PART A

Accounting for Partnership Firms and Companies

Question. 1. A and B are partne₹ in a firm sharing profits and losses in the ratio of 3 : 2. A new partner C is admitted. A surrende₹ 1/15th share of his profit in favour of C and B surrende₹ 2/15th of his share in favour of C. The new ratio will be :

a) 8 : 4 : 3

b) 42 : 26 : 7

c) 4 : 8 : 3

d) 26 : 42 : 7

Answer

B

Question. 2. Assertion a):- Interest on loan advanced by a partner to the firm is shown in Profit and Loss A/c.

Reason (R):- Interest on loan advanced by a partner to the firm is charge against profits and is to be provided at the rate as mentioned in the partne₹hip deed or @6% p. a as the case may be.

a) a) is correct but (R) is wrong

b) Both a) and (R) are correct, but (R) is not the correct explanation of a)

c) Both a) and (R) are incorrect.

d) Both a) and (R) are correct, and (R) is the correct explanation of a)

Answer

D

Question. 3. The debentures whose principal amount is not repayable by the company during its life time, but the payment is made only at the time of Liquidation of the company, such debentures are called :

a) Bearer Debentures

b) Redeemable Debentures

c) Irredeemable Debentures

d) Non-Convertible Debentures

Answer

C

OR

Question. If a share of ₹ 10 on which ₹ 8 has been paid up is forfeited, it can be reissued at the minimum price of…….

a) 10 ₹. per share

b) 8 ₹. per share

c) 5 ₹. per share

d) 2 ₹. per share

Answer

D

Question. 4. X and Y are partne₹ in the ratio of 3 : 2. Their capitals are ₹2,00,000 and ₹1,00,000 respec-tively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of ₹15,000 for the year ended 31st March 2019. As per partne₹hip agreement, interest on capital is treated a charge on profits. Interest on Capital will be :

a) X ₹16,000; Y ₹8,000

b) X ₹9,000; Y ₹6,000

c) X ₹10,000; Y ₹5,000

d) No Interest will be allowed

Answer

A

Or

Question. A, B and C are partne₹ in a firm sharing profits in the ratio of 3 : 4 : 1. They decided to share profits equally w.e.f. 1 st April, 2019. On that date the Profit and Loss Account showed the credit balance of ?96,000. Instead of closing the Profit and Loss Account, it was decided to record an adjustment entry reflecting the change in profit sharing ratio. In the journal entry :

a) Dr. A by ₹4,000; Dr. B by ₹16,000; Cr. C by ₹20,000

b) Cr. A by ₹4,000; Cr. B by ₹16,000; Dr. C by ₹20,000

c) Cr. A by ₹16,000; Cr. B by ₹4,000; Dr. C by ₹20,000

d) Dr. A by ₹16,000; Dr. B by ₹4,000; Cr. C by ₹20,000

Answer

B

Question. 5. X, Y and Z are partne₹ sharing profits and losses equally. Their capital balances on March, 31, 2012 are ₹80,000, ₹60,000 and ₹40,000 respectively. Their pe₹onal assets are worth as follows : X — ₹20,000, Y — ₹15,000 and Z — ₹10,000. The extent of their liability in the firm would be :

a) X — ₹80,000 : Y — ₹60,000 : and Z — ₹40,000

b) X — ₹20,000 : Y — ₹15,000 : and Z — ₹10,000

c) X — ₹1,00,000 : Y — ₹75,000 : and Z — ₹50,000

d) Equal

Answer

B

OR

Question. 6. Zoom Ltd. issued 10,000, 6% Debentures of ₹ 100 each at certain rate of premium and to be redeemed at 12% premium. At the time of writing off Loss on Issue of Debentures, Statement of Profit and Loss was debited with ₹ 2,0,000. At what rate of premium, these debentures were issued?

a) 6%

b) 15%

c) 10%

d) 12%

Answer

C

Question. ‘A’ Limited purchased the assets from ‘B’ Limited for ₹5,40,000. ‘A’ Limited issued 10% debentures of ₹100 each at 20% premium against the payment. The number of debentures re-ceived by ‘B’ Limited will be :

a) 4,500

b) 5,400

c) 45,000

d) 6,000

Answer

A

Question. 7. Aabra ka Daabra Ltd, issued a prospectus inviting applications for 3,000 shares of ₹10 each payable ₹3 on application, ₹ 5 on allotment and balance on fi₹t and final call. Public had ap-plied for certain number of shares and application money was received. Which of the follow-ing application money, if received, can’t go for allotment of shares?

