Please refer to Assignments Class 12 Accountancy Reconstitution of a Partnership Firm – Admission of a Partner Chapter 3 with solved questions and answers. We have provided Class 12 Accountancy Assignments for all chapters on our website. These problems and solutions for Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner Class 12 Accountancy have been prepared as per the latest syllabus and books issued for the current academic year. Learn these solved important questions to get more marks in your class tests and examinations.

Reconstitution of a Partnership Firm – Admission of a Partner Assignments Class 12 Accountancy

ASSERTION REASON QUESTIONS

Question: Assertion (A): At the time of admission of a new partner he is required to bring premium or goodwill.

Reason (R) : Due to admission of a new partner , the existing partner’s sacrifice their share of profits in favour of new partner. So, he has to compensate the existing partners for loss of their share in super profits of the firm.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

C

Question: Assertion (A): A newly admitted partner has the right to share the assets of the partnership firm.

Reason (R): As per the provisions of the Partnership deed, the new partner has to bring some amount as Capital which can be in cash or in kind of assets to get rights in the assets and future profits of the firm.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

A

Question: Assertion (A): At the time of admission of a new partner unrecorded liability are debited to Revaluation account.

Reason(R): Unrecorded liabilities are the gain for the partnership firm.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

C

Question: Assertion (A): The amount of premium brought in by the new partner is shared by the existing partners in their ratio of Sacrifice.

Reason (R): Because the old partners sacrifice their share of profits in favour of new partner.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

C

Question: Assertion (A): At the time of admission of a new partner, general reserve appearing in the old balance sheet is transferred to all partner’s capital

account.

Reason(R): The new partner is not entitled to have any share in general reserve (accumulated profits). These are transferred to old partner’s capital accounts in old profit-sharing ratio.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

B

Question: Assertion (A): At the time of admission of a partner the goodwill already existing in the book of accounts, the goodwill is written off by all partners including new partner.

Reason(R): When goodwill already exists in books at the time of admission, the existing goodwill must be written off by debiting the old partners in their old profit sharing ratio.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

A

Question: Assertion (A): At the time of admission, the gain or loss on revaluation is transferred to all partner’s capital account in their new profit-sharing

Reason (R): All partners have the right to share the assets and liabilities of the partnership firm.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

B

Question: Assertion (A): At the time of admission of a new partner, advertisement suspense account is transferred to old partner’s capital account in their old profit-sharing ratio

Reason(R): Advertisement suspense account is a part of accumulated losses therefore like any other losses it should be transferred to old partners’ capital

account.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

B

Question: Assertion (A): The revaluation account is prepared for the purpose of transferring the profit or loss arising out of increase or decrease in the book value of assets or liabilities of the partnership at the time of admission of a new partner.

Reason (R): At the time of admission of a new partner, it is always desirable to ascertain whether the assets of a firm are shown in books at their current

values. In case the assets are overstated or understated, these are revaluated.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

D

Question: Assertion (A) :When the new partner brings his share of Goodwill in cash and it is to be paid to the existing partners privately, no entry is passed in the books.

Reason (R): The intention of the partners is not to show amount/transaction relating to Goodwill for any of the reasons.

Choose the correct answer

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

D

Question: Assertion (A): Unrecorded assets are credited to revaluation account at the time of admission of a new partner.

Reason (R): Unrecorded assets are gain for the partnership firm because it increases the value of assets.

a) Both Assertion (A) and Reason (R) are true.

b) Both Assertion (A) and Reason (R) are false.

c) Assertion (A) is true and Reason (R) is false.

d) Assertion (A) is false and Reason (R) is true.

Answer

D

Question: Assertion (A): A new partner can be admitted into a partnership firm with consent of the existing partners.

Reason(R): According to section 31 of the Indian Partnership Act, 1932, new partner shall not be introduced into firm without consent of all the existing partners. Unless it is agreed otherwise by the partners and partnership deed.

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

B

Question: Assertion (A): New profit sharing ratio is the ratio in which the old partner including the new partner share profits or losses of the firm

Reason(R): When new partner is admitted to the firm it is necessary to calculate the new profit sharing ratio with help of the share agreed to forgo by the old partners.

