation Fund appears in the balance at ₹ 13,500 and Investment (cost) at ₹ 1,50,000 . If the market value of investments is ₹ 1,45,000. Investment Fluctuation Fund will be shown at ……… .

(a) ₹ 13,500

(b) ₹ 10,000

(c) ₹ 5,000

(d) ₹ 6,500

Answer

C

18. If a partner withdraws equal amount at the end of each quarter, then ……… months are to be considered for interest on total drawings.

(a) 5.5

(b) 6

(c) 4.5

(d) 7.5

Answer

C

Section – B

19. A and B are partners sharing profits in the ratio of 3 : 2. They admit Z as a new partner. After his admission, the profit sharing ratio becomes 5 : 5 : 3. On the date of Z’s admission, goodwill of the firm is valued at ₹ 1,30,000. The amount of goodwill brought in by Z will be

(a) ₹ 50,000

(b) ₹ 1,00,000

(c) ₹ 30,000

(d) ₹ 1,30,000

Answer

C

20. Find the closing balance of capital account from the given information.

Opening balance of capital account as at 1st April, 2020 of A and B are ₹ 5,00,000 and ₹ 5,40,000 respectively. A is entitled to take salary for ₹ 1,000 per month and B is to take commission for ₹ 20,000.

(a) A = ₹ 5,40,000, B = ₹ 5,80,000

(b) A = ₹ 5,00,000, B = ₹ 5,40,000

(c) A = ₹ 5,12,000, B = ₹ 5,60,000

(d) A = ₹ 5,60,000, B = ₹ 5,12,000

Answer

C

21. XYZ Ltd has in its Memorandum of Association, capital clause stating that it is formed with 7,500 equity shares of ₹ 100 each. The company has issued the entire shares and the public has also subscribed and paid up for the full amount on application itself.

What will be the subscribed capital?

(a) ₹ 7,50,000

(b) ₹ 1,00,000

(c) ₹ 10,000

(d) ₹ 75,000

Answer

A

22. Which of the following is not correct in relation to right of a partner?

(i) Right to inspect the books of the firm

(ii) Right to take part in the affairs of the company

(iii) Right to share the profits/losses of the firm

(iv) Right to receive salary at the end of each month

(a) (i) and (ii)

(b) (i) and (iv)

(c) Only (iv)

(d) Only (i)

Answer

C

23. Assertion(A) A private company restricts the right to transfer its shares.

Reason (R) A private company is allowed to make any invitation to the public to subscribe for any securities of the company.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

24. Sacrificing ratio is computed

(a) when profit sharing ratio is changed

(b) when a new partner is admitted

(c) Both (a) and (b)

(d) when a partner leave the firm

Answer

C

25. Assertion (A) A charitable dispensary run by 10 members is deemed to be a partnership firm.

Reason (R) For a partnership business there must be a business and there must be sharing of profits among the partners from such business.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

D

26. PQR Ltd is registered with a capital of 1,00,000 equity shares of ₹ 10 each. 60,000 equity shares were offered for subscription to public. Applications were received for 60,000 shares. All calls were made and amount was duly received except final call of ₹ 2 on 8,000 shares. What will be the amount of share capital shown in the balance sheet?

(a) ₹ 6,00,000

(b) ₹ 5,84,000

(c) ₹ 58,400

(d) ₹ 60,000

Answer

B

27. Assertion (A) At the time of change in profit sharing ratio , it is important to determine the sacrificing ratio and gaining ratio.

Reason (R) At the time of change of change in profit sharing ratio ,gaining partner compensates the sacrificing partner by paying him proportionate amount of goodwill.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

28. A shareholder to whom 9,000 shares of ₹ 10 per share allotted, failed to pay first and final call of ₹ 2 per share. How will it be recorded in the books of company?

(a) ₹ 18,000 will be debited to Calls-in-arrear A/c

(b) ₹ 18,000 will be debited to Share Forfeiture A/c

(c) ₹ 18,000 will be credited to Calls-in-arrear A/c

(d) ₹ 18,000 will be credited to Share Forfeiture A/c

Answer

A

29. Ram and Zen are two partners sharing profits in the ratio of 2 : 1. Ben , a new partner is admitted for 1/4th share. At the time of admission, loss from revaluation is ₹ 4,500.