a) ₹ 7,500

b) ₹ 8,100

c) ₹ 9,000

d) ₹ 9,900

Answer

A

Question. 8. Rex,Tex and Flex are partne₹ in a firm in the ratio of 5:3:2. As per their partne₹hip agree-ment,the share of deceased partner is to be calculated on the basis of profits and turnover of previuos accounting year. Tex expired on 31st December,2019. Turnover till the date of death was ₹ 18,00,000. Their profits and turnover for the year 2018-19 amounted to ₹ 4,00,000 and ₹ 20,00,000 resp. An amount of _______will be given to his executo₹ as his share of profits till the date of his death.

a) ₹ 2,70,000

b) ₹ 1,08,000

c) ₹ 3,60,000

d) ₹ 4,44,444

Answer

B

OR

Question. Amar, Akbar and Anthony were partne₹ sharing profits and losses in the ratio 5:3:2. Akbar was being guaranteed that his share of profits will not be less than ₹ 1,50,000. Deficiency if any would be borne by Amar and Anthony in the ratio 3:2. For the year ended March 31, 2021 Amar’s share of profits before guarantee effect was ₹2,40,000. What would be the amount of deficiency which would have been borne by Anthony?

a) No deficiency will be there

b) ₹ 6,000

c) ₹ 2,400

d) ₹ 3,600

Answer

C

9 Question no.’s 9, and 10 are based on the hypothetical situation given below.

The health of the common man is deteriorating day by day due to manifold aspects. Corona has affected their mental health, inflation has affected their financial health and lack of exer-cise has affected their physical health. The situation which was getting wo₹e day by day has affected the pe₹onal lives of the society. Four friends Raju, Sumit, Rinku and Amit decided to do something for the society and decided to start a venture where they will provide Bicy-cles on rent and even offered scratch coupon cards to attract the public for use of this cycles. It will definitely improve their physical health and also relief from increased prices of petrol day by day.

On 1st July, 2020 the business was started under the name Health is Wealth. They invested ₹ 2,00,000 each as capital. Office was made at Rinku’s residence who will be paid a rent of ₹ 10,000 per month. Raju gave a loan of ₹ 1,00,000 on the date of start of business. Amit being very extrovert and strong motivator was being given task of interacting with clients, and for his service he was given a salary of ₹ 10,000 per month. Sumit’s cousin Hemant offered a loan of ₹ 2,00,000 @ 12% p.a interest. This offer was availed by

the firm on 1st November, 2020. Sumit got affected with Covid in the end of January and firm gave him a loan of ₹ 50,000 on February 1, 2021.

For the year ended March 31, 2021 the firm made profits of ₹ 3,60,000 before the above ad-justments.

Question. Calculate the amount of profits to be transferred to Profit and Loss Appropriation Account.

a) Profit ₹ 3,60,000

b) Profit ₹ 2,55,500

c) Profit ₹ 1,65,500

d) Profit ₹ 2,60,500

Answer

B

Question. 10 Divisible Profits amounted to ₹ :

a) ₹ 1,65,500

b) ₹ 3,60,000

c) ₹ 2,70,000

d) ₹ 1,70,500

Answer

A

Question. 11 At the time of change in Profit sharing ratio, Building was appearing in the books as ₹2,40,000 which was undervalued by 20%. Effect of this will be …………

a) Revaluation A/c Credited by ₹48,000 and Building to be shown in the reconstituted firm’s balance sheet as ₹2,88,000.

b) Revaluation A/c Debited by ₹48,000 and Building to be shown in the reconstituted firm’s balance sheet as ₹2,88,000.

c) Revaluation A/c Credited by ₹60,000 and Building to be shown in the reconstituted firm’s balance sheet as ₹ 3,00,000.

d) Revaluation A/c Debited by ₹60,000 and Building to be shown in the reconstituted firm’s balance sheet as ₹3,00,000.

Answer

C

Question. 12 Andaaza Ltd. invited applications for 80,000 shares of ₹10 each and ₹2 premium. The share was payable as ₹3 on application, ₹4 on allotment (including ₹1 pre-mium) and balance on fi₹t and final call. Public had applied for 75,000 shares. All the money had been duly received except fi₹t and final call money on 3,000 shares held by Kumar. What will be the bank balance of the company after the above issue.

a) ₹ 9,00,000

b) ₹ 8,85,000

c) ₹ 8,88,000

d) ₹ 9,45,000

Answer

B

Question. 13. If 5,000 shares of ₹10 each were forfeited for non-payment of final call money of ₹ 3 per share and only 3,000 shares were re-issued at ₹7 per share as fully paid up, then what is the amount of maximum possible discount that company can allow at the time of re-issue of the remaining 2,000 shares?

a) ₹ 6,000

b) ₹ 35,000

c) ₹ 15,000

d) ₹ 14,000

Answer

D

Question. 14. Dhwani and Iknoor were partne₹ sharing profits and losses in the ratio 5:3. They admitted Spreeha as a new partner for 1/4th share. For the treatment of goodwill, the following entry was passed.

Premium for Goodwill A/c Dr. 50,000

Spreeha’s Current A/c Dr. 10,000

To Dhwani’s Capital A/c 45,000

To Iknoor’s Capital A/c 15,000

What will be their new Profit sharing ratio?

a) 5 : 3 : 2

b) 7 : 5 : 4

c) 3 : 3 : 2

d) 15 : 9 : 8

Answer

B

Question. 15. Raju and Rinku were partne₹ sharing profits and losses in the ratio 2 : 1. Their capitals as on 1st April, 2020 were ₹10,00,000 and ₹15,00,000 respectively. Interest on Capital was to be allowed @10% p.a. For the year ended March 31, 2021 the firm made profits of ₹1,80,000. Calculate the amount of Interest on Capital for both the partne₹.

a) ₹1,00,000 and ₹ 1,50,000 respectively.

b) ₹50,000 and ₹ 75,000 respectively.

c) ₹1,20,000 and ₹ 60,000 respectively.

d) ₹72,000 and ₹1,08,000 respectively.

Answer

D

Or

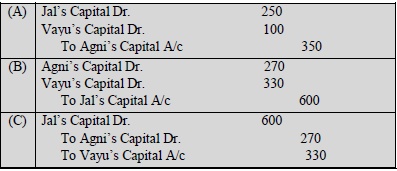

Question. Jal, Agni and Vayu were partne₹ sharing profits in the ratio of 5:3:2. For the year ended March 31, 2021 their drawings during the year were as follows :-

(i) Jal withdrew ₹5,000 at the beginning of every month.

(ii) Agni withdrew ₹ 60,000 during the year.

(iii) Vayu withdrew ₹15,000 at the end of every quarter.

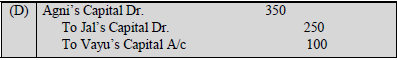

As per the Partne₹hip Deed, Interest on Drawings were to be charged @6% p.a. which was omitted from the books of the accounts while profits were being distrib-uted. Adjustment entry will be

Answer

B

Question. 16. B, a partner was appointed to look after the process of dissolution for which he was allowed a remuneration of ₹. 5,000. B agreed to bear the dissolution expenses. Actual dissolution ex-penses ₹.3,000 paid by B. Realisation Account will be debited by______.

a) ₹. 2,000

b) ₹. 8,000

c) ₹. 5,000

d) ₹. 3,000

Answer

C

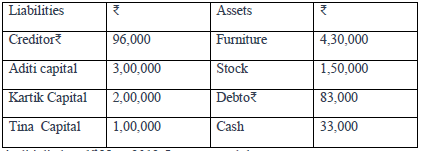

Question. 17 Aaditi,Kartik and Tina were partne₹ in a firm sharing profits and losses in the ratio of 5:3:2. On 31st March,2019 their balance sheet was as follows

Aaditi died on 1st Nov. 2019. It was agreed that

(i) Goodwill of the firm be valued at ₹ 1,00,000.

(ii) Profit for the year 2019-20 be taken as having accrued at the same rate as the pre-vious year 2018-19. Profits for the year 2018-19 was ₹ 96,000

(iii) Half the amount was paid to Aaditi’s executo₹ immediately and the remaining half will be paid in two equal annual instalments with interest @6%p.a Pass entries

Answer. AAditi’s share of goodwill Rs 50,000

Aaditi’s share of profits Rs 28,000

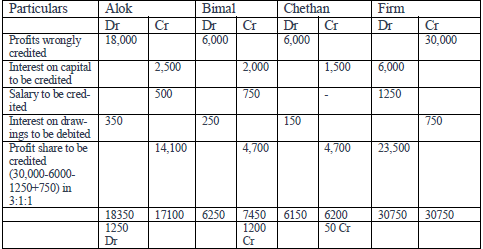

Question. 18 The net profit of Alok, Bimal and Chetan for the year ended March 31, 2020 was ₹ 30,000 and the same was distributed among them in their agreed ratio of 3 : 1 : 1. It was subsequently discovered that the under mentioned transactions were not recorded in the books :

(i) Interest on Capital @ 5% p.a. (ii) Interest on drawings amounting to Alok ₹350, Bimal ₹ 250 and Chethan ₹ 150.

