See below CBSE Class 12 Accountancy Term 1 Sample Paper Set B with solutions. We have provided CBSE Sample Papers for Class 12 Accountancy as per the latest paper pattern issued by CBSE for the current academic year. All sample papers provided by our Class 12 Accountancy teachers are with answers. You can see the sample paper given below and use them for more practice for Class 12 Accountancy examination.

CBSE Sample Paper for Class 12 Accountancy Term 1 Set B

Part – I

Section – A

1. Features of a partnership firm are

(i) two or more persons are carrying common business under an agreement.

(ii) they are sharing profits and losses in the fixed ratio.

(iii) business is carried by all or any of them acting for all as an agent.

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

2. A partner withdraws ……… on 30th September, 2021. Deed provides interest on drawings @ 10%. The total interest charged was ₹ 500.

(a) ₹ 500

(b) ₹ 2,500

(c) ₹ 5,000

(d) ₹ 10,000

Answer

D

3. Equity shares cannot be issued for the purpose of

(i) cash receipts

(ii) purchase of assets

(iii) redemption of debentures

(iv) distribution of dividend

(a) (ii) and (iv)

(b) (ii) and (iii)

(c) (iii) and (iv)

(d) Only (iv)

Answer

D

4. On 1st October, 2020 X extended loan to his partnership firm (without any agreement) of ₹ 5,000. His interest for year ending 31st December, 2020 is

(a) ₹ 300

(b) ₹ 150

(c) ₹ 75

(d) Nil

Answer

C

5. PQR Limited was formed with share capital of ₹ 25,00,000 divided into 25,000 shares of ₹ 100 each. 15,000 shares were allotted in payment of cash on which ₹ 70 per share was called and paid. State the amount of shares subscribed and fully paid up.

(a) ₹ 25,00,000

(b) ₹ 15,25,000

(c) ₹ 15,00,000

(d) ₹ 10,00,000

Answer

C

6. Any change in the relationship of existing partners which result in an end of the existing agreement and enforces making of a new agreement is called

(a) Revaluation of partnership

(b) Reconstitution of partnership

(c) Realisation of Partnership

(d) None of these

Answer

B

7. A company has ……… .

(i) separate legal entity

(ii) perpetual existence

(iii) limited liability

(a) (i) and (iiii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

8. An Extract of Balance Sheet

Provision to be maintained @ 2.5% at the time of change in profit sharing ratio, what is the amount credited / debited in revaluation account?

(a) Debit ₹ 10,000

(b) Debit ₹ 15,000

(c) Debit ₹ 5,000

(d) Credit ₹ 10,000

Answer

D

9. 1,000 shares of ₹ 10 on which ₹ 7 have been called and ₹ 5 has been paid are forfeited out of these 750 shares are reissued for ₹ 9 as fully paid. What is the amount to be debited to share forfeiture account at the time of reissue of shares?

(a) ₹ 6,750

(b) ₹ 750

(c) ₹ 7,500

(d) ₹ 7,000

Answer

B

10. According to Section 31 (1) of the Indian Partnership Act, 1932, ‘‘A person can be admitted as a new partner only with the ……… unless otherwise agreed upon.’’

(a) consent of one partner

(b) consent of the existing partners

(c) Both (a) and (b)

(d) consent of the firm

Answer

B

11. L and M were partners in a firm with capitals of ₹ 1,50,000 and ₹ 1,00,000, respectively, N was admitted as a new partner for 1/4th share in the profits of the firm. N brought ₹ 60,000 for her share of goodwill premium and ₹ 1,20,000 for her capital. The amount of goodwill premium credited to L will be

(a) ₹ 20,000

(b) ₹ 15,000

(c) ₹ 36,000

(d) ₹ 30,000

Answer

D

12. Balance of share forfeiture account is shown in the balance sheet under the head..…… .

(a) share capital account

(b) reserve and surplus

(c) current liabilities and provisions

(d) unsecured loans

Answer

A

13. A company forfeited 1,500 shares of ₹ 10 each (which were issued at par) held by X for non-payment of allotment money of ₹ 5 per share. The called-up value per share was ₹ 8. On forfeiture, the amount debited to share capital will be

(a) ₹ 15,000

(b) ₹ 12,000

(c) ₹ 7,500

(d) ₹ 3,000

Answer

B

14. A newly admitted partner acquires the right to

(a) share in the future profits

(b) share in the assets of the firm

(c) Both (a) and (b)

(d) None of these

Answer

C

15. When a new partner does not bring his share of goodwill in cash, the amount is debited to

(a) Cash A/c

(b) Premium A/c

(c) Current A/c of new partner

(d) Capital A/cs of old partners

Answer

C

16. XYZ Ltd. company took over assets worth ₹ 5,00,000 and liabilities of ₹ 1,50,000 for a purchase consideration of ₹ 6,00,000, ₹ 1,00,000 bills payable accepted and remaining was paid by issuing shares at a premium of 25% on face value ₹ 100. How much amount will be credited to securities premium account?