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

D

Question: Assertion (A): On admission of new partner, Assets and Liabilities are revalued and reassessed

Reason(R): The Assets and Liabilities are revalued and reassessed as to show the proper financial position of the firm and capital held by the partners at the time of admission.

Choose the correct answer

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

C

Question: Assertion (A): Profit or loss on revalution of assets and reassessment of liabilities is transferred to the old partners’ Capital account/Current account in old profit sharing ratio.

Reason(R): All the accumulated profits or losses and reserves are transferred to old partners’ capital account/current account in the old profit sharing ratio

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

A

Question: Assertion (A): it is right of the new partner on the firm’s Assets and Labilities

Reason(R): Old partners of the firm sacrifice some profit according to the new profit sharing ratio in favour of incoming partner.

Choose the correct answer

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

C

Question: Assertion (A): The treatment of revaluation of assets and reassessment of liabilities is done in the same manner as done in case of change in profit sharing ratio.

Reason(R): Revaluation of assets and liabilities is only done when new partner is admitted.

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

A

Question: Assertion (A): At the time of admission of partners if there is any general reserve, reserve fund or the balance of profit & loss account appearing in the balance sheet, it should be transferred to old partners’ capital/current accounts in their old profit sharing ratio.

Reason(R): The general reserve, reserve fund or the balance of profit & loss account are the result of the past profits when the new partner was not admitted.

(a) Both Assetion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

A

Question: Assertion (A): Whenever new partner brings Goodwill in cash he should bring the amount of Goodwill only for his share .

Reason(R): It is common rule that the gaining partner should compensate the sacrificing partner, to extent of his gain.

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

D

Question: Assertion (A): If the goodwill is not brought in cash, it can be adjusted only through the new partner’s capital account.

Reason(R):The adjustment will reduce the capital of the partner.

Choose the correct answer

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and the reason (R) are true, but the reason (R ) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason ( R) is false

(d) Assertion (A) is false, but Reason (R) is True

Answer

C

Question. In case of change in profit sharing ratio, when revised values are not to be recorded in the books, then steps to be followed are

(i) Pass a single adjustment entry.

(ii) To find share of sacrifice/(gain) by partners.

(iii) Calculation of the net effect of revaluation.

(iv) Calculation of proportional amount of net effect of revaluation.

(a) (ii) (iii) (iv) (i)

(b) (iii) (ii) (iv) (i)

(c) (iv) (iii) (ii) (i)

(d) None of these

Answer

B

Question. Calculate net effect of revaluation when revised values are to be recorded in books.

(i) Stock is to be valued at 10% less (Book value ₹ 3,00,000).

(ii) Provision for bad debts is no more required, (Shown in balance sheet for ₹ 4,000).

(iii) An outstanding salary which is unrecorded of ₹ 16,000.

(a) ₹ 40,000 profit

(b) ₹ 42,000 profit

(c) ₹ 42,000 loss

(d) None of these

Answer

C

Question. The entry to be passed for adjustment of goodwill when there is a change in profit (loss) sharing ratio of partners, without opening goodwill account is

(a) Sacrificing Partners’ Capital A/c Dr

To Gaining Partners’ Capital A/c

(b) Gaining Partners’ Capital A/c Dr

To Sacrificing Partners’ Capital A/c

(c) Gaining Partners’ Current A/c Dr

To Sacrificing Partners’ Current A/c

(d) Either (b) or (c)

Answer

D

Question. Assertion (A) At the time of reconstitution of firm, assets are revalued and liabilities are reassessed.

Reason (R) The change in the value of assets and liabilities belongs to the period prior to reconstitution and any gain or loss on revaluation is shared in the old ratio by the partners.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

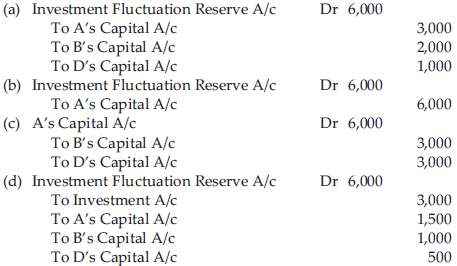

Question. A, B and D are partners in a firm sharing profits (losses) in the ratio of 3 : 2 : 1. They change their ratio into 2 : 1 : 2 for future profits. At that time, their balance sheet shows the following balances.