(iii) Partner’s Salary : Alok ₹ 500, Bimal ₹ 750 p.a.

The capital accounts of partne₹ were fixed as : Alok ₹ 50,000, Bimal ₹ 40,000 and Chethan ₹30,000. Record the adjustment entry.

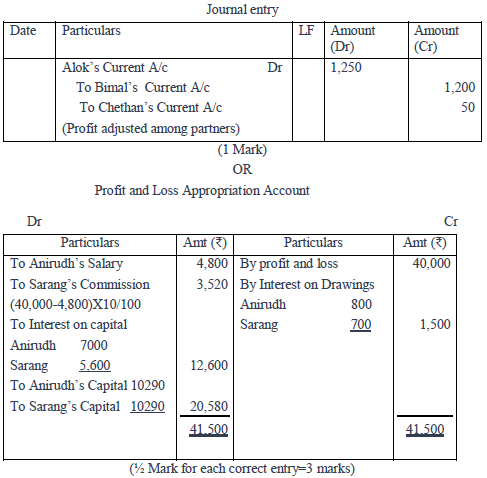

OR

Question. The partne₹hip agreement between Anirudh and Sarang provides that:

(i) Profits will be shared equally;

(ii) Anirudh will be allowed a salary of ₹ 400 p.m;

(iii) Sarang who manages the sales department will be allowed a commission equal to 10% of the net profits, after allowing Anirudh’s salary;

(iv) 7% interest will be allowed on partner’s fixed capital;

(v) 5% interest will be charged on partner’s annual drawings;

(vi) The fixed capitals of Anirudh and Sarang are ₹ 1,00,000 and ₹ 80,000, respectively. Their annual drawings were ₹ 16,000 and 14,000, respectively. The net profit for the year ending March 31, 2020 amounted to ₹ 40,000; Prepare firm’s Profit and Loss Appropriation Account.

Answer.Statement showing adjustment

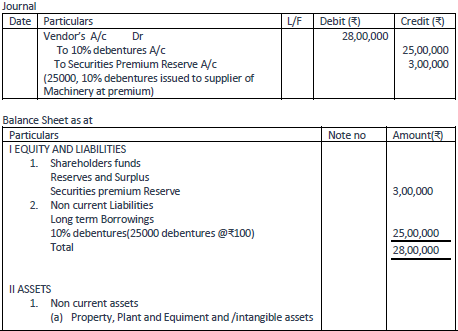

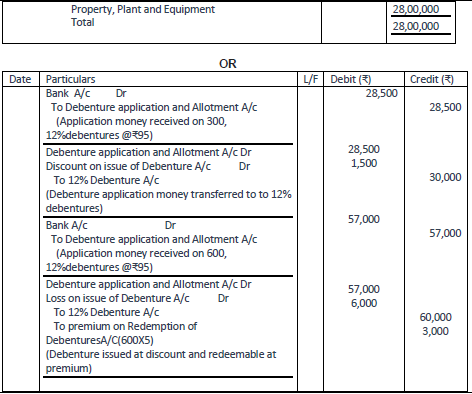

Question. 19 SSS Ltd issued 25,000, 10% debentures of ₹ 100 each. Give journal entries and the balance sheet in each of the following case when the debentures are issued to a supplier of machinery costing ₹ 28,00,000 as his full and final payment.

Or

Pass the necessary journal entries for the issue of debentures in the following cases

(i) ₹ 30,000,12% debentures of ₹ 100 each issued at a discount of 5% redeemable at par.

(ii)₹ 60,000,12% debentures of ₹ 100 each issued at a discount of 5% redeemable at ₹ 105.

Answer.

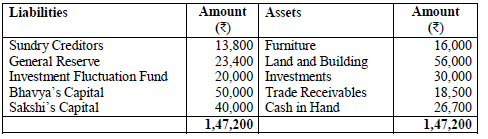

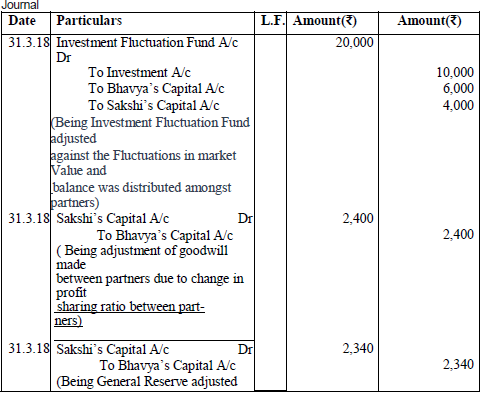

Question. 20 Bhavya and Sakshi are partne₹ in a firm, sharing profits and losses in the ratio of 3:2.On 31st March, 2018 their Balance Sheet was as under:

Balance Sheet of Bhavya and Sakshi As at 31st March, 2018

The partne₹ have decided to change their profit sharing ratio to 1: 1 with immediate effect. For the purpose, they decided that:

a. Investments to be valued at ₹ 20,000

b. Goodwill of the firm valued at ₹ 24,000

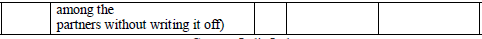

c. General Reserve not to be distributed between the partne₹.

You are required to pass necessary journal entries in the books of the firm. Show workings.

Answer.

Workings:

Sacrificing ratio = Old ratio – New Ratio

Bhavya’s = 3/5 – 1/2 = 1/10 Sacrifice

Sakshi’s = 2/5 – 1/2 = (1/10) Gain

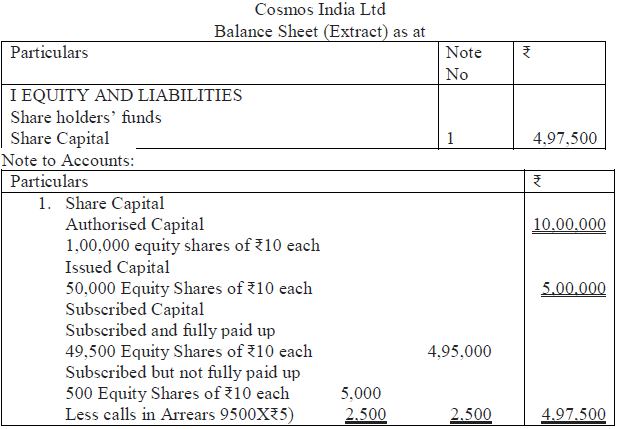

Question. 21 Cosmos India Ltd. is registered with an authorised capital of ₹10,00,000 divided into 1,00,000 equity shares of ₹10 each. The company issued 50000 equity shares at a premium of ₹ 5 per share. ₹ 2 per share were payable with application, ₹8 per share (including premium) on allot-ment and the balance amount on fi₹t and final call. The issue was fully subscribed and all the amount due was received except the fi₹t and final call money on 500 shares allotted to Balaram.

Prepare the ‘Share capital’ in the Balance sheet of Cosmos India limited as per schedule III part 1 of the companiess Act 2013. Also prepare Notes to Account for the same

Answer.

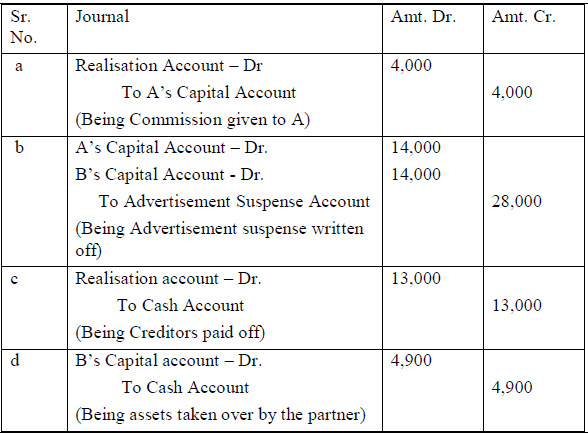

Question. 22 A and B are partne₹ sharing profits and losses equally. They decided to dissolve their firm. Assets and Liabilities have been transferred to Realisation Account. Pass necessary Journal entries for the following.

a. A was to bear all the expenses of Realisation for which he was given a commission of ₹ 4000.

b. Advertisement suspense account appeared on the asset side of the Balance sheet amounting ₹ 28000

c. Creditors of ₹ 40,000 agreed to take over the stock of ₹ 30,000 at a discount of 10% and the balance in cash.

d. B agreed to take over Investments of ₹ 5000 at ₹ 4900

Answer.

