Please refer to Accounting Ratios Class 12 Accountancy Important Questions with solutions provided below. These questions and answers have been provided for Class 12 Accountancy based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these problem solutions as it will help them to gain more marks in examinations. We have provided Important Questions for Class 12 Accountancy for all chapters in your book. These Board exam questions have been designed by expert teachers of Standard 12.

Class 12 Accountancy Important Questions Accounting Ratios

Case Based Questions :

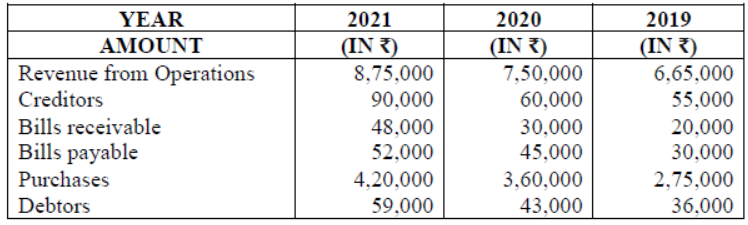

Read the following hypothetical extract of Surya Ltd. And answer the given questions on the basis of the same:

Question. Average Collection Period for the year 2021 will be ________

(a) 65 days

(b) 52 days

(c) 73 days

(d) 38 days

Answer

D

Question. Average Payment Period for the year 2020 will be ________

(a) 110 days

(b) 125 days

(c) 109 days

(d) 115 days

Answer

B

Question. Trade Receivables Turnover Ratio for the year 2021 will be ________

(a) 7.95 times

(b) 9.72 times

(c) 6.11 times

(d) 6.85 times

Answer

B

Question. Trade Payables Turnover Ratio for the year 2020 will be ________

(a) 3.23 times

(b) 2.91times

(c) 2.11 times

(d) 3.85 times

Answer

B

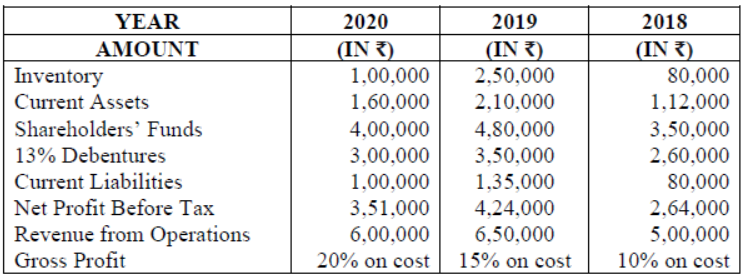

Read the following hypothetical extract of Isko Ltd. and answer the given questions on the basis of the same:

Question. Current Ratio for the year 2020 will be ________

(a) 1.3 : 1

(b) 2.1 : 1

(c) 1.6 :1

(d) 2.8 : 1

Answer

C

Question. Interest Coverage Ratio for the year 2020 will be ________

(a) 10 times

(b) 8 times

(c) 6 times

(d) 9 times

Answer

B

Question. Liquid Ratio for the year 2018 will be ________

(a) 0.4 : 1

(b) 1.2 : 1

(c) 0.8 :1

(d) 1.8 : 1

Answer

C

Question. Debt-Equity Ratio for the year 2019 will be ________

(a) 0.91 : 1

(b) 1.2 : 1

(c) 0.85 :1

(d) 0.73 : 1

Answer

C

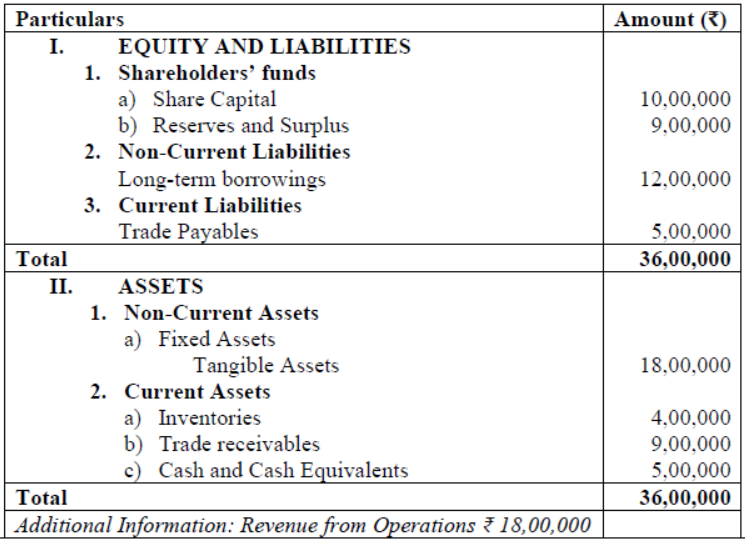

From the following Balance Sheet and other information and answer the given questions on the basis of the same:

Question. Trade Receivables Turnover Ratio will be ________

(a) 1 times

(b) 3 times

(c) 0.9 times

(d) 2 times

Answer

D

Question. Debt-Equity Ratio will be ________

(a) 0.63 : 1

(b) 1.20 : 1

(c) 0.81 :1

(d) 0.72 : 1

Answer

C

Question. Working Capital Turnover Ratio will be ________

(a) 1.87 times

(b) 1.39 times

(c) 1.25 times

(d) 2 times

Answer

B

Read the following hypothetical extract of Ace Ltd. and answer the given questions on the basis of the same:

Question. Return on Investment for the year 2019 will be ________

(a) 11 %

(b) 8.8 %

(c) 9.84 %

(d) 10 %

Answer

A

Question. Total Assets to Debt Ratio for the year 2019 will be ________

(a) 0.33 : 1

(b) 1.44 : 1

(c) 1.33 :1

(d) 0.22 : 1

Answer

C

Question. Return on Investment for the year 2020 will be ________

(a) 16.47 %

(b) 15 %

(c) 17.21 %

(d) 13.1 %

Answer

A

Question. Total Assets to Debt Ratio for the year 2020 will be ________

(a) 0.63 : 1

(b) 1.44 : 1

(c) 0.81 :1

(d) 0.72 : 1

Answer

B

From the following information answer the given questions:

Question. If Debt-Equity Ratio is 2 : 1 and Total Assets to Debt Ratio is 2.5 : 1, what will be the Proprietary Ratio?

(a) 0.2 : 1

(b) 0.5 : 1

(c) 1 : 1

(d) 1.21 : 1

Answer

A

Question. Revenue from Operations = ₹ 2,50,000

Gross Profit Ratio = 40 %

Operating Expenses = ₹ 60,000

The Operating Profit Ratio will be _____________

(a) 84 %

(b) 16 %

(c) 96 %

(d) 40 %

Answer

B

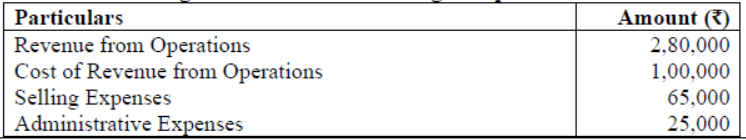

Question. Gross Profit Ratio will be ________

(a) 64.28%

(b) 69.80 %

(c) 58.33 %

(d) 70 %

Answer

A

Question. ____________ reveals the efficiency of the business in utilisation of funds entrusted to it by shareholders, debenture holders and long-term loans.

(a) Working Capital Turnover Ratio

(b) Net Profit Ratio

(c) Return on Investment

(d) Operating Ratio

Answer

C

Question. Operating Ratio will be ________

(a) 75.71 %

(b) 72.80 %

(c) 67.85%

(d) 70 %

Answer

C

Short Answer Questions :

Question. Indicate which ratio would be used by a Long-Term creditor who is interested in determining whether his claim is adequately secured ?

Answer : Debt-Equity-Ratio.

Question. From the given information, calculate the stock turnover ratio: sales Rs.5,00,000, Gross Profit 25% on cost , opening stock was 1/3rd of the value of closing stock. Closing stock was 30% Of sales.

Answer : Stock turnover Ratio = 4 times .

Question. State one transaction which result in a decrease in ‘ debt-equity ratio ‘ and no change in ‘ current Ratio ‘.

Answer : Conversion of debentures into shares.

Question. The ratio of current Assets (Rs. 9,00,000) to current liabilities is 1.5:1. The accountant of this Firm is interested in maintaining a current ratio of 2:1 by paying some part of current liabilities You are required to suggest him the amount of current liabilities which must be paid for the Purpose.

Answer : Payment of current Liabilities Rs.3,00,000.

Question. How will you asses the liquidity or short term financial position of a business ?

Answer : Short term financial position of the business is assessed by calculating current ratio and liquid ratio.

Question. State one transaction involving a decrease in Liquid ratio and no change in current ratio.

Answer : Purchase of goods for cash .

Question. The Debaters turnover Ratio of a company is 6 times. State with reasons whether the ratio will Improve , decrease, or not change due to increases in the value of closing stock by Rs. 50,000?

Answer : No change because it will neither affect net credit sales nor average receivable.

Question. Current ratio of Reliance Textiles Ltd. Is 1.5 at present. In future it want to improve this ratio to 2. Suggest any two accounting transaction for improving the current ratio.

Answer : (i) Payment of current liabilities.

(ii) Issue of share capital etc.

Question. What will be the impact of ‘ Issue of shares against the purchase of fixed assets ‘ on a debt Equity ratio of 1:1 ?

Answer : Debt-equity ratio will decrease because the Long-term loans remain unchanged where as the Shareholders funds are increased by the amount f share capital issued .

Question. How does ratio analysis becomes less effective when the price level changes?

Answer : Accounting ratios are calculated from financial statements, which are down on the basis of historical Cost as recorded in the book of accounts .

Question. (a) Calculate return on Investment from the following information :

Net profit after Tax Rs.6,50,000.

12.5% convertible debentures Rs 8,00000.

Income Tax 50%.

Fixed Assets at cost Rs.24,60,000.

Depreciation reserve Rs.4,60,000.

Current Assets Rs. 15,00,000.

Current Liabilities Rs. 7,00,000.

(b) Profit before interest and tax(PBIT) Rs.2,00,000, 10% preference shares of Rs.100 each.

Rs.2,00,000, 2,0000 equity shares of Rs. 10 each, Rate of tax @ 50% calculate earning pen Share(EPS).

Answer : (a) Net profit before interest Rs.14,00,000

capital employed Rs. 28,00,000

Return on investment 50%.

(b)Earning per share Rs. 4.

Question. What will be the Operating profit, If operating Ratio is 78% ?

Answer : 100-78=22%

Question. State one transaction which results in an increase in ‘ liquid ratio ‘and nochange in ‘current ratio’.

Answer : Sale of stock at cost price.

Question. Calculate cost of goods sold from the following information: Sales Rs.12,00,000, Sales Returns Rs.80,000, operating expenses Rs.1,82,000, operating ratio 92%.

Answer : Cost of goods sold =Rs.8,48,400.

Question. Assuming that the Debt Equity Ratio is 2:1. State giving reason , whