Please refer to the Accounting Ratios Revision Notes given below. These revision notes have been designed as per the latest NCERT, CBSE and KVS books issued for the current academic year. Students will be able to understand the entire chapter in your class 12th Accountancy book. We have provided chapter wise Notes for Class 12 Accountancyas per the latest examination pattern.

Revision Notes Chapter 5 Accounting Ratios

Students of Class 12 Accountancy will be able to revise the entire chapter and also learn all important concepts based on the topic wise notes given below. Our best teachers for Grade 12 have prepared these to help you get better marks in upcoming examinations. These revision notes cover all important topics given in this chapter.

Meaning of Accounting Ratios

It is a ratio that describes relationship between accounting variables / numbers contained in financial statements.

Meaning of Ratio Analysis

It means the study (analysis) and interpretation of relationship between different accounting variables contained in financial statements using accounting ratios.

Objectives of Ratio Analysis

♦ To simplify accounting information.

♦ To determine liquidity & solvency.

♦ To assess operational efficiency of the business

♦ To determine profitability.

♦ To facilitate comparison

♦ To know the areas of the business which need more attention

♦ To know about the potential areas which can be improved with the effort in the desired direction.

♦ To provide information derived from financial statements useful for making projections and estimates for the future.

Advantages of Ratio Analysis

♦ Helps to understand efficacy of decisions.

♦ Simplifies complex figures and establish relationships.

♦ Helpful in comparative analysis.

♦ Identification of problem areas.

♦ Enables SWOT analysis.

♦ Useful in inter-firm & intra-firm comparison.

Limitations of Ratio Analysis

♦ Limitations of Accounting Data i.e. if financial statements do not reflect true state of affairs, then ratios will also show false picture.

♦ Ignores Price-level Changes.

♦ Ignore Qualitative or Non-monetary Aspects

♦ Variations in Accounting Practices may hamper comparison using ratio analysis.

♦ May not be helpful in forecasting merely from historical analysis.

♦ Lack of standard ratios.

Types of Ratios

(A) Traditional Classification :

(i) Statement of Profit and Loss Ratios

(ii) Balance Sheet Ratios

(iii) Composite Ratios i.e. ratios computed with one variable from the

statement of profit and loss and another variable from the balance

sheet.

(B) Functional Classification :

(i) Liquidity Ratios – It shows the ability of the business to meet its short-term obligations.

(ii) Solvency Ratios – It shows the ability of the business to meet its long-term obligations.

(iii) Activity (or Turnover) Ratios – It shows how efficiently resources are being used to generate sales.

(iv) Profitability Ratios – It helps in analysis of profits i n relation to revenue from operations or funds (or assets) employed in the business. Thus, it helps in assessing profitability of a business.

MCQs Questions Accounting Ratios Class 12 Accountancy

Question: At the time of change in the profit-sharing ratio, when revised values of Assets & Liabilities are not to be recorded (Assets & Liabilities will appear in Balance Sheet at old value). Calculate the net effect of revaluation Gain/Loss:

(A) a. Add: Increase in the value of Assets

b. Add: Decrease in the value of liabilities

c. Less: Decrease in the value of Assets

d. Less: Increase in the value of liabilities

(B) a. Add: Increase in the value of liabilities

b. Add: Decrease in the value of Assets

c. Less: Increase in the value of Assets

d. Less: Decrease in the value of liabilities

(C) a. Add: Decrease in the value of Assets

b. Add: Increase in the value of liabilities

c. Less: Decrease in the value of Assets

d. Less: Increase in the value of Assets

(D) None of the above

Answer

A

Question: Mira, Sita and Priya were sharing profits I the ratio of 2:2:1. They decided to share future profits in the ratio of 7:5:3. Their Balance Sheet showed a balance of Rs. 45,000 in Advertisement Account. The amount to be debited respectively to the Capital accounts of Mira, Sita and Priya for writing off the amount in Advertisement Suspense account will be

(A) Rs.15,000, Rs.15,000, Rs.15,000

(B) Rs.22,500, Rs.22,500, Nil

(C) Rs.18,000, Rs.18,000, Rs.9,000

(D) Rs.21,000, Rs.15,000, Rs.9,000

Answer

C

Question: Which of the following is NOT true in relation to goodwill? i It is an intangible asset ii It is fictitious asset iii It has a realisable value iv None of the above

Answer

B

Question: X Y and Z are partners sharing profits and losses in the ratio 5 : 3 : 2. They decide to share the future profits in the ratio 3 : 2 : 1. Workmen compensation reserve appearing in the balance sheet on the date, if no information is available for the same,will be : i Distributed to the partners in old profit sharing ratio ii Distributed to the partners in new profit sharing ratio iii Distributed to the partners in capital ratio iv Carried forward to new balance sheet without any adjustment

Answer

A

Question: On the reconstitution of a firm change in the value of assets is called ___

(A) Revaluation of assets

(B) Reassessment of assets

(C) Devaluation of assets

(D) Reassessment of liabilities

Answer

A

Question: Revaluation account is a _______________ Account.