Investment Fluctuation Reserve = ₹ 6,000;

Investment = ₹ 25,000

Now, the market value of investments is ₹ 22,000. Distribute investment fluctuation reserve among partners.

Answer

D

Question. Which of the following statement(s) is/are incorrect?

(i) Gaining ratio is computed as difference between new share and old share.

(ii) At the time of reconstitution of firm, goodwill can be valued according to average profit method only.

(iii) When any asset or liability is revalued, it is shown in profit and loss adjustment account.

(iv) Revaluation account is real account in nature.

(a) (i) and (ii)

(b) (ii) and (iv)

(c) (i), (iii) and (iv)

(d) Only (ii)

Answer

B

Question. ‘P’, ‘Q’ and ‘R’ are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their new profit sharing ratio will be equal. Which partner has sacrificed and by how much?

(a) Q = 4/30

(b) R = 1/30

(c) P = 5/30

(d) Q = 1/30 and R = 4/30

Answer

C

Question. Reserves are distributed in old partners in……… ratio.

(a) old

(b) gain

(c) new

(d) sacrifice

Answer

A

Question. ‘A’ and ‘B’ are partners in a firm. They share their profits and losses in the ratio of 3 : 2. They have decided that their new profits (losses) sharing ratio will be 1 :1. At that time their goodwill is valued at ₹ 30,000. Calculate amount of goodwill which will be given by B to A.

(a) ₹ 2,500

(b) ₹ 2,400

(c) ₹ 2,800

(d) ₹ 3,000

Answer

D

Question. X, Y and Z are partners sharing profits and losses in the ratio of 5: 4 : 1. Calculate sacrificing or gaining share for each if Z acquires 1/10 th share of X and 1/2 share of Y.

(a) X Sacrifice = 5/100, Y Sacrifice = 20/100, Z Sacrifice = 25/100

(b) X Sacrifice = 5/100, Y Sacrifice = 20/100, Z Gains = 25/100

(c) X Gains = 5/100, Y Gains = 20/100, Z Sacrifice = 25/100

(d) None of the above

Answer

B

Question. Karan and Naman are partners in a firm sharing profits and losses in the ratio of 7 : 5 respectively. From, 1st April, 2021, they decided to share profits and losses in equal ratio. On that date, the extract of their balance sheet is as follows

If value of fixed assets in the balance sheet is undervalued by 20%, then at what value will fixed assets be shown in reconstituted balance sheet?

(a) ₹ 20,62,500

(b) ₹ 14,85,000

(c) ₹ 1,65,000

(d) ₹ 3,30,000

Answer

A

Question. P, Q and R were partners in a firm for 2:2:1 share respectively. P wants to value goodwill but Q is of the opinion that if they valued their goodwill then it will amount to reconstitution. You are required to solve the issue by selecting one option from the following.

(a) They can value goodwill but after reconstitution

(b) Q is correct, if goodwill is valued then reconstitution would take place

(c) P is correct, they can value goodwill whether reconstitution takes place or not

(d) None of the above

Answer

C

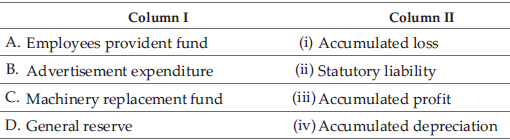

Question. Match the following.

Codes

A B C D

(a) (iii) (ii) (i) (iv)

(b) (iii) (ii) (iv) (i)

(c) (ii) (i) (iv) (iii)

(d) (i) (ii) (iv) (iii)

Answer

C

Question. Change in relationship among partners is called………….. .

(a) dissolution of firm

(b) reconstitution of firm

(c) insolvency of firm

(d) None of these

Answer

B

Question. Assertion (A) When reserves and accumulated profits/losses are adjusted through capital accounts, they appear in the balance sheet of new firm at the old figures.

