Please see Money and Credit Class 10 Social Science Revision Notes provided below. These revision notes have been prepared as per the latest syllabus and books for Class 10 Social Science issues by CBSE, NCERT, and KVS. Students should revise these notes for Chapter 3 Money and Credit daily and also prior to examinations for understanding all topics and to get better marks in exams. We have provided Class 10 Social Science Notes for all chapters on our website.

Chapter 3 Money and Credit Class 10 Social Science Revision Notes

Money :

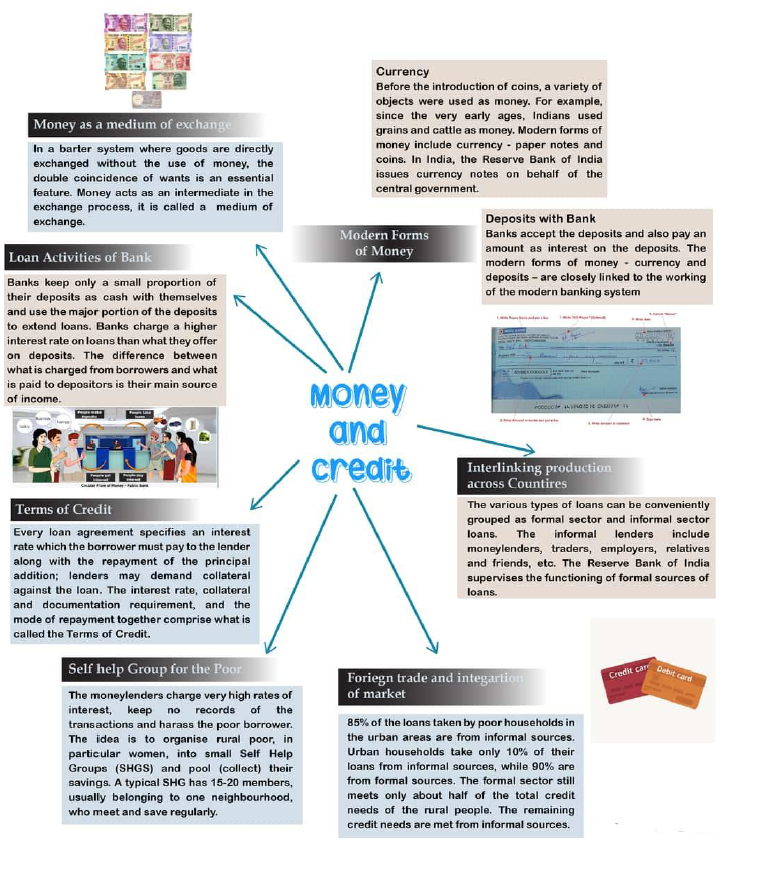

Money acts as an intermediate in the exchange process & it is called medium of exchange. In many of our day to day transactions, goods are being bought & sold with the use of money.

The reason as to why transactions are made in money is that, a person holding money can easily exchange it for any commodity or service that he or she wants.

Double coincidence of wants :

When in the exchange, both parties agree to sell and buy each others commodities it is called double coincidence of wants. In the barter system double coincidence of wants is an essential feature.

Demand Deposits in Bank :

Deposits in the bank account that can be withdrawn on demand. People need only some currency for their day to day needs. For instance workers who receive their salaries at the end of each month, have some extra cash. They deposit it with the banks by opening a bank account in their name. Bank accept the deposits and also pay an interest rate on the deposits.

Cheque :

Paper instructing the bank to pay a specific amount from a person’s account to the person in whose name the cheque is drawn.

Reserve Bank of India :

1. It is the central bank of India which controls the monetary policy of the country.

2. Reserve Bank of India supervises the activities of formal sector and keep the track of their activities but there is no one supervise the functioning of informal sector.

3. Periodically banks have to submit information to the RBI on how much they are lending and to whom, at what interest rate, etc.

Credit :

The activity of borrowing and lending money between two parties.

Collateral :

1. Collateral is an asset that the borrower owns (such as land, building, vehicle, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid.

2. Property such as land titles, deposits with banks, livestock are some common examples of collateral used for borrowing.

Terms of Credit :

1. Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit.

2. The terms of credit vary substantially from one credit arrangement to another. They may vary depending on the nature of the lender and the borrower.

Formal sector :

1. Includes banks & cooperatives; RBI supervises the functioning of formal sources of loans.

2. To see that the bank maintains a minimum cash balance and monitors that these banks give loans not just to profit-making business and traders but also to small cultivators , small scale industries , to small borrowers etc. periodically banks have to submit information to RBI of their activities.