(a) ₹ 4,00,000

(b) ₹ 1,00,000

(c) ₹ 5,00,000

(d) ₹ 6,00,000

Answer

B

17. D and E are partners in a firm sharing profits in the ratio of 3 : 2. They admit F as a partner for 1/4 th share in the profits, F acquires his share from D and E in the ratio of 2 : 1. The new profit sharing ratio will be

(a) 2 : 1 : 4

(b) 19 : 26 : 15

(c) 3 : 2 : 4

(d) 26 : 19 : 15

Answer

D

18. Out of the following when there is a need to value the goodwill?

(i) Admission of partner

(ii) Retirement of partner

(iii) Death of partner

(a) Only (iii)

(b) (i) and (iii)

(c) (ii) and (iii)

(d) (i), (ii) and (iiii)

Answer

D

Section – B

19. R and S are partners sharing profit or loss in the ratio of 3 : 2 T is admitted into partnership as a new partner. R sacrifices 1/3rd of his share. S sacrifices 1/4th of his share in favour of T. What will be the T’s share in the firm?

(a) 1/5

(b) 2/10

(c) 3/10

(d) None of these

Answer

C

20. Assertion (A) Securities premium reserve cannot be used as working capital.

Reason (R) Securities premium reserve can only be used for purposes which are specified under Section 52 of Companies Act, 2013.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

21. Which of the following is not correct in regards to profit and loss appropriation account?

(i) Interest on partner’s loan

(ii) Partner’s salary

(iii) Interest on partner’s capital

(iv) Partner’s commission

(a) (i) and (ii)

(b) (i) and (iii)

(c) (i) and (iv)

(d) Only (i)

Answer

D

22. E and F are partners in a firm sharing profits in the ratio of 3 : 2. As per their agreement, E will receive 5% per annum interest on his loan of ₹ 50,000 and F will receive 2% commission on sales affected by him, which were ₹ 50,000. Calculate E’s share of profit when net profit as per profit and loss account is ₹ 50,000.

(a) ₹ 29,400

(b) ₹ 29,000

(c) ₹ 30,000

(d) ₹ 24,100

Answer

A

23. DLF Ltd. had allotted 40,000 shares to the applicants of 48,000 shares on pro-rata basis. The amount payable on application is ₹ 2. P applied for 900 shares. The number of shares allotted and the amount carried forward for adjustment against allotment money due from him is

(a) 300 shares, ₹ 750

(b) 750 shares, ₹ 300

(c) 800 shares, ₹ 200

(d) 600 shares, ₹ 600

Answer

B

24. Assertion (A) It is important to have a partnership deed in writing.

Reason (R) A written partnership agreement contains terms and conditions agreed upon by all partners and is helpful in avoiding disputes.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true A

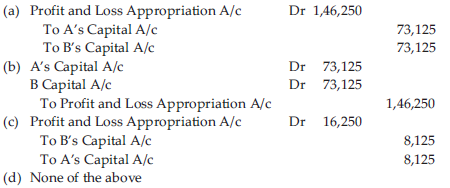

25. The firm of A and B earned a profit of ₹ 1,62,500 during the year ending on 31st March,

2020. They have decided to donate 10% of this profit to an NGO working for senior

citizens. Journal entry will be

Answer

A

26. Public subscription of shares include

(i) issuing prospectus

(ii) receiving applications

(iii) making allotment

(a) (i) and (iii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

27. L,M and N are partners in a firm in ratio of 1 : 2 : 3. Debit balance of profit and loss account was ₹ 2,000 and general reserve was ₹ 5,000 when partners decided to share profits equally. If these balances are not to be shown in balance sheet, what will be the journal entry?

(a) Dr L ₹ 5,00 ; Cr N ₹ 5,00

(b) Dr N ₹ 500; Cr L ₹ 500

(c) Cr L ₹ 500 ; Cr M ₹ 1,000; Cr N ₹ 1,500

(d) Cr L ₹ 10,00; Cr M ₹ 1,000; Cr N ₹ 1,000

Answer

C

28. Assertion (A) At the time of admission, if profit sharing ratio among old partners does not change, then sacrificing ratio will be the old profit sharing ratio.

