Please refer to MCQ Questions Chapter 6 Trial Balance and Rectification of Errors Class 11 Accountancy with answers provided below. These multiple-choice questions have been developed based on the latest NCERT book for class 11 Accountancy issued for the current academic year. We have provided MCQ Questions for Class 11 Accountancy for all chapters on our website. Students should learn the objective based questions for Chapter 6 Trial Balance and Rectification of Errors in Class 11 Accountancy provided below to get more marks in exams.

Chapter 6 Trial Balance and Rectification of Errors MCQ Questions

Please refer to the following Chapter 6 Trial Balance and Rectification of Errors MCQ Questions Class 11 Accountancy with solutions for all important topics in the chapter.

MCQ Questions Answers for Chapter 6 Trial Balance and Rectification of Errors Class 11 Accountancy

Question. Format of a trial balance is

(a) Name of Accounts, LF, Debit Balance, Credit Balance

(b) Name of Accounts, JF, Debit Balance, Credit Balance

(c) Name of Accounts, Voucher no., Debit Balance, Credit Balances

(d) Name of Accounts, Voucher no., LF, JF, Debit and Credit Balances

Answer

A

Question. Balance method of trial balance shows

(a) total of debit and credit of all ledger accounts separately

(b) final balance of all ledger accounts

(c) total of debit and credit balance separately and then in separate column, final balance of all ledger accounts

(d) None of the above

Answer

B

Question. Which of the following statements is/are correct about suspense account?

(i) Suspense account is a temporary account opened to rectify one sided errors.

(ii) Debit balance of suspense account is taken to balance sheet on the assets side.

Alternatives

(a) Only (i)

(b) Only (ii)

(c) Both (i) and (ii)

(d) None of these

Answer

C

Question. Identify the incorrect characteristic of trial balance.

(a) It shows balances of all ledger accounts and cash book

(b) It shows final position of all accounts

(c) It is a part of double entry system of book-keeping

(d) It can be prepared anytime

Answer

C

Question. Which error(s) does/do not affect the trial balance?

(a) Error of commission

(b) Error of principle

(c) Error of complete omission

(d) Both (b) and (c)

Answer

D

Question. Which of the following is not an error of commission?

(a) Overcasting of sales book

(b) Credit sales to Ramesh ₹ 5,000 credited to his account

(c) Wrong balancing of machinery account

(d) Cash sales not recorded in cash book

Answer

D

Question. Raghu wrongly treated capital expenditure worth ₹ 10,000 as revenue expenditure worth ₹ 10,000. Identify the error committed by Raghu.

(a) Error of principle

(b) Error of commission

(c) Error of omission

(d) Compensating error

Answer

A

Question. Credit purchases from Rohan ₹ 9,000 was posted to the debit of Gobind as ₹ 10,000. In this case, suspense account will be debited with

(a) ₹ 9,000

(b) ₹ 10,000

(c) ₹ 19,000

(d) None of these

Answer

C

Question. Identify the error that do not affect trial balance.

(a) Error of commission

(b) Error of principle

(c) Error of partial omission

(d) All of these

Answer

B

Question. Which of the following statements is/are true about trial balance?

(a) Trial balance is prepared with the help of all accounts and cash book

(b) Trial balance is prepared only at the end of financial or calendar year

(c) Both (a) and (b)

(d) None of the above

Answer

A

Question. Sales return book was overcast by ₹ 5,000. Which of the undermentioned options reflect correct rectifying entry for the above mistake?

(a) Suspense A/c Dr 5,000

To Sales Return A/c 5,000

(b) Sales Return A/c Dr 5,000

To Suspense A/c 5,000

(c) Debtors A/c Dr 5,000

To Sales Return A/c 5,000

(d) Sales Return A/c Dr 5,000

To Debtors A/c 5,000

Answer

A

Question. If closing stock is shown in trial balance, it means

(a) it is adjusted against opening stock

(b) it is adjusted against purchases

(c) Both (a) and (b)

(d) None of these

Answer

B

Question. Trial balance is prepared

(a) monthly

(b) quarterly

(c) half yearly

(d) on any date

Answer

D

Question. Preeti was paid cash ₹ 2,800 but Jyoti was debited by ₹ 2,000. In rectifying entry, suspense account will be

(a) debited by ₹ 2,800

(b) credited by ₹ 2,000

(c) credited by ₹ 800

(d) debited by ₹ 800

Answer

C

Question. Goods of ₹ 1,000 purchased on credit from Mr ‘A’ are recorded in purchases book for ₹ 10,000. Which type of error is this?