Reason (R) If partner decide to record net effect of reserves, etc, a single adjusting entry involving the capital accounts of sacrificing and gaining partners is passed.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

CASE STUDY BASED QUESTIONS

Read the following hypothetical text and answer the given questions on the basis of the same:

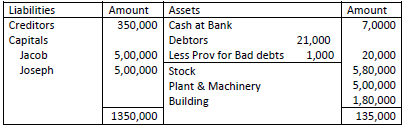

Jacob and Joseph are friends and they are doing manufacturing toys car. Their profit-sharing ratio was 3:2. They got a new project of making electronic toys and they needed additional fund for doing that project. So, they decided to admit their common friend, James for raising the additional fund and he brought Rs.5, 00,000 as capital for 2/7th share. The goodwill of the firm is valued at Rs.14, 00,000.

At the time of James admission their balance sheet as follows:

At the time of revaluation of assets and reassessment of liabilities the following things was found:

a) Provision for bad and doubtful debts should be increased to Rs.3,000

Unexpired insurance of Rs.1, 500 should be brought into record

Question: What will be the correct journal entry for unexpired insurance brought into record?

a) Unexpired Insurance A/c Dr 1500

To Revaluation A/c 1500

b) Revaluation A/c Dr 1500

To Unexpired Insurance A/c 1500

c) Revaluation A/c Dr 1500

To Insurance 1500

d) Insurance A/c Dr 1500

To Revaluation A/c 1500

Answer:

A

Question: What is the treatment of Provision for doubtful debts at the time of James admission?

a) ?3000 debited to Revaluation A/c

b) ?2000 debited to Revaluation A/c

c)?1000 debited to Revaluation A/c

d)?4000 debited to Revaluation A/c

Answer:

B

Question: What will be the new ratio between Jacob, Joseph and James

a) 3:2:2

b) 1:1:1

c) 5:3:2

d) 15:10:5

Answer:

A

Question: What will be the amount of premium or goodwill is credited to Joseph’s A/c

a) 4,00,000

b) 2,40,000

c) 1,60,000

d) 7,00,000

Answer:

C

Read the following hypothetical text and answer the given questions on the basis of the same:

After completing MBA Ram and Rahim started a new business. Their profit-sharing ratio was 3:2. They are running the business very successfully. One day they met their friend Vimal and they are engaged in a friendly talk Vimal said he also wants to join with Ram and Rahim. They admitted Vimal as a new partner for 3/13th share in the profits. Their new profit-sharing ratio will be 5:5:3. On the date of admission the goodwill of the firm valued at Rs.5, 20,000. Vimal brought his share of Capital Rs.2, 50,000 and premium for goodwill in cash. There was a Workmen Compensation Reserve at Ram and Rahim’s Balance sheet Rs.1, 00,000. There was a claim against workmen compensation amounted to Rs. 1, 10,000. At the time of admission of Vimal they found that there was an unrecorded Computer and they brought into account.

Based on above information answer the following

Question: What will be the sacrificing ratio among Ram and Rahim?

a) 1:14

b) 14:1

c) 3:2

d) 1:1

Answer:

B

Question: How much amount of Workmen compensation is distributed among the partners?

a) 1,00,000

b) 1,10,000

c)10,000

d) None of these

Answer:

D

Question: What is the amount of goodwill brought in by Vimal?

a) ?2,50,000

b) ?5,20,000

c) ?1,20,000

d) ?1,12,000

Answer:

C

Question: What will be the treatment of unrecorded computer?

a) Debited to Revaluation A/c

b) Credited to Revaluation A/c

c) Transferred to Debit side of Partners’ capital a/c

d) Transferred to Credit side of Partners’ capital a/c

Answer:

B

Read the following text and answer the following

Rekha, Sunita and Teena are doing paper business in Ludhiyana. They used to share profits in the ratio of 3:2:1. They decided to provide note books to students of rural area at free of cost. Sunitha wants to admit her friend Samiksha in their firm. All others are agreed with Sunitha and Rekha surrenders 1/4th of her share; Sunita surrenders 1/3rd of her share and Teena 1/5th of her share in favour of Samiksha.