(A) Real

(B) Nominal

(C) Personal

(D) None of the above

Answer

B

Question: Which adjustment is not required when existing partners decide to change their profit sharing ratio:

(A) Reserves

(B) Accumulated profits

(C) Employee Provident Fund

(D) Goodwill

Answer

C

Question: Accounting Standard ____ requires goodwill should be recorded in the books of accounts only when some money or money’s worth is paid for it.

(A) 26

(B) 23

(C) 27

(D) 10

Answer

A

Question: The Excess amount which the firm can get on selling its assets over and above the saleable value of its assets while business purchases is called :

(A) Surplus

(B) Super profits

(C). Resereve

(D) Goodwill

Answer

D

Question: Arun, Beena and Chandani are sharing profits in the ratio of 2:1:1. They have decided to share future profits in the ratio of 3:2:1. Find out the gaining partner. a. Both Arun and Chandani are the gaining partner. b. Chandani is the gaining partner c. Beena is the gaining partner d. Arun is the gaining partner

Answer

C

Question: A, B and C shared profit and losses in the ratio of 3:2:1 respectively. With effect from 1st April, 2016, they agreed to share profit equally. The goodwill of the firm was valued at Rs.36,000. Pass necessary journal entry.

(A) A’s capital a/c ………………Dr 6,000

To B’s capital a/c 6,000

(B) B’s capital a/c ………………Dr 6,000

To A’s capital a/c 6,000

(C) B’s capital a/c ………………Dr 6,000

To C’s capital a/c 6,000

(D) C’s capital a/c ………………Dr 6,000

To A’s capital a/c 6,000

Answer

D

Question: WCR = 30,000 and there is no claim against WCR. What journal entry would be passed in case when X,Y and Z decide to change profit sharing ratio from 2:1:2 to 5:3:2-

(A) Workmen Compensation Reserve A/c Dr 30,000

To Provision for workmen compensation claim 10,000

To X’ Capital or current A/c 8,000

To Y’ Capital or current A/c 4,000

To Z’ Capital or current A/c 8,000

(B) Workmen Compensation Reserve A/c Dr30,000

Revaluation a/c…………………………………..Dr 10,000

To Provision for workmen compensation claim 40,000

(C) Workmen Compensation Reserve A/c Dr 30,000

To X’ Capital or current A/c 12,000

To Y’ Capital or current A/c 6,000

To Z’ Capital or current A/c 12,000

(D) Workmen Compensation Reserve A/c Dr 30,000

To X’ Capital or current A/c 15,000

To Y’ Capital or current A/c 9,000

To Z’ Capital or current A/c 6,000

Answer

C

Question: A and B were partners in a firm sharing profits or loss equally. With effect from –1-4-2021 they agreed to share profits in the ratio 5:3. Due to change in profit sharing ratio B’s gain or sacrifice will be:

(a) Gain 1/8.

(b) Sacrifice 1/8

(c) Gain 1/10

(d) Sacrifice 1/10

Answer

B

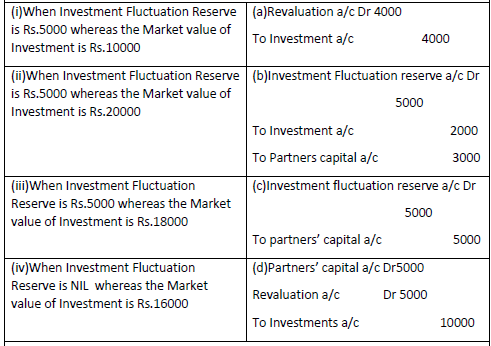

Question: MATCH THE FOLLOWING: Investment shown in the Balance Sheet is Rs.20000

(A) (i)-(d) (ii)-(c ) (iii) (b) (iv)-(a)

(B) (i)-(a) (ii)-(b ) (iii) (c) (iv)-(d)

(C) (i)-(a) (ii)-(b ) (iii) (d) (iv)-(c)

(D) (i)-(c) (ii)-(d ) (iii) (a) (iv)-(b)

Answer

A

Question :Arrange in a proper sequence to determine the goodwill in case of superprofit method.1. Goodwill = super profit* no.of years of purchase.

2. Calculate the super profit.

3. Calculate the capital employed in the business and normal profit

4. calculate/find out the average profit or actual profit.

(A) 1,2,3,4

(B) 2,4,1,3

(C) 4,1,2,3

(D) 4,3,2,1

Answer

D

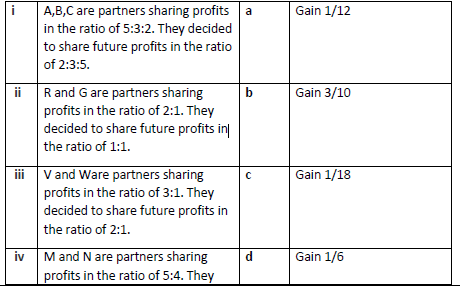

Question: In the following cases, what is the gaining share of the gaining partner

(A) i-c, ii-a, iii-d, iv-b

(B) i-a, ii-b, iii-c, iv-d

(C) i-b, ii-d, iii-a, iv-c

(D) i-d, ii-c, iii-b, iv-a

Answer

C

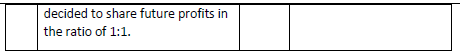

Question: MATCH THE FOLLOWING:

(A) (i)-(b) (ii)-(c ) (iii) (d) (iv)-(a)

(B) (i)-(a) (ii)-(b ) (iii) (c) (iv)-(d)

(C) (i)-(a) (ii)-(b ) (iii) (d) (iv)-(c)

(D) (i)-(c) (ii)-(d ) (iii) (a) (iv)-(b)

Answer

A

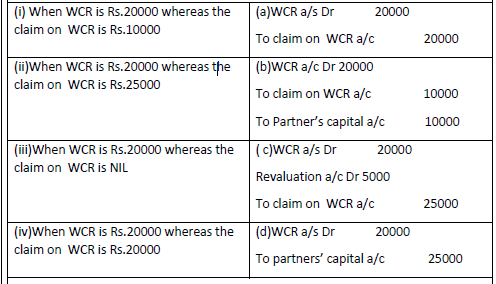

Question: 7. Nitin, Tarun and Amar are partners sharing profits equally and decide to share profits in the ratio of 2 : 2 : 1 w.e.f. 1st April, 2019. The extract of their Balance Sheet as at 31st March, 2019 is as follows:

(A) i-c, ii-a, iii-d, iv-b

(B) i-a, ii-b, iii-c, iv-d

(C) i-b, ii-c, iii-a, iv-d

(D) i-d, ii-c, iii-b, iv-a

Answer

D

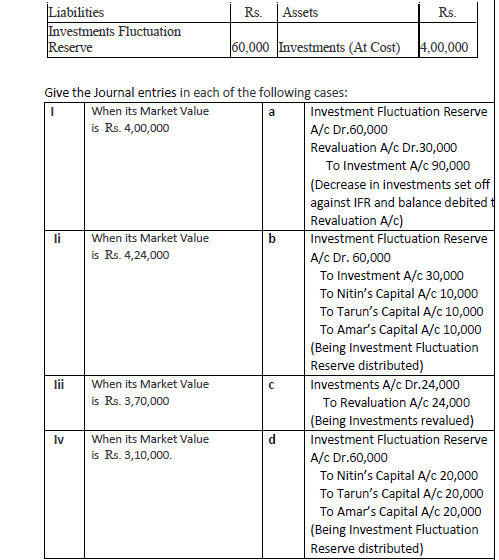

Question: 1. Match the following:–

(A) 1.d;2.b;3.a;4.c

(B) 1.a;2.c;3.d;4.b

(C) 1.b;2.d;3.a;4.c

(D) 1.c;2.a;3.b;4.d

Answer

A

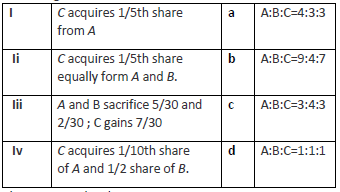

Question: Match the following: A, B and C are partners sharing profits and losses in the ratio of 5 : 4 : 1. Calculate new profit-sharing ratio, sacrificing ratio and gaining ratio in each of the following cases:

(A) i-c, ii-a, iii-d, iv-b

(B) i-a, ii-b, iii-c, iv-d

(C) i-b, ii-c, iii-a, iv-d

(D) i-d, ii-a, iii-b, iv-c

Answer

A