Reason (R) Old profit sharing ratio plus new profit sharing ratio is sacrificing ratio.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

29. PQR Limited issued shares of ₹ 100 each at a premium of 10%. Zen purchased 1,000 shares and paid ₹ 20 on application but did not pay the allotment money of ₹ 30. If the company forfeited his 30% shares, the forfeiture account will be credited by

(a) ₹ 9,000

(b) ₹ 7,000

(c) ₹ 3,300

(d) ₹ 6,000

Answer

D

30. D and E are partners sharing profits and losses equally. At the time of admission of F. Revaluation of assets and liabilities was done. Investments were raised by ₹ 10,000 and there was a provision created on debtors @ 5% (debtors being ₹ 50,000), stock was also revalued, loss on realisation for D was ₹ 2,500. New profit sharing ratio of D:E:F would be 1 : 1 : 2. Find the revalued amount of stock, if initially stock was ₹ 30,000.

(a) ₹ 17,500

(b) ₹ 42,500

(c) ₹ 27,500

(d) ₹ 32,500

Answer

A

31. Issue of shares at a price higher than its face value is called ……… .

(a) Issue at a loss

(b) Issue at a profit

(c) Issue at a discount

(d) Issue at a premium

Answer

D

32. If the incoming partner brings the amount of goodwill in cash and also a balance exists in goodwill account, then this goodwill account is written-off among the old partners in

(a) the new profit sharing ratio

(b) the old profit sharing ratio

(c) the sacrificing ratio

(d) the gaining ratio

Answer

B

33. 700 shares of ₹ 10 each were reissued as ₹ 9 paid up for ₹ 7 per share. Entry for reissue is

Bank A/c Dr X

Share Forfeiture A/c Dr Y

To Share Capital A/c Z

Here X, Y, Z are

(a) ₹ 4,900, ₹ 1,400, ₹ 6,300 respectively

(b) ₹ 1,400, ₹ 4,900, ₹ 6,300 respectively

(c) ₹ 4,900, ₹ 2,100, ₹ 7,000 respectively

(d) ₹ 2,100, ₹ 4,900, ₹ 7,000 respectively

Answer

A

34. On average profit basis, goodwill is calculated by

(a) no. of years purchased multiplied with average profits.

(b) no. of years purchased multiplied with super profits.

(c) summation of the discounted value of expected future benefits.

(d) super profit divided with expected rate of return.

Answer

A

35. Which of these can be a special advantage for firm that would help in generating goodwill?

(i) Import licences

(ii) Long-term contracts for supply

(iii) Patents

(a) (i) and (iii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

36. A company forfeited 2,000 shares of ₹ 10 each on which application money of ₹ 3 has been paid. Out of these 1,000 shares were reissued as fully paid up and ₹ 2,000 has been transferred to capital reserve. Calculate the rate at which these shares were reissued.

(a) ₹ 10 per share

(b) ₹ 9 per share

(c) ₹ 11 per share

(d) ₹ 8 per share

Answer

B

Section – C

Glorious Ltd. was incorporated on 1st April, 2020 with its registered office at Hyderabad.

It invited applications for issuing 4,00,000 equity shares of ₹ 10 each at premium of ₹ 20 per share The amount was payable as follows

On Application – ₹ 2 per share

On Allotment – ₹ 13 per share (including ₹ 10 premium)

On First Call – ₹ 7 per share (including ₹ 5 premium)

On Final Call – ₹ 8 (including ₹ 5 premium)

Applications for 3,60,000 shares were received. Shares were allotted to all the applicants. Vijay, a shareholder holding 10,000 shares paid his entire share money along with the allotment money. Kartik a, holder of 14,000 shares, failed to pay the allotment money. Afterwards the first call was made. Kartik paid the allotment money along with the first call money.

Neeraj, holding 4,000 shares did not pay the final call. Neeraj’s shares were forfeited immediately after the final call. Out of the forfeited shares, 3,000 shares were reissued at ₹ 8 per share fully paid up.

37. What is the amount of final call money received?

(a) ₹ 27,68,000

(b) ₹ 26,96,000

(c) ₹ 26,80,000

(d) ₹ 27,60,000

Answer

A

38. What is the amount of forfeiture transferred to capital reserve?

(a) ₹ 3,000

(b) ₹ 12,000

(c) ₹ 15,000

(d) ₹ 18,000

Answer

C

Kartik and Amit were partners in a firm carrying on a tiffin service in Delhi. Kartik noticed that a lot of food is left at the end of the day. To avoid wastage, he suggested that it can be distributed to the needy; Amit wanted that it should be mixed with the food being served the next day.

Amit then give a proposal that if his share in the profit increased, he will not mind free distribution of left over food. Kartik happily agreed. So, they decided to change their profit sharing ratio 1 : 2 with immediate effect. On that data, revaluation of assets and reassessment of liabilities was carried out that resulted into a gain of ₹ 36,000. On that date, the goodwill of the firm was valued at ₹ 2,40,000.

39. Sacrifice/Gain of Kartik and Amit will be

(a) Kartik sacrifice 1/6, Amit gains 1/6

(b) Kartik gains 1/6, Amit sacrifice 1/6

(c) Only Kartik gains 1/6

(d) Only Amit sacrifice 1/6

Answer

A

40. At the time of change in profit sharing ratio, gaining partner’s capital account is ……… and sacrificing partner’s capital account is …… for adjustment of goodwill.