Samiksha brought ? 50,000 as capital and Rs.20000 as goodwill. In the old partners’ balance sheet there was an existing goodwill ?25,000. There was an Investment fluctuation Reserve of Rs.15000 and investment (book value) Rs,30,000. At the time of admission of Samiksha all assets are revalued and liabilities are reassessed and found that market value of investment is Rs,25,000.

Question: What will be the new ratio?

a) 45:40:12:6

b) 135:80:48:97

c) 6:4:2:1

d) 24:18:30:45

Answer:

B

Question: What will be the ratio of Samiksha?

a)3/12

b)6/12

c)97/360

d)45/ 150

Answer:

C

Question: What will be the journal entry for existing goodwill?

a) Goodwill A/c Dr 25,000

To Rekha’s Capital A/c 6250

To Sunitha’s Capital A/c 6250

To Teena’s Capital A/c 6250

To Samiksha’s Capital A/c 6250

(Being ……………………………………)

b) Goodwill A/c Dr 25,000

To Rekha’s Capital A/c 12500

To Sunitha’s Capital A/c 8333

To Teena’s Capital A/c 4167

(Being ……………………………………)

c) Rekha’s Capital A/c 6250

Sunitha’s Capital A/c 6250

Teena’s Capital A/c 6250

Samiksha’s Capital A/c 6250

To Goodwill A/c 25000

(Being ……………………………………)

d) Rekha’s Capital A/c 12500

Sunitha’s Capital A/c 8333

Teena’s Capital A/c 4167

To Goodwill A/c 25000

(Being ……………………………………)

Answer:

D

Question: What will be the treatment of Investment Fluctuation Reserve?

a) Investment Fluctuation Reserve A/c Dr 15,000

To Rekha ‘s Capital A/c 7500

To Sunitha’s Capital A/c 5000

To Teena’s Capital A/c 2500

(Being ……………………………………)

b) Investment Fluctuation Reserve A/c Dr 15000

To Investment A/c 5000

To Rekha ‘s Capital A/c 5000

To Sunitha’s Capital A/c 3333

To Teena’s Capital A/c 1667

(Being ……………………………………) C

c) Revaluation A/c Dr 5,000

To Investment A/c 5,000

(Being ……………………………………) D

d) Investment A/c Dr 25,000

To Revaluation A/c 25000

(Being ……………………………………)

Answer:

B

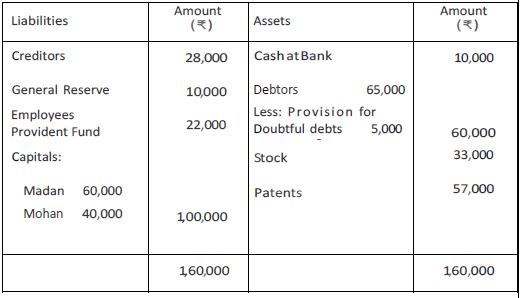

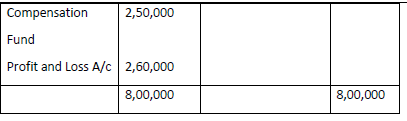

Madan and Mohan who share profits and losses in the ratio of 3 : 2 . Their Balance sheet was as follows as on 31-03-2020

They decided to admit Gopal on 1st April, 2020 for 1/5th share which Gopal acquired wholly from Mohan on the following terms:

(i) Gopal shall bring Rs,10,000 as his share of premium for Goodwill.

(ii) Create provision for doubtful debts @10%.

(iii) (iii) A claim of Rs,5,000 on account of workmen’s compensation was to be provided for.

(iv) Patents were undervalued by Rs, 2,000. Stock in the books was valued 10% more than its market value.

Question: What will be the treatment of Workmen Compensation Reserve at the time of admission of Gopal?

a) Debited to Partners Capital A/c

b) Credited to Old partners’ capital A/c

c) Debited to Revaluation A/c

d) Credited to Revaluation A/c

Answer:

C

Question: What will be the treatment of provision for doubtful debts in Revaluation A/c?

a) ? 6500 debited to Revaluation A/c

b) ? 6500 credited to Revaluation A/c

c) ? 1500 debited to Revaluation A/c

d) ?1500 credited to Revaluation A/c

Answer:

C

Question: What is the journal entry for the treatment of goodwill?

a) Premium for Goodwill A/c Dr 10000

To Madan’s Capital A/c 6000

To Mohan’s Capital A/c 4000

b) Premium for Goodwill A/c Dr 10000

To Madan’s Capital A/c 5000

To Mohan’s Capital A/c 5000

c) Premium for Goodwill A/c Dr 10000

To Madan’s Capital A/c 10000

d) Premium for Goodwill A/c Dr 10000

To Mohan’s Capital A/c 10000

Answer:

D

Question: What will be the treatment for Employee Provident Fund?

