Please refer to Analysis of Financial Statements Class 12 Accountancy Important Questions with solutions provided below. These questions and answers have been provided for Class 12 Accountancy based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these problem solutions as it will help them to gain more marks in examinations. We have provided Important Questions for Class 12 Accountancy for all chapters in your book. These Board exam questions have been designed by expert teachers of Standard 12.

Class 12 Accountancy Important Questions Analysis of Financial Statements

Question. Give the heading under which the following items will be shown in a company’s Balance sheet:

(i) Goodwill.

(ii) Preliminary Expenses

(iii) Loose Tools

(iv) Capital Redemption Resave.

(v) Live Stock.

Answer : (i) Fixed Assets.

(ii) Miscellaneous Expenditures

(iii) Current Assets Loans & Advance under Current Assets.

(iv) Reserve and Surplus.

(v) Fixed Assets.

Question. List any two information required to be given in the balance sheet of a company or by way of foot Notes.

Answer : (i) Uncalled Liability on share partly paid up .

(ii) Arrears of fixed Cumulative Dividend.

Question. List any three items that can be shown as contingent Liabilities in a company’s Balance sheet.

Answer : (i) Claims against the Company not acknowledged as debts .

(ii) Uncalled Liability on partly paid shares.

(iii)Arrears of Dividend on Cumulative preference shares.

Question. Give the example of Horizontal Analysis.

Answer : Comparative Financial Statement.

Question. What is the interest of Shareholders in the analysis of Financial statements ?

Answer : (i) They want to judge the present and future earning capacity of the business.

(ii) They want to judge the safety of their investment.

Question. Under what heads the following items on the Liabilities side of the Balance sheet Of a company will be presented

(i) Proposed Dividend.

(ii) Unclaimed Dividend.

Answer :

Question. The following balance have been from the book of Sahara Ltd. Share capital Rs.10,00,000, securities Premium Rs. 1,00,000, 9% Debentures Rs. 500,000, Creditors Rs. 200,000., Proposed Dividend Rs. 50,000. , Freehold property RS. 9,00,000, share of Reliance Industries Rs. 4,00,000, Work-in- Progress Rs. 4,00,000, Discount on Issue of Debentures Rs. 1,00,000.

Prepare the balance sheet of the company as per schedule VI part 1 of the companies Act.1956.

Answer : Total of Balance Sheet Rs.18,50,000.

Question. Name two tools of Financial Analysis ?

Answer : (i) Comparative Financial Statements.

(ii) Ratio Analysis etc.

Question. State any two items which are shown under the head ‘Investment’ in a company balance sheet.

Answer : (i) Government Securities.

(ii) Sinking Fund Investment.

Question. State whether the Balance sheet of a Company is prepared ’ as on a particular date ‘ or ‘ as at a Particular date ‘ ?

Answer : Balance of a Company is prepared ‘ as at a particular date ‘.

Question. Which item is assumed to be 100 in the case of common size Income statement.

Answer : Sales.

Question. Give the example of Vertical Analysis ?

Answer : Ratio Analysis.

Question. Give two example each of Non-Current Assets and Non- Current Liabilities.

Answer : Non-Current Assets – Building, Machinery.

Non-Current Liabilities – Share Capital , Debentures.

Question. How will you show the following items in the Balance sheet of a company.

(i) Calls in Arrears

(ii) Calls in Advance.

Answer : (i) Calls in Arrears: It is deducted from the subscribed capital.

(iii) Calls in Advance: It is shown separately under the subscribed capital

Question. How is a Company’s balance sheet different from that of a Partnership firm? Give Two point only.

Answer : (i) For company’s Balance Sheet there are two standard forms prescribed under the companies Act.1956 Whereas there is no standard form prescribed under the Indian partnership Act,1932 for a partnership Firms balance sheet.

(ii) In case of a company’s Balance sheet previous years figures are required to be given whereas it is not so in the case of a partnership firms balance sheet.

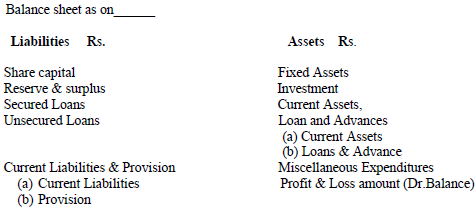

Question. Give the format of the Balance sheet of a company(main headings only) as per the requirement of Schedule VI of the companies Act.1956.

Answer :

Question. What is Horizontal Analysis ?

Answer : The analysis which is made to review and compare the financial statements of two or more then two Years is called Horizontal Analysis.

Question. Which part of Schedule VI to the Companies Act.1956 prescribes the forms of the balance sheet ?

Answer : Part I of Schedule VI to the Companies Act.1956.

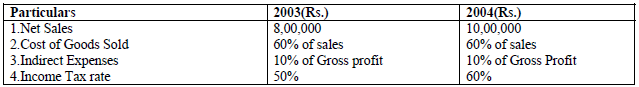

Question. Prepare Comparative income statement from the following information for the years ended march 31,2003 and 2004.

Answer : Percentage Change –

Net sale 25%

Cost of Goods sold 25%

Gross profit 25%

Indirect Expenses 87.50%

Net profit before Tax 18.05%

Income Tax 41.67%

Net Profit after Tax 5.56%

Question. What is Vertical Analysis ?

Answer : The Analysis which is made to review the financial statements of one particular year only is called Vertical Analysis.

Question. How is analysis of Financial statements suffered from the limitation of window dressing ?

Answer : Analysis of financial statements is affected from the limitation of window dressing as companies hide Some vital information or show items at incorrect value to portray better profitability and financial Position of the business, for example the company may overvalue closing stock to show higher profits.