Entry for distribution of loss is

Ram ’s Capital A/c Dr X

Zen’s Capital A/c Dr Y

To Revaluation A/c Z

Here X , Y , Z are

(a) ₹ 3,000, ₹ 1,500, ₹ 4,500 respectively

(b) ₹ 1,500, ₹ 3,000, ₹ 4,500 respectively

(c) ₹ 3,500, ₹ 1,000, ₹ 4,500 respectively

(d) ₹ 1,000, ₹ 3,500, ₹ 4,500 respectively

Answer

A

30. ……… is that part of un-called capital, which is to be called only in the liquidation of a company.

(a) Un-reserved Capital

(b) Reserve Capital

(c) Capital Reserve

(d) Calls-in-arrear

Answer

B

31. Nita is a partner in a firm with a fixed capital of ₹ 80,000. He withdrew ₹ 5,000 during the financial year. Journal entry will be

(a) Drawings A/c Dr 5,000

To Nita’s Current A/c 5,000

(b) Drawings A/c Dr 5,000

To Nita’s Capital A/c 5,000

(c) Nita’s Current A/c Dr 5,000

To Drawings A/c 5,000

(d) Nita’s Capital A/c Dr 5,000

To Drawings A/c 5,000

Answer

C

32. Zen Ltd purchased a Machinery from Kisan Ltd for ₹ 2,25,000. Zen Ltd. immediately paid ₹ 45,000 by bank draft and the balance by issue of preference shares of ₹ 100 each at 20% premium for the purchase consideration of machinery. Number of preference shares issued will be ……… .

(a) 1,500

(b) 15,000

(c) 1,800

(d) 18,000

Answer

A

33. Which of the following is correct with regard to usage of balance of share forfeiture account?

(i) Provide for discount given at the time of reissue

(ii) Write-off preliminary expenses

(iii) Write-off bad debts

(a) (i) and (ii)

(b) Only (i)

(c) Only (iii)

(d) (i) and (ii)

Answer

B

34. On the admission of a new partner, increase in the value of assets is debited to

(a) revaluation account

(b) assets account

(c) old partners’ capital account

(d) None of the above

Answer

A

35. In a firm, 10% of net profit after deducting all adjustments, including reserve is transferred to general reserve. Net profit after all adjustments but before transfer to general reserve is ₹ 44,000. Amount to be transferred to reserve is ……… .

(a) ₹ 2,500

(b) ₹ 4,000

(c) ₹ 4,400

(d) ₹ 2,200

Answer

B

36. At the time of admission of a partner, undistributed profits appearing in the balance sheet of the old firm is transferred to the capital account of

(a) old partners in old profit sharing ratio

(b) old partners in new profit sharing ratio

(c) all the partner in the new profit sharing ratio

(d) None of the above

Answer

A

Section – C

Raj and Taj are partners engaged in the business of manufacturing and selling electrical appliances.

They share profits and losses in 3 : 2 ratio. Their initial fixed capital contribution was ₹ 6,00,000 and ₹ 4,00,000 respectively.

At the end of first year their profit was ₹ 6,00,000 before allowing the remuneration of ₹ 15,000, per quarter to Raj and ₹ 10,000 per half year to Taj. The performance for first year was providing and encouraging, therefore, they decided to expand the area of operations.

For this purpose, they needed additional machinery and a person to support. After six months of the accounting year they decided to admit Rohan as a new partner and offered him 20% as a share of profits along with monthly remuneration of ₹ 12,500, Rohan was bought ₹ 6,50,000 for capital and ₹ 3,50,000 for premium for goodwill. Besides this Rohan extended ₹ 5,00,000 as loan for two years.

37. Upon the admission of Rohan, the sacrifice for providing his share of profits would be done by

(a) Only Raj

(b) Only Taj

(c) Raj and Taj equally

(d) Raj and Taj in the ratio of 3 : 2

Answer

D

38. Rohan will be entitled to a remuneration of ……… at the end of the year.

(a) ₹ 55,000

(b) ₹ 65,000

(c) ₹ 75,000

(d) ₹ 70,000

Answer

C

Chrome Ltd was incorporated on 1st April, 2020. It has its registered office in Bengaluru. It invited applications for 1,00,000 equity shares of ₹ 10 each. The shares were issued at a premium of ₹ 5 per share. The amount was payable as follows.

On application and allotment ₹ 8 per share (including premium ₹ 3). The balance including premium on the first and final call.

Applications for 1,50,000 shares were received. Applications for 10,000 shares were rejected and pro-rata allotment was made to the remaining applicants on the following basis

(i) Applicants for 80,000 shares were allotted 60,000 shares.

(ii) Applicants for 60,000 shares were allotted 40,000 shares.