(a) Error of casting

(b) Error of recording

(c) Error of carrying forward

(d) Error of posting

Answer

B

Question. An item of ₹ 53 has been debited to a personal account as ₹ 35. It is an error of

(a) commission

(b) omission

(c) complete error

(d) principle

Answer

A

Question. Repairs were debited to building account for ₹ 20,000. Which journal entry reflects correct rectification of error done by Manoj Enterprises?

(a) Repairs A/c Dr 20,000

To Building A/c 20,000

(b) Repairs A/c Dr 20,000

To Suspense A/c 20,000

(c) Building A/c Dr 20,000

To Suspense A/c 20,000

(d) Building A/c Dr 20,000

To Repairs A/c 20,000

Answer

A

Question. Sundry creditors worth ₹ 50,000 will be shown

(a) in debit column of trial balance

(b) in credit column of trial balance

(c) as an adjustment at end

(d) None of these

Answer

B

Question. Interest received worth ₹ 1,000 and sales worth ₹ 5,00,000 are shown

(a) in debit column and credit column respectively of trial balance

(b) in credit column and debit column respectively of trial balance

(c) in credit column of trial balance

(d) in debit column of trial balance

Answer

C

Question. Balance of purchase is shown

(a) in debit column of trial balance

(b) in credit column of trial balance

(c) as an adjustment at end

(d) None of these

Answer

A

Question. Identify the incorrect objective of preparing trial balance.

(a) To prepare financial statements

(b) To locate errors

(c) To communicate accounting information to the users

(d) To ascertain arithmetical accuracy of ledger accounts

Answer

C

Question. Undercasting of sales book is corrected by …… sales account.

(a) debiting

(b) crediting

(c) both debit/credit

(d) None of these

Answer

B

Question. Error in which effect of one error is nullified by the effect of another error is called …… error.

(a) error of commission

(b) compensating error

(c) error of omission

(d) None of these

Answer

B

Question. Trial balance is

(a) an account

(b) a statement

(c) ledger

(d) Both (a) and (b)

Answer

B

Question. A trader has prepared the trial balance and total doesn’t tie. Which approach the trader should follow?

(a) Firstly, he should recheck all the ledger

(b) He should recheck the total of trial balance

(c) He should open the suspense account

(d) All of these

Answer

D

Question. If wages paid for installation of new machinery is debited to wages account, it is

(a) an error of commission

(b) an error of principle

(c) a compensating error

(d) an error of omission

Answer

B

Question. Balance of bad debts is shown

(a) in debit column of trial balance

(b) in credit column of trial balance

(c) as an adjustment at end

(d) by adjusting it with debtors

Answer

A

Question. What will be the effect on trial balance if ₹ 2,000 received as rent and correctly entered in the cash book but not posted to rent account?

(a) Debit side of trial balance will exceed by ₹ 2,000

(b) Debit side of trial balance will decrease by ₹ 2,000

(c) Credit side of trial balance will decrease by ₹ 2,000

(d) Credit side of trial balance will exceed by ₹ 2,000

Answer

A

Question. Which of the following error(s) does/do affect trial balance?

(a) Error of principle

(b) Compensating errors

(c) Error of partial omission

(d) Error of complete omission

Answer

C

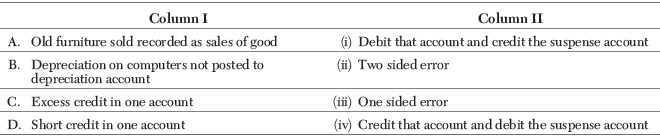

Question. Match the items given in column I with column II.

Codes

A B C D

(a) (ii) (iii) (i) (iv)

(b) (iv) (i) (ii) (iii)

(c) (iii) (ii) (iv) (i)

(d) (iii) (i) (ii) (iv)

Answer

A

Question. ……… are not disclosed by trial balance. Therefore, trial balance total will still agree.

(a) One sided errors

(b) Partial sided errors

(c) Two sided errors

(d) Biased sided errors

Answer

C

Assertion-Reasoning MCQs :

Question. Assertion (A) Error of incorrectly recording transaction in the books of accounts is rectified by opening suspense account.

Reason (R) Suspense account is opened to rectify one sided errors.

(a) Both Assertion (A) and Reason (R) are correct

(b) Both Assertion (A) and Reason (R) are wrong

(c) Assertion (A) is correct, but Reason (R) is wrong

(d) Assertion (A) is wrong, but Reason (R) is correct

Answer

D

Question. Assertion (A) Owner’s wife loan to the business is shown in debit column of trial balance.