Informal sector :

1. Includes money lenders, traders, employers, relatives & friends etc.

2. There is no one to supervise their credit activities.

3. They can charge whatever rate of interest.

4. There is no one to stop them from using unfair means to get their money back.

Self Help Groups (SHG) :

1. A typical SHG has 15-20 members usually belonging to a neighborhood, who meet and save regularly. Saving per month varies from 25-100 rupees or more depending upon the ability of the people.

2. Members take small loans from group itself to meet their needs.

VERY SHORT ANSWER QUESTIONS

Question. Which authority issues currency notes in India ?

Answer : In India, Reserve Bank of India issues currency notes on behalf of the central government.

Question. State any one advantage of Self-Help Groups.

Answer : The regular meetings of the group provide a platform to discuss and act on a variety of social issues as health, nutrition, domestic violence etc.

Question. Which is the main source of income of the banks ?

Answer : The difference between what is charged from the borrowers and what is paid to depositors is the main source of income of the banks.

Question. Why are transactions made in money ?

Answer : Transactions are made in money because a person holding money can easily exchange it for any commodity or service that he or she might want.

Question. Why no person can refuse to accept payments in rupee?

Answer : No one can refuse to accept payment in rupee because it is a legal currency authorized by the government.

Question. What is the basic feature of double coincidence of wants ? In which system is it practiced ?

Answer : Basic feature is that both parties agree to sell and buy each other’s commodities. It is practiced in Barter system.

Question. What is credit ?

Answer : Credit (loan) refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Question. Why do people deposit money with the banks ?

Answer : People deposit surplus money with the banks because in this way their money is safe and it earns an interest too.

Question. What are “terms of credit” ?

Answer : Interest rate, collateral and documentation requirement, and the mode of repayment together comprise the terms of credit.

Question. Why is currency accepted as a medium of exchange ?

Answer : Because it is authorised by the government of a country e.g., Indian Government.

Question. Which authority does supervise the functioning of formal sources of loans and how ?

Answer : 1. Reserve Bank of India.

2. The RBI monitors that the banks actually maintain the cash balance. It also sees that the banks give loans to all rich as well as poor.

Question. Which are the major sources of cheap credit in rural areas ?

Answer : Banks and the cooperative societies.

Question. How do banks use the major portion of the deposits ?

Answer : Banks use the major portion (55%) of the deposits to extend loans to people for various economic activities.

Question. How do the demand deposits share the essential features of money ?

Answer : The facility of cheques against demand deposits make it possible to directly settle payments without the use of cash. Since demand deposits are accepted widely as a means of payment, along with currency, they constitute money in the modern economy.

Question. Who are the informal lenders ?

Answer : Moneylenders, traders, employers, relative and friends are the informal lenders.

Question. What are the modem forms of money ? State any one.

Answer : Modern forms of money include currency- paper notes and coins.

Question. Who takes the important decisions in SHG regarding the savings and loan activities ?

Answer : Most of the important decisions regarding the savings and loan activities are taken by the group members.

Question. In rural areas which is the main demand for credit ?

Answer : In rural areas, the main demand for credit is crop production and purchase of pesticides and fertilizers.

Question. What is a cheque ?

Answer : A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been made.

Question. How much amount of the deposits is kept as cash by the banks and why?

Answer : Banks hold about 15 per cent of their deposits as cash to pay the depositors who might come to withdraw money from the bank on any given day.

Question. Which Nobel Prize was awarded to Professor Muhammad Yunus and when ?

Answer : In 2006, Professor Muhammad Yunus of Bangladesh was given Nobel Prize for Peace.

Question. Why are deposits with the banks called demand deposits ?

Answer : Deposits with the banks are called demand deposits because they can be withdrawn on demand.

Question. What is debt-trap ?

Answer : When a borrower particularly in rural area fails to repay the loan due to the failure of the crop, he is unable to repay the loan and is left worse off. This situation is commonly called debt-trap. Credit in this case pushes the borrower into a situation from which recovery is very painful.

Question. State any one difference between the formal lenders and the informal lenders.

Answer : Most of the informal lenders charge a much higher interest on loans.

Question. What is a collateral ?

Answer : Collateral is an asset that the borrower owns (such as land, building, vehicle, livestocks, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid.

Question. Which hank was founded by Prof. Muhammad Yunus and why ?

Answer : Grameen Bank of Bangladesh was started by Prof. Muhammad Yunus to meet the credit needs of the poor at reasonable rates.

SHORT ANSWER QUESTIONS

Question. What is a collateral ? What happens if a borrower fails to repay the loan ? Give some examples of collateral.