Credited to Partners Capital A/c

a) Debited to Partners Capital A/c

b) Transferred to Revaluation A/c

c) Transferred to Liability side of Balance Sheet

Answer:

D

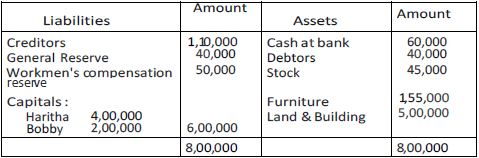

Haritha and Bobby were partners in a firm sharing profits and losses in the ratio of 3:1. On 31st March, 2019, their balance sheet was as follows

They admitted Vihaan as a new partner for 1/5th share in the profits of the firm on the following terms:

(a) Vihaan brought Rs.1, 00,000 as his capital.

b) Goodwill of the firm was valued at ?4, 00,000. Vihaan brought the necessary amount in cash for his share of goodwill premium, half of which was withdrawn by the old partner

(c) Liability on account of workmen’s compensation amounted to Rs. 80,000.

(d) Haritha took over stock at Rs, 35,000.

On the basis of above information answer the following.

Question: What will be the correct treatment of stock at the time of admission?

a) ?10,000 debited to Revaluation A/c and ?35000 debited to Haritha’s capital A/c

b) ?10,000 credited to Revaluation A/c

c) ?10,000 debited to Revaluation A/c

d) ?45,000 credited to Haritha’s capital A/c and ?10,000 credited to Revaluation A/c

Answer:

A

Question: What will be the correct journal entry of Workmen compensation reserve?

a) Workmen compensation reserve A/c Dr 50,000

To Haritha’s Capital A/c 37,500

To Bobby’s Capital A/c 12,500

(Being ……………………………………)

b) Workmen compensation reserve A/c Dr 80000

To Haritha’s Capital A/c 60,000

To Bobby’s Capital A/c 20,000

(Being ……………………………………)

c) Workmen compensation reserve A/c Dr 80,000

To workmen compensation claim A/c 30,000

To Haritha’s Capital A/c 37,500

To Bobby’s Capital A/c 12,500

(Being ……………………………………)

Revaluation A/c Dr 30,000

To workmen compensation claim A/c 30000

(Being ……………………………………)

Answer:

D

Question: What is the treatment of General Reserve at the time of admission?

a) Debited to all partners’ capital A/c

b) Debited to old partners’ capital A/c

c) Credited to old partners’ capital A/c

d) Shown on the liability side of balance sheet.

Answer:

B

Question: What will be the amount of goodwill premium brought by Vihan?

a) 80,000

b) 40,000

c)4,00,000

d) 1,00,000

Answer:

D

Mayank and Ayush are planning to manufacture stuffed toys for utilizing waste material of one of their garment’s factories. They decided that this manufacturing unit will be set up in a rural area, so that people living in rural areas can have job opportunities.

Their capital contributions were Rs. 5, 00,000 and Rs.4, 00,000. Their profit sharing ratio is 5:3. For starting new venture they need of some additional fund. For meeting the additional fund, they decided to admit Vishal as a new partner. Mayank and Ayush sacrificed their share of profit in favour of Vishal. Mayank forgo ¼ th of his share and Ayush forgo 2/5th of his share. Vishal is admitted as per the agreement and he brought ?200000 as his capital and ?40000 as goodwill premium.

At the time of admission of Vishal the old balance sheet of Mayank and Ayush had Advertisement Suspense A/c of Rs.30,000 on the assets side and Profit and Loss A/c on liability side.