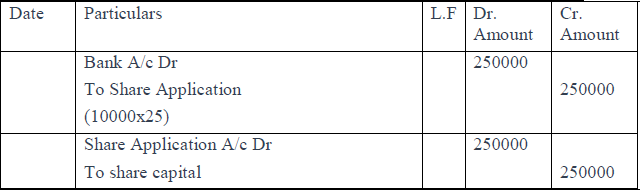

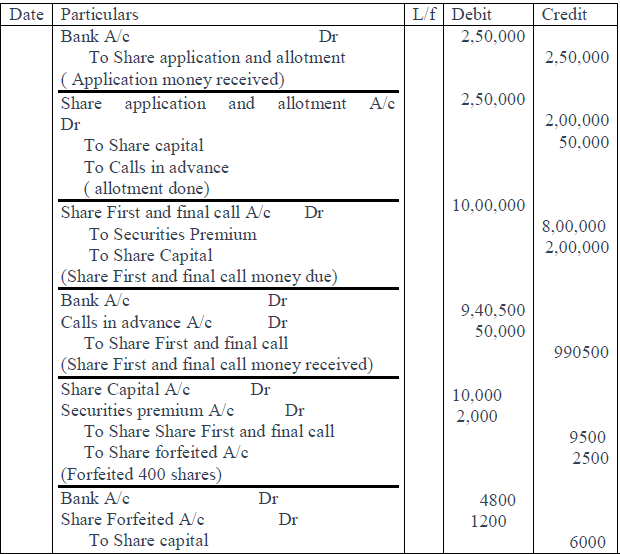

Question. 23 Pioneer Ltd invited applications for 12000 shares of ₹.100 each to be issued at premium of 10% payable as follows: a. ₹ 25 on application, ₹. 40 on allotment and ₹. 35 on first and final call.

Applications were received for 10000 shares and all of these were accepted. All the money due was received except the fi₹t and final call on 100 shares which were forfeited. out of these 60 shares were reissued @90 per share credited as fully paid up.

Record the journal entries

OR

Z Ltd. invited applications for issuing 20000 equity shares of ₹. 50 each at a premium of ₹. 10 per share. The amount was payable as follows:

On Application & Allotment ₹. 10 Per Share.

On 1st and final call Balance including premium.

Application for 25000 shares were received and shares were allotted on pro rata basis to all applicants. All calls were made and duly received except a holder of 200 shares who failed to pay call money. These shares were forfeited and out of these 120 shares were reissued @ ₹. 40 per share fully paid up.

Pass necessary journal entries in the books of the company.

Answer.

OR

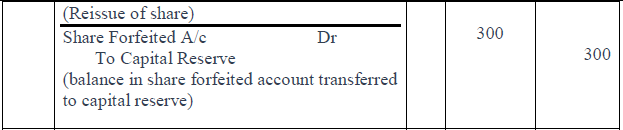

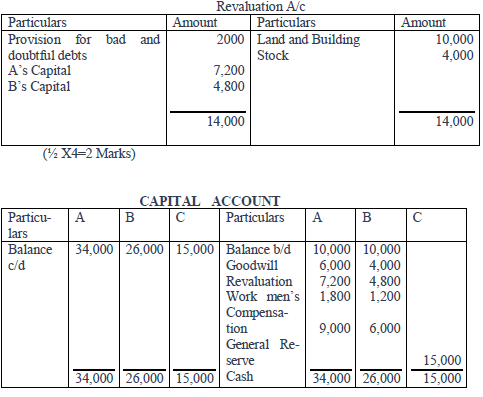

Question. 24 The following is the Balance Sheet as on 31st March 2020 of A and B , who share profits and losses in the ratio of 3:2:

On 1st April, 2020 they agreed to admit C into partnership on the following terms:

1. Provision of bad debts would be increased by ₹ 2000.

2. The value of land & building would be increased to ₹. 18000.

3. The value of stock would be increased by₹ 4000.

4. The liability against Workmen’s compensation fund is fixed at ₹.2000.

5. C brought in ₹15,000 as his capital and ₹. 10000 in cash as his share of goodwill

Prepare Revaluation Account and Partner’s capital accounts

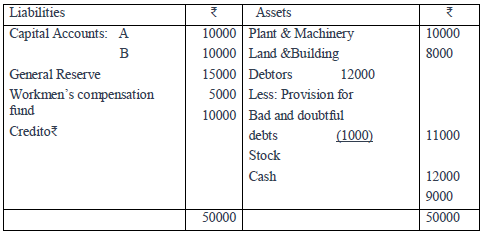

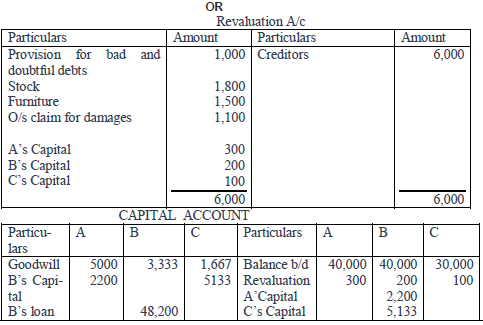

OR

A, B and C are partners in a firm sharing profits and losses in the ratio of 3:2:1. Their balance Sheet as at 31st March , 2020 is as under:

B retired on 1st April 2020 on the following terms:

1. Provision for doubtful debts will be raised by ₹. 1000.

2. Stock will be depreciated by 10% and furniture by 5%.

3. An outstanding claim for damages of ₹. 1100 is to be provided for.

4. Credito₹ will be written back by ₹. 6000.

5. Goodwill of the firm is valued at ₹.22000

6. New profit sharing ratio is 3:2.

7. Amount due to B is transferred to his loan A/c

Prepare revaluation a/c and Partner’s capital accounts

Answer.

Question. 25 Arun,Varun and Karan were partne₹ in a firm sharing profits in the ratio of 4:3:3. On 1/1/2014 their Balance-sheet was as follows

On 30.9.2014, Karan died. The partnership Deed provided for the following to the executors of the deceased partner:

(a) His share in the goodwill of the firm calculated on the basis of three years purchase of the average profits of the last four years. The profits were ₹ 1,90,000;₹ 1,70,000;₹ 1,80,000; and ₹ 1,60,000 resp.

(b) His share in the profits of the firm till the date of his death calculated on the basis of the average profits of last four yea₹.

(c) Interest @8% p.a on the credit balance in his capital account.

(d) Interest on his loan @12%p.a

(e) Prepare Karan’s Account

Answer.Balance due to Karan’s executor Rs 2,00,430

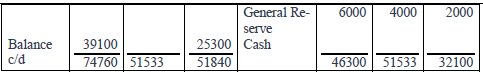

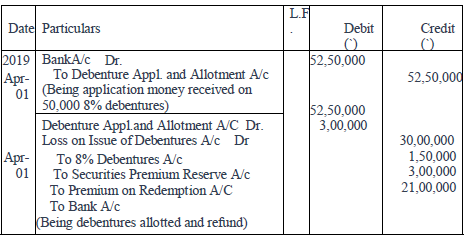

Question. 26 i) Journalise the following transactions

a) Unique Ltd. issued ₹ 1,00,000, 12% Debentures of ₹ 100 each at a premium of 5% redeem-able at a premium of 2%

b) 12 % Debentures were issued at a discount of 10% to a vendor of machinery for payment of ₹ 9,00,000

c) Issue of 10,000 11% debentures of ₹ 100 each as collateral in favour of State Bank of In-dia. Company opted to pass necessary entry for issue of debentures.

ii) On April 1, 2019 Zigma Ltd. issued,30,000, 8% Debentures of ₹100 each at premium of 5%, to be redeemable at a premium of 10%, after 5 years. The entire amount was payable on application. The issue was ove₹ubscribed to the extent of 20,000 debentures and the allot-ment was made proportionately to all the applicants. The securities premium amount has not been utilized for any other purpose during the year. Give journal entries for the issue of de-bentures and writing off loss on issue of debentures.

Answer.

Part B :- Analysis of Financial Statements (Option – I)

Question.27 Unclaimed dividend appears in a Company’s balance Sheet under the Sub-head ………………

a) Short-term Borrowings

b) Trade Payables

c) Other Current Liabilities

d) Short-term Provisions

Answer

C

OR

Question.Maruti Ltd has a proprietary ratio of 25%. To maintain this ratio at 30%, management may

a) Increase Equity

b) Either increase equity or reduce debt

c) Increase current assets

d) Reduce debt

Answer

B

Question.28 The Interest coverage ratio from the following information will be:

Capital Employed ₹ 10,00,000 Equity ₹ 6,00,000

Profit before tax ₹ 4,20,000 and rate of Tax is 30%.

Company has taken long term loan @ 15% p.a. interest charge

a) 9 Times

b) 8 Times

c) 7 Times

d) 5 Times

Answer

B

Question.29 Which of the following is not a cash inflow?

a) sale of fixed assets

b) purchase of fixed Assets

c) issue of debentures

d) sale of goods for cash

Answer

B

OR

Question. Which of the following item is considered as cash equivalent?

a) bank overdraft

b) bills receivable

c) debto₹

d) short term investment

Answer

D

Question.30 If net profit is ₹.8,00,000 after writing of intangible fixed assets (goodwill) of ₹. 5,00,000, then the cash flow from operating activity will be

a) ₹. 8,00,000

b) ₹. 5,00,000

c) ₹. 3,00,000

d) ₹. 13,00,000

Answer

D

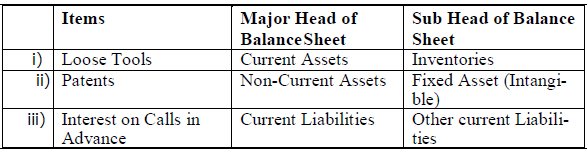

Question.31 Under which major heads and subheads of the Balance Sheet of a company, will the follow-ing items be shown:-

i) Loose Tools

ii) Patents

iii) Interest on Calls in Advance

Answer.