Answer : 1. Collateral is an asset that the borrower owns and uses this as a guarantee to a lender until the loan is repaid.

2. If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

3. Property such as land titles, deposits with banks, livestock are some common examples of collateral used for borrowing.

Question. How is money used in everyday life? Explain with examples.

Answer : 1. Money plays a central role in our daily life. It is used as a medium of exchange to carry out transactions.

2. Money buys us food, clothing, shelter and other basic necessities of life.

3. Money provides us social security. It is needed to procure services like transport, education, healthcare, entertainment, recreation, and so on. Money facilitates business and trade and is the basis of the working of an economy.

Question. What is meaning of Barter system ? Why is double coincidence of wants is an essential feature of a Barter system ?

Answer : • A system in which goods are directly exchanged without the use of money is called barter system.

• Double coincidence of wants means when both the parties – seller and purchaser – agree to sell and buy each other’s commodities. It implies that what a person desires to sell is exactly what the other wishes to buy. No money is used in such an arrangement. Therefore it is an essential feature of barter system.

Question. Explain with examples, how people are involved with the banks.

Answer : 1. Banks help people to save their money and keep their money in safe custody of the bank. Banks accept deposits from the public and also help people to earn interest on their deposits.

2. People can withdraw the money deposited with the bank at the time of their need. As the money can be withdrawn on demand, these are called demand deposits.

3. Banks also grant loans to people for a variety of purposes. In times of need individuals, business houses and industries can borrow money from the banks.

Question. Why is it necessary for the banks and cooperative societies to increase their lending facilities in rural areas? Explain.

Answer : Banks and Cooperatives can help people in obtaining cheap and affordable loans. This will help people to grow crops, do business, set up small-scale industries or trade in goods and also help indirectly in the country’s development. They should do so, so that relatively poor people do not have to depend on informal sources of credit (money-lenders).

Question. Why is modern currency accepted as a medium of exchange without any use of its own ? Find out the reason.

Answer : Modern currency is accepted as a medium of exchange without any use of its own due to reasons as mentioned below :

• In India, the Reserve Bank of India issues currency notes on behalf of the central government.

• As per Indian law, no other individual or organisation is allowed to issue currency.

• The law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India.

• No individual in India can legally refuse a payment made in rupees. Hence the rupee is widely accepted as a medium of exchange.

Question. How is money transferred from one bank to another bank account ?

Or

Describe how cheque payments are made and realised.

Answer : If a person has to make a payment, he issues a cheque for a specific amount in his name. The bank will deposit the cheque in their own account in the bank. Thereafter, the money is transferred from one bank to another bank account in a couple of days. Thus, transaction takes place without any payment of cash from one bank account to another bank account.

LONG ANSWER QUESTIONS

Question. What are Self-Help Groups ? Describe in brief their functioning including their aim and importance.

Answer : (1) Atypical Self-Help Group has 15-20 members, usually belonging to one neighborhood who meet and save regularly.

(2) The functioning of SHGs is as given below :

1. Aim : The aim of Self-Help Group is to organize rural poor, women in particular and collect their savings and to take loans from the group to meet their needs. The group takes loan from the bank to create self-employment opportunities for the members.

2. Working of the SHG : Decisions on loans and savings are taken by the group members. All matters relating to the purpose, amount, interest rate, repayment schedule are decided by the group members. The group is responsible for the repayment of the loan. Non-repayment of loan by any member is followed up seriously by other members of the group.

3. Importance :

(a) SHGs have helped borrowers overcome the problem of lack of collateral because the banks are willing to lend to the poor women organized in SHGs, even though they have no collateral as such.

(b) The borrowers can get timely loans at a reasonable interest rate.

(c) It has helped women in the rural areas to become financially self-reliant.

(d) The meetings of the groups provide a platform to discuss and act on a variety of social issues such as health, nutrition and domestic violence.

Thus, SHGs are playing a significant role in the improvement of the condition of the poor, particularly women.

Question. Why should credit at reasonable rates from the banks and cooperatives be available for all ?

Answer : 1. Credit at reasonable interest rates should be available for all so that they may increase their income and help in the overall development of the country.

2. High interest rate does little to increase the income of the borrowers.

3. It is necessary that the banks and cooperatives increase their lending particularly in rural areas, so that the dependence of the people on informal sources of credit reduces.

4. In addition to this more credit should be given to the poor to get maximum benefit from the cheaper loans.

5. This will help in increasing their income as well as standard of living.

Question. Explain three terms of credit.

Answer : (1) The terms of credit are as mentioned below :

1. Interest rate.

2. Collateral and documentation requirement.

3. Mode of repayment.

(2) The terms of credit vary substantially from one credit arrangement to another.