Sonu, who belonged to the first category and was allotted 300 shares, failed to pay the first call money. Monu , who belonged to the second category and was allotted 200 shares, also failed to pay the first call money. Their shares were forfeited. The forfeited shares were re-issued @ ₹ 12 per share fully paidup.

39. Number of shares applied by Sonu and Monu is ……… .

(a) Sonu 400, Monu 300

(b) Sonu 300, Monu 400

(c) Sonu 300, Monu 200

(d) Sonu 200, Monu 300

Answer

A

40. What is the amount of security premium reflected in the balance sheet at the end of the year?

(a) ₹ 5,01,000

(b) ₹ 2,00,000

(c) ₹ 3,00,000

(d) ₹ 4,99,000

Answer

D

41. What is the amount of calls-in-advance received on application?

(a) ₹ 3,00,000

(b) ₹ 3,20,000

(c) ₹ 2,00,000

(d) ₹ 2,40,000

Answer

B

Part – II

Section – A

42. ………… is ideal level of liquid ratio.

(a) 1:1

(b) 2:2

(c) 3:3

(d) All of these

Answer

A

43. Equal increase in current assets and current liabilities would result in ………… when current ratio is 2 : 1.

(a) no change in current ratio

(b) increase in current ratio

(c) decrease in current ratio

(d) current ratio will be double

Answer

C

44. Livestock is shown under which sub-head?

(a) Intangible fixed assets

(b) Inventories

(c) Trade receivables

(d) Tangible fixed assets

Answer

D

45. Creditors are interested to know the ……… from financial statement analysis.

(i) liquidity

(ii) profitability

(iii) efficiency

(iv) capital

(a) (i) and (ii)

(b) Only (i)

(c) (i), (ii) and (iii)

(d) Only (iii)

Answer

B

46. Which of the following is true in relation to financial statements of a company?

(i) Preparation of balance sheet

(ii) Preparation of statement of profit and loss

(iii) Preparation of cash flow statement

(a) Only (i)

(b) (i) and (ii)

(c) Only (iii)

(d) (i), (ii) and (iii)

Answer

D

47. Out of the following, which are limitations of ratio analysis?

(i) Ratio analysis may result in false results, if variations in price levels are not considered.

(ii) Ratio analysis ignores qualitative factors.

(iii) Ratio analysis ignores quantitative factors.

(iv) Ratio analysis is historical analysis.

(a) (i), (ii) and (iv)

(b) (i), (iii) and (iv)

(c) (i), (ii) and (iii)

(d) (i), (ii), (iii) and (iv)

Answer

A

48. Assertion (A) Conversion of debentures into preference shares will decrease debt equity ratio.

Reason (R) Conversion of debentures into preference shares will reduce the long-term debts but increase the shareholder’s funds.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

Section – B

49. ……… is considered as the ideal current ratio for a better financial position of company.

(a) 1 : 1

(b) 1 : 2

(c) 2: 1

(d) 3 : 1

Answer

C

50. Total purchase ₹ 85,000, cash purchases ₹ 8,000, purchase return ₹ 4,000, creditors at the end of the year ₹ 16,000, creditors in the beginning ₹ 12,000. creditors turnover ratio will be ……… .

(a) 5.12 times

(b) 5.16 times

(c) 5.21 times

(d) 5.25 times

Answer

C

51. Assertion (A) When financial statements for a number of years are analysed, the analysis is called Horizontal analysis.

Reason (R) Horizontal analysis is mostly in the form of common size statements.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

52. Which of the following is incorrect in regards to limitations of financial statement?

(i) Ignore qualitative aspects

(ii) Ignores price level

(iii) Personal bias

(iv) Provide information about the profitability of the business

(a) Only (iii)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) Only (iv)

Answer

D

53. A firm has inventory turnover of 3 and cost of revenue from operations is ₹ 1,35,000. If the inventory turnover is increased to 5, it would result in ………… .

(a) increase in inventory by ₹ 27,000

(b) decrease in inventory by ₹ 18,000

(c) increase in cost of goods sold by ₹ 10,000

(d) decrease in inventory by ₹ 45,000

Answer

B

54 . Assertion (A) Financial statements are prepared following accounting concepts and principles.

Reason (R) Financial statements are prepared as per cash basis of accounting.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

55. Consider the following information. Long-term borrowings ₹ 1,00,000; Long-term provision ₹ 50,000; Current liabilities ₹ 25,000; Non-current assets ₹ 1,80,000; Current assets ₹ 45,000; Proprietary ratio will be ………… .

(a) 22.2%

(b) 21.8%

(c) 36%

(d) None of these

Answer

A