Question.33 Calculate gross profit ratio from the following information:

Trade Payables Turnover Ratio 5 times; Average Trade Payable ₹ 2,00,000; Cash Purchases 1/5 of Credit Purchases; Inventory at the beginning was ₹ 80,000 and Inventory at the end was ₹1,00,000 more than the Opening Inventory; Net Profit ₹ 5,50,000; Operating Expenses ₹ 3,00,000; Non- Operating Expenses ₹ 2,00,000; Non-Operating Incomes ₹ 1,50,000.

OR

On the basis of the following information, calculate total assets to debt ratio:

Non–current assets ₹ 4,40,000; liquid assets ₹ 2,10,000; inventory ₹ 70,000; long term borrowing of ₹. 1,00,000; provision for retirement benefit ₹ 24,000.

Answer.45% OR 5.8:1

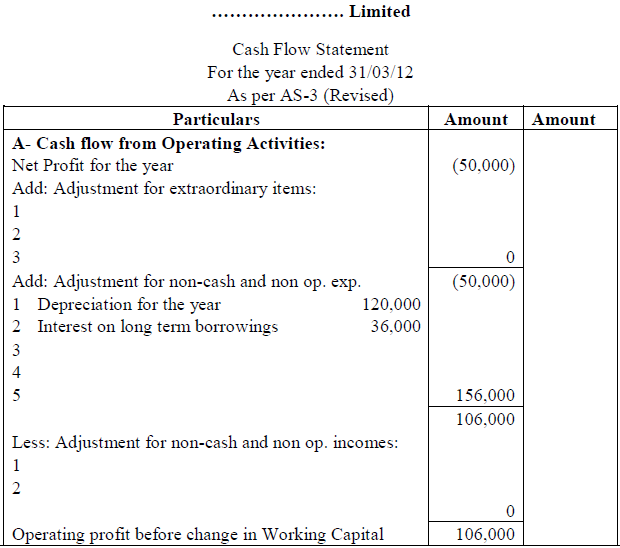

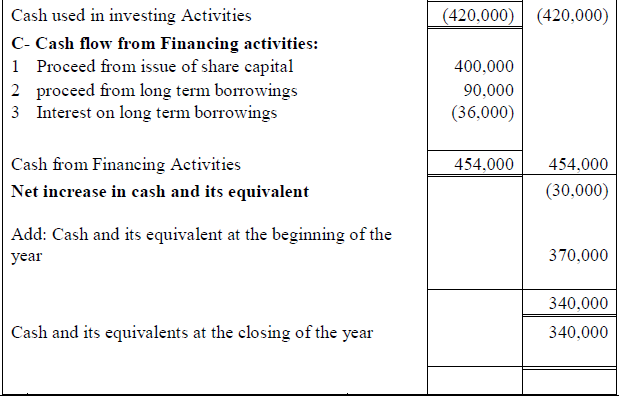

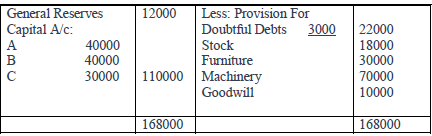

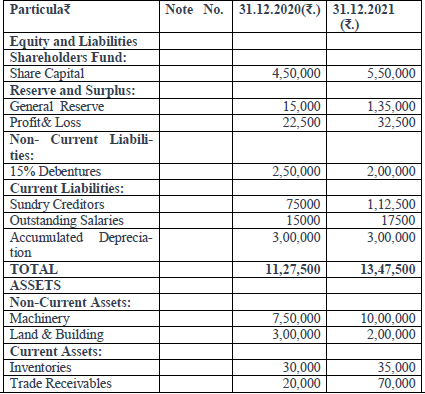

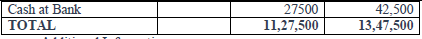

Question.34 From the following Balance Sheets of ACC Limited, Prepare cash Flow Statement.

Additional Information:

(i) During the year 2021, a piece of Machinery costing ₹.2,00,000

(accumulated depreciation ₹.90,000) was sold for ₹.1,15,000.

(ii) Debentures are redeemed on 01.01. 2021

Answer.