(a) credited, debited

(b) debited, credited

(c) increased, decreased

(d) decreased, increased

Answer

B

41. Pass the journal entry for adjustment of goodwill.

(a) Amit’s Capital A/c Dr 24,000

To Kartik’s Capital A/c 24,000

(b) Kartik’s Capital A/c Dr 12,000

To Amit’s Capital A/c 12,000

(c) Amit’s Capital A/c Dr 40,000

To Kartik’s Capital A/c 40,000

(d) Kartik’s Capital A/c Dr 2,00,000

To Amit’s Capital A/c 2,00,000

Answer

C

Part – II

Section – A

42. The formula for calculating trade payables turnover ratio is

(a) Net Credit Purchases / Average Creditors

(b) Net Credit Purchases / Average Creditors +Average Bills Payable

(c) Cash Purchases / Total Creditors

(d) None of these

Answer

B

43. Which of the following is true in regard to decrease in current ratio and an increase in quick ratio?

(i) Purchase of stock-in-trade for cash

(ii) Sale of non-current assets for cash

(iii) Sale of stock-in-trade at loss

(iv) Cash payment of non-current liability

(a) Only (iii)

(b) (i) and (ii)

(c) (ii) and (iv)

(d) (iii) and (iv)

Answer

A

44. Assertion (A) Sale of fixed assets at a loss increase debt-equity ratio.

Reason (R) When fixed assets are sold at a loss, debts remain unchanged but shareholders’ funds are decreased by the amount of loss.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

45. Which of the following is not required to be prepared under the Companies Act?

(i) Statement of Profit and Loss

(ii) Balance Sheet

(iii) Report of Directors and Auditors

(iv) Funds Flow Statement

(a) (i) and (iii)

(b) (iii) and (iv)

(c) (i) and (iv)

(d) Only (iv)

Answer

D

46. Sincere Ltd. has a proprietary ratio of 20%. To maintain this ratio at 25%, management may

(i) increase equity

(ii) Reduce debt

(iii) increase current assets

(a) Only (i)

(b) Either (i) and (iii)

(c) Both (i) and (ii)

(d) Only (iii)

Answer

B

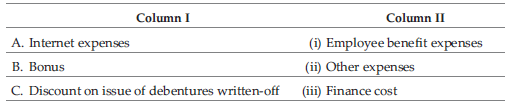

47. Match the colum

Codes

A B C

(a) (ii) (i) (iii)

(b) (i) (ii) (iii)

(c) (iii) (ii) (i)

(d) (i) (iii) (ii)

Answer

A

48. Which analysis is considered as static?

(a) Horizontal analysis

(b) Vertical analysis

(c) Internal analysis

(d) External analysis

Answer

B

Section – B

49. Interest accrued on investments appear in a company’s balance sheet under the sub-head.

(a) Non-current investments

(b) Current investments

(c) Other current assets

(d) Other non-current assets

Answer

C

50. Assertion (A) Analysis carried out at one particular point of time, generally when accounts are closed in vertical analysis.

Reason (R) Vertical analysis is made to review and analyse financial statements for a number of years.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

51. If opening inventory is ₹ 60,000, cost of revenue from operations is ₹ 5,00,000 and inventory turnover ratio is 5 times, then closing inventory will be

(a) ₹ 1,60,000

(b) ₹ 1,40,000

(c) ₹ 80,000

(d) ₹ 2,00,000

Answer

B

52. A transaction involving a decrease in both current ratio and quick ratio is

(i) sale of non-current asset for cash

(ii) sale of stock-in-trade at loss

(iii) case payment of a current liability

(iv) purchase of stock-in-trade on credit

(a) (i) and (iii)

(b) (ii) and (iii)

(c) (iii) and (iv)

(d) Only (iv)

Answer

D

53. Total purchase ₹ 85,000, cash purchases ₹ 8,000, purchase return ₹ 4,000, creditors at the end of the year ₹ 16,000, creditors in the beginning ₹ 12,000. What will be the creditors turnover ratio?

(a) 5.12 times

(b) 5.16 times

(c) 5.21 times

(d) 5.25 times

Answer

C

54. Assertion (A) Liabilities which may or may not arise because they are dependent on event happening in future are contingent liabilities.

Reason (R) In the balance sheet, contingent liabilities are shown under the head other current liabilities.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

55. Which of the following is/are objectives of ratio analysis?

(i) To know the areas of the business which need more attention.

(ii) To provide a deeper analysis of the profitability, liquidity, solvency and efficiency levels in the business.

(iii) To provide information by making cross sectional analysis by comparing the performance with the best industry standards.

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D