(3) Interest rate in the formal sector e., banks and cooperative is about 9-10 per cent but in informal sector, the moneylender and grain merchants etc. charge much higher interest. Thus the cost to the borrower of informal loans is much higher.

(4) Moneylenders take collateral such as land. As the interest rate is higher and if the borrower is unable to repay for any reason, they try to exploit the borrower by taking control of the collateral land etc.

(5) Banks insist on documentation requirement and collateral before granting loans. That is why it becomes difficult for the poor to get loans from the banks.

Question. Describe the pattern of formal and informal sources of credit in urban areas. Why do we need to expand formal sources of credit ?

Answer : (1) The people in the urban areas are divided into four categories :

• Poor households

• Households with few assets

• Well-off households

• Rich households.

85 per cent of the poor households take loans from informal sources whereas only 10 per cent of the rich households take loans from informal sources. 90 per cent of the rich households take loans from the formal sources.

(2) In urban areas, poor households suffer at the hands of informal sources. The same is the position in rural areas. Most of the informal lenders charge a much higher interest on loans.

As a result of it, larger part of the earnings of the borrowers is used to repay the loan. In some cases, the amount to be repaid becomes greater than the income of the borrower. This leads to debt-trap. These reasons make it necessary to expand the formal sources of credit i.e., banks and cooperatives which will make available cheap and affordable credit to the people.

Question. What are the differences between formal and informal sectors of credit or loans ?

Or

Explain any two features each of formal sector loans and informal sector loans.

Answer : The main differences between formal sector and informal sector loans are as given below :

(image)

| Formal sector | Informal sector |

| (1) Formal sector source are banks and cooperatives. | (1) Informal sector sources are moneylenders, traders, employers, relatives and friends. |

| (2) The banks and cooperatives charge less rate of interest i.e., about 10 per cent per annum or so. | (2) Informal sector sources charge higher interest Le., 3 to 5 per cent per month. |

| (3) It results in more income and better condition of the borrower. There is improvement in his financial condition. | (3) Higher rate of interest results in less income for the borrowers. It sometimes leads to debt-trap. |

| (4) Reserve Bank of India supervises the functioning of formal sources of loans. | (4) There is no organization which supervises the credit activities of the lenders in the informal sector. They do whatever is in their interest. |

Question. “Deposits in the hanks are beneficial to the depositors as well as to nation.” Examine the statement.

Answer : (1) Deposits are beneficial to the depositors as mentioned below :

• Banks accept the deposit and pay as interest rate on the deposits.

• Money is safe with the bank.

• People (depositors) may withdraw the money as and when they require.

• Depositors may make payments through cheques instead of cash.

(2) Deposits are beneficial for the banks too as mentioned below :

• Banks keep only a small proportion of deposits. Now days, banks keep about 15 per cent as cash in order to pay the depositors who might come to withdraw money from the bank on any given day.

• Bank use the major portion of the deposits to extend loans. There is huge demand for loans for various economic activities. Banks make use of the deposits to meet the loan requirements of the people. Businessmen and other entrepreneurs take loans from the banks and open factories. They help in the advancement of the economy. Thus the deposits are beneficial to the nation.

CASE BASED STUDY QUESTIONS

PASSAGE 1

The other form in which people hold money is as deposits with banks. At a point of time, people need only some currency for their day-to-day needs. For instance, workers who receive their salaries at the end of each month have extra cash at the beginning of the month. What do people do with this extra cash. They deposit it with the banks by opening a bank account in their name. Banks accept the deposits and also pay an amount as interest on the deposits and in this way people’s money is safe with the banks and it earns an amount as interest. People also have the provision to withdraw the money as and when they require. Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits.

1. What do workers do with extra cash?

Answer : 1. The workers deposit the extra cash in the banks by opening a bank account in their name. Banks accept the deposits and also pay an amount as interest on the deposits.

2. When can people withdraw money?

Answer : People have the provision to withdraw the money as and when they require.

3. Name the other form in which people hold money?

Answer : Deposits with Bank

PASSAGE 2

Demand deposits are another interesting facility. It is this facility which lends it the essential characteristics of money that of a medium of exchange. You would have heard of payments being made by cheques instead of cash. For payment through cheque, the payer who has an account with the bank, makes out a cheque for a specific amount. A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

1 . What is a cheque?

Answer : A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

2. Who issues a cheque?

Answer : The account holder who has an account with the bank.

3. What benefit would you find with cheque transaction?

Answer : 1. It allows to have cashless transaction.

2. It can be used in distant places.