Reason (R) All assets are shown in credit column of trial balance.

(a) Assertion (A) is correct, but Reason (R) is wrong

(b) Both Assertion (A) and Reason (R) are correct

(c) Assertion (A) is wrong, but Reason (R) is correct

(d) Both Assertion (A) and Reason (R) are wrong

Answer

D

Question. Assertion (A) Furniture and fixtures is shown in debit column of trial balance.

Reason (R) All assets are shown in debit column of trial balance.

(a) Assertion (A) is correct, but Reason (R) is wrong

(b) Both Assertion (A) and Reason (R) are correct

(c) Assertion (A) is wrong, but Reason (R) is correct

(d) Both Assertion (A) and Reason (R) are wrong

Answer

B

Question. Assertion (A) Purchase book overcast by ₹ 700 is rectified by opening suspense account.

Reason (R) One sided errors cannot be rectified by recording a journal entry unless a suspense account is opened.

(a) Both Assertion (A) and Reason (R) are correct

(b) Both Assertion (A) and Reason (R) are wrong

(c) Assertion (A) is correct, but Reason (R) is wrong

(d) Assertion (A) is wrong, but Reason (R) is correct

Answer

A

Question. Assertion (A) Trial balance is not a conclusive proof of accuracy of accounts.

Reason (R) Error of commission do not affect trial balance.

(a) Assertion (A) is correct, but Reason (R) is wrong

(b) Both Assertion (A) and Reason (R) are correct

(c) Assertion (A) is wrong, but Reason (R) is correct

(d) Both Assertion (A) and Reason (R) are wrong

Answer

A

Question. Assertion (A) Rent received is shown in credit column of trial balance.

Reason (R) All incomes and profits are shown in credit column of trial balance.

(a) Assertion (A) is correct, but Reason (R) is wrong

(b) Both Assertion (A) and Reason (R) are correct

(c) Assertion (A) is wrong, but Reason (R) is correct

(d) Both Assertion (A) and Reason (R) are wrong

Answer

B

Question. Assertion (A) Inspite of the fact that trial balance tallies, some errors may still be there in accounting records.

Reason (R) Error of partial omission and error of casting do not affect the agreement of trial balance.

(a) Both Assertion (A) and Reason (R) are correct

(b) Both Assertion (A) and Reason (R) are wrong

(c) Assertion (A) is correct, but Reason (R) is wrong

(d) Assertion (A) is wrong, but Reason (R) is correct

Answer

C

Question. Assertion (A) Trial balance total may agree inspite of errors.

Reason (R) Various errors like errors of principle, errors of partial omission are not disclosed by trial balance.

(a) Assertion (A) is correct, but Reason (R) is wrong

(b) Both Assertion (A) and Reason (R) are correct

(c) Assertion (A) is wrong, but Reason (R) is correct

(d) Both Assertion (A) and Reason (R) are wrong

Answer

A

Question. Assertion (A) Trial balance is not a conclusive proof of accuracy of records.

Reason (R) Errors of complete omission and compensating errors do not affect the agreement of trial balance.

(a) Both Assertion (A) and Reason (R) are correct

(b) Both Assertion (A) and Reason (R) are wrong

(c) Assertion (A) is correct, but Reason (R) is wrong

(d) Assertion (A) is wrong, but Reason (R) is correct

Answer

A

Question. Assertion (A) Expectancy account is opened to rectify one sided errors.

Reason (R) One sided errors cannot be rectified by recording a journal entry.

(a) Both Assertion (A) and Reason (R) are correct

(b) Both Assertion (A) and Reason (R) are wrong

(c) Assertion (A) is correct, but Reason (R) is wrong

(d) Assertion (A) is wrong, but Reason (R) is correct

Answer

D

Case Based MCQs :

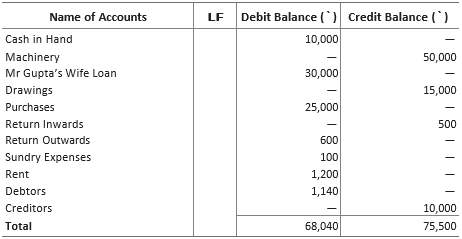

Mr Gupta is a sole proprietor who lives near Darya ganj and deals in sanitary ware. He started his business on 1st April, 2021 with capital of ₹ 1,40,000. His daughter, Reena who is in class 11th of ABC school prepares his trial balance as on 31st March, 2022. Mr. Gupta is a penny pincher who does not want to appoint a CA to prepare his financial statements. Following is extract of trial balance prepared by Reena.