Based on above text answer the following

Question: What will be the new ratio?

a) 5:3:3

b) 20:12:8

c) 1:1:1

d) 4:2:3

Answer:

B

Question: What is the goodwill of the firm?

a) 40,000

b) 2,00,000

c) 50,000

d) 60,000

Answer:

B

Question: What is the correct entry of Advertisement Suspense A/c?

a) Advertisement Suspense A/c Dr 30000

To Mayank’s capital A/c 10000

To Ayush’s capital A/c 10000

To Vishal’s capital A/c 10000

(Being ……………………………………)

b) Advertisement Suspense A/c Dr 30000

To Mayank’s capital A/c 15000

To Ayush’s capital A/c 15000

(Being ……………………………………)

c) Mayank’s capital A/c Dr 18750

Ayush’s capital A/c Dr 11250

To Advertisement Suspense A/c 30,000

(Being ……………………………………)

There is no treatment at the time of admission C

Question: What is the treatment of Profit and Loss A/c

a) Credited to all partners’ capital A/c

b) Credited to old partners’ capital A/c

c) Credited to old partners’ capital A/c in their sacrificing ratio

d) Debited to old partners’ capital A/c

Answer:

D

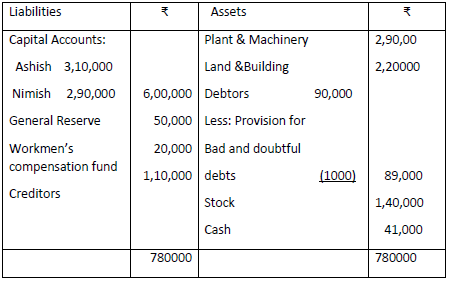

Ashish and Nimish were partners in a firm sharing profits and losses in the ratio of 3: 2.

Balance sheet of Ashish and Nimish was as follows.

Geeta was admitted into the partnership for ¼ th share in the profits on the following terms:

(i) Goodwill of the firm was valued at Rs.2, 00,000.

(ii) Geeta brought Rs. 3, 00,000 as her capital and her share of goodwill premium in cash.

(iii) Bad debts amounted to Rs. 1,000. Create a provision for doubtful debts @ 5% on debtor

(iv) The liability against workmen’s compensation fund was determined at Rs.30,000.

Based on above information answer the following;

Question: What is the amount of provision for doubtful debts to be created?

a)4500

b)4450

c)4400

d) 4550

Answer:

A

Question: What will be the new ratio?

a) 3:2:1

b) 3:2:5

c) 9:6:5

d) 5:3:2

Answer:

C

Question: Which amount will be debited to revaluation a/c as workmen compensation claim

a) 20,000

b) 30,000

c) 50,000

d) 10,000

Answer:

D

Question: What is the amount of premium contributed by Geeta?

a) 2,00,000

b) 50,000

c) 3,00,000

d) 5,000

Answer:

B

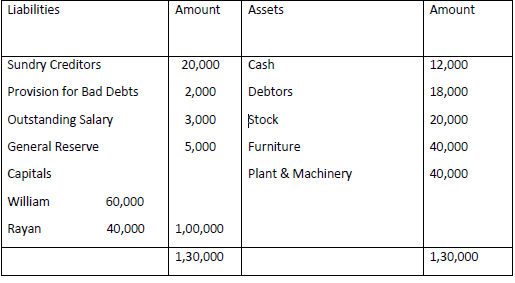

William and Rayan are the partners in a firm sharing profits in the ratio of 3:2. Their Balance sheet as at 31st March, 2020 was as follows:

On the above date, Clement was admitted for 1/5th share in the profits which he acquired equally from William and Rayan on the following terms:

(i) Clement will bring Rs.30,000 as his capital and Rs.10,000 for his share of goodwill premium.

(ii) Investments of Rs. 2,500 not mentioned in the Balance Sheet were to be taken in to account.

(iii) A creditor of Rs. 2,100 not likely to claim

Based on above information answer the following.

Question: What is the correct treatment of Investments?

a) Debited to Revaluation A/c

b) Credited to Revaluation A/c

c) Debited to Partners’ capital A/c

d) There is no treatment at the time of admission

Answer:

B

Question: What will be the new ratio?

a) 3:2:1

b) 5:3:2

c) 6:4:2

d) 2:2:1

Answer:

B

Question: What is the share of General Reserve for Clement?

a) 1,000

b) 5,000

c) 2000

d) No share in General Reserve

Answer:

D

Question: How much amount will record as creditors in new Balance sheet?

a) 2100

b) 22,100

c) 18,900

d) 17,900

Answer:

C

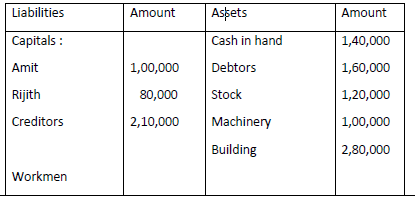

Amit and Rijith are equal partners started the business of preparation and supplying sweets through home delivery at a production cum show-room ‘Express Sweets’ at Bangalore. They wanted to extend their business operation to Hyderabad. Due to some personal reasons Rijith can’t contribute additional capital for the expansion of the business. So Rijith introduced his friend Kamal to Amit and he is ready to invest in their business. They decided to share the future profits in the ratio of 5:3:2.Kamal brought Rs. 1, 00,000 as capital and his share of goodwill in cash. The goodwill of the firm is valued at 2 years purchase of previous 3 years profit. Profit for the year ended 2018 and 2019 were Rs. 1, 40,000 and Rs. 2, 00,000 respectively.

Balance Sheet as on 31-03-2020 as follows

Based on above details answer the following:

Question: What is the amount of firm’s goodwill?

a) 2, 00,000

b) 4, 00,000

c) 3, 40,000

d) 6, 00,00

Answer:

B

Question: What is the amount of premium brought in by Kamal

a) 1,60,000

b) 80,000

c) 40,000

d) 2,00,000

Answer:

B

Question: What will be the ratio of new Partner Kamal

a) 2/10

b) 5/10

c) 3/10

d) ½

Answer:

A

Question: What is the treatment of Profit & Loss A/c shown in the Balance Sheet?

a) Distributed among all partners in new profit sharing ratio.

b) Distributed among old partners in their new ratio.

c) Distributed among old partners in their old ratio.

d) Transferred to revaluation a/c.

Answer:

C

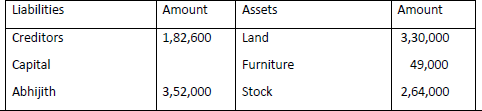

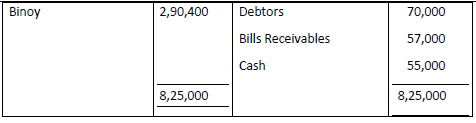

Abhijith and Binoy are college mates after completion of their studies they started a business of manufacturing pickles. They are sharing profits in the ratio of 3:1. Their balance sheet as at 31st March 2020 was as follows.

On this date Chandru was admitted in to partnership for 1/8th share in profits. He brought Capital and goodwill premium in cash. At the time of admission of Chandru the firm revalued the assets and reassessed the liabilities and found the following.

1. Stock was overvalued by Rs. 4,000

2. Furniture is to be depreciated by 10% and Land to be appreciated by 20%. Provision for doubtful debts is to be created @5% on debtor

3. Provision for damages is to be made at Rs.3, 000.

Based on above information answer the following:

Question: What is the correct treatment entry of provision for damages?

a) Revaluation A/c Dr 3,000

To Provision for damages A/c 3,000

b) Provision for damages A/c Dr 3,000

To Revaluation A/c 3,000

c) Liability A/c Dr 3,000

To Revaluation A/c 3,000

d) Liability A/c Dr 3,000

To Provision for damages 3,000

Answer:

A

Question: What is the amount of stock will show in the new Balance Sheet?

a) 2,68,000

b) 2,64,000

c) 2,60,000

d) 2,72,000

Answer:

C

Question: What will be the result of revaluation A/c

a) Gain on revaluation ? 68,400

b) Gain on revaluation ? 48600

c) Gain on revaluation ? 50,600

d) Gain on revaluation ? 66,000

Answer:

C

Question: What will be the new ratio?

a) 3:7:4

b) 7:21:3

c) 1:1:1

d) 21:7:4

Answer:

D