Question. Reena has omitted to show balance of discount allowed and discount received. Can you identify where both will be shown?

(a) In debit and credit column respectively

(b) In credit and debit column respectively

(c) Both will be shown in debit column

(d) Both will be shown in credit column

Answer

A

Question. According to rules for preparing trial balance, liabilities and drawings are shown in

(a) debit column of trial balance

(b) credit column of trial balance

(c) debit and credit column respectively

(d) credit and debit column respectively

Answer

D

Question. Reena has shown machinery in credit balance of trial balance. According to you, where it should be shown?

(a) In credit balance

(b) In debit balance

(c) As an adjustment

(d) Should be adjusted against cash

Answer

B

Question. Identify the item(s) that has/have been shown incorrectly by Reena.

(I) Mr Gupta’s wife loan

(II) Cash-in-hand

(III) Drawings

(IV) Purchases

Alternatives

(a) Only (I)

(b) Only (II)

(c) Both (I) and (III)

(d) Both (IV) and (II)

Answer

C

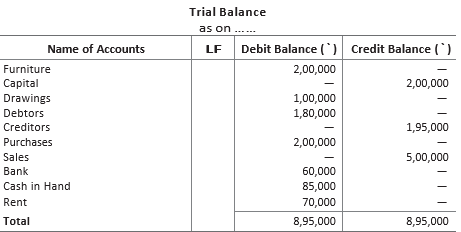

Manuj Jindal, dropout UPSC aspirant has now started his own Edtech Company “MJ Enterprises”, where he sell UPSC, RBI and SEBI exam courses books. To maintain his books of accounts, he hired his friend Sahil, who has just passed IPCC group II.

After preparing following trial balance, Sahil discovered that some transactions were not recorded.

Following transactions were not recorded

(i) Books worth ₹ 5,000 purchased on credit.

(ii) Manuj withdraws ₹ 10,000 for personal use.

(iii) Purchased from M/s Kamran Furniture costing ₹ 20,000.

Question. Which of the following will be the amount of purchases shown in trial balance?

(a) ₹ 2,15,000

(b) ₹ 2,25,000

(c) ₹ 1,95,000

(d) ₹ 2,05,000

Answer

D

Question. What will be the amount of cash to be shown in trial balance?

(a) ₹ 75,000

(b) ₹ 85,000

(c) ₹ 55,000

(d) ₹ 45,000

Answer

A

Question. Which journal entry reflects the correct accounting treatment of transaction “Manuj withdraws ₹ 10,000 for personal use”?

(a) Drawings A/c Dr 10,000

To Cash A/c 10,000

(b) Manuj A/c Dr 10,000

To Cash A/c 10,000

(c) Capital A/c Dr 10,000

To Cash A/c 10,000

(d) MJ Enterprises A/c Dr 10,000

To Cash A/c 10,000

Answer

A

Question. What will be the total of trial balance after taking into consideration unrecorded transactions?

(a) ₹ 9,80,000

(b) ₹ 9,20,000

(c) ₹ 10,50,000

(d) ₹ 12,00,000

Answer

B

Tanvi Kaur, after completing her M.Com from Delhi School of Economics, decided to open her own boutique at Kamla Nagar. She buys clothes from Ramesh park in bulk and sell them in retail.

Due to wide knowledge of accounts, she is also handling books of accounts herself. On 31st March 2020, she prepared the trial balance and she was very elated as both sides were tallied. On the same day in afternoon, Neha, her friend who is a CA in PWC, visited her boutique to buy designer clothes. To Ensure accuracy of records, Tanvi requested

her friend Neha to recheck the books of accounts. Neha happily agreed to check them at night. Next day, in the morning Neha informed Tanvi about two sided errors that were discovered by her.

Following two sided errors were discovered by Neha

(a) Credit sales to Priya ₹ 10,000 were recorded as ₹ 1,000.

(b) Purchases return of ₹ 25,000 to ABC Limited was not recorded.

(c) Purchased furniture for cash worth ₹ 1,00000 but debited to building account.

(d) Credit purchases from Rohan for ₹ 2,00,000 were not recorded.

Question. Which of the following options reflect correct rectification entry for ‘Purchased furniture for cash worth₹ 1,00,000 but debited to building account’?

(a) Furniture A/c Dr 1,00,000

To Building A/c 1,00,000

(b) Building A/c Dr 1,00,000

To Cash A/c 1,00,000

(c) Building A/c Dr 1,00,000

To Suspense A/c 1,00,000

(d) Suspense A/c Dr 1,00,000

To Furniture A/c 1,00,000

Answer

A

Question. Which of the undermentioned options reflect correct rectification entry for ‘Credit sales to Priya ₹ 10,000 were recorded as ₹ 1,000’?

(a) Priya Dr 10,000

To Suspense A/c 10,000

(b) Priya Dr 9,000

To Sales A/c 9,000

(c) Priya Dr 9,000

To Suspense A/c 9,000

(d) Priya Dr 10,000

To Sales A/c 10,000

Answer

B

Question. Read the following statements carefully.

I Suspense account is temporary account which is opened to rectify errors that affect the trial balance.

II Posting twice in an account, error of partial omission, error in carrying forward, etc affect the agreement of trial balance.

In context of above two statements, which of them is incorrect?

(a) Only I

(b) Only II

(c) Both I and II

(d) None of these

Answer

D

Question. Which of the following journal entries reflect correct rectification entry for ‘Purchases return of ₹ 25,000 to ABC Limited was not recored’?

(a) ABC Limited Dr 25,000

To Purchases Return A/c 25,000

(b) Purchases Return A/c Dr 25,000

To ABC Limited 25,000

(c) ABC Limited Dr 25,000

To Suspense A/c 25,000

(d) Suspense A/c Dr 25,000

To Purchases Return A/c 25,000

Answer

A

Niharika, a B.Com graduate from Dyal Singh College got job as an accountant at Anuj Furniture Enterprises, Kriti Nagar. She is very diligent girl who is working hard to earn her livelihood as she is sole bread earner of her family.

Anuj, CEO of Anuj Furniture Enterprises asked Niharika to make trial balance and then to prepare final accounts. She prepared all the subsidiary books and ledger accounts and then put in place final balances of them in format of trial balance. Unexpectedly, trial balance total didn’t agree. At the same time, Anuj came to her cabin and Niharika shared her problem with him.

Anuj being a benevolent person asked her not to worry and called his brother Rahul, who is a CA in PWC.

Rahul asked Niharika to mail him all accounting records. Then, she went home.

Next day, Rahul mailed Niharika all errors that she has committed while making trial balance.

Following errors were identified

(a) Purchases book under cast by ₹ 3,000.

(b) Goods withdrawn for personal use by Anuj worth ₹ 20,000 were not recorded in books.

(c) A credit sale of ₹ 16,500 credited to the sales account and also to the sundry debtors account.

(d) A cheque for ₹ 9,000 received from Ashok was dishonoured and posted to the debit of sales return account.

Niharika quickly rectified above errors and prepared a corrected trial balance.

Question. Read the following statements carefully.

I Error due to partial omission, error of casting, error in carrying forward and error of principle are one sided errors.

II Suspense account is used for rectifying the errors which do not affect trial balance while errors which affect trial balance are not rectified with the help of suspense account.

In the context of above two statements, which of them is correct?

(a) Only I

(b) Only II

(c) Both I and II

(d) None of these

Answer

D

Question. Which of the following options reflect correct rectification entry for ‘Purchase book undercast by ₹ 3,000’?

(a) Purchases A/c Dr 3,000

To Suspense A/c 3,000

(b) Suspense A/c Dr 3,000

To Purchases A/c 3,000

(c) Purchases A/c Dr 3,000

To Creditors A/c 3,000

(d) Suspense A/c Dr 3,000

Purchase A/c Dr 3,000

To Creditors A/c 6,000

Answer

A

Question. Which of the following options reflect correct rectification entry for ‘A cheque for ₹ 9,000 received from Ashok was dishonoured and posted to the debit of sales return account’?

(a) Suspense A/c Dr 9,000

To Sales Return A/c 9,000

(b) Ashok Dr 18,000

To Sales Return A/c 9,000

To Suspense A/c 9,000

(c) Ashok Dr 9,000

To Sales Return A/c 9,000

(d) Suspense A/c Dr 18,000

To Sales Return A/c 9,000

To Ashok 9,000

Answer

C

Question. Which of the undermentioned options reflect correct rectification entry for ‘A credit sale of ₹ 16,500 credited to the sales account and also to the Sundry debtors account’?

(a) Sundry Debtors A/c Dr 33,000

To Suspense A/c 33,000

(b) Sundry Debtors A/c Dr 16,500

To Suspense A/c 16,500

(c) Suspense A/c Dr 33,000

To Sundry Debtors A/c 33,000

(d) Suspense A/c Dr 16,500

To Sundry Debtors A/c 16,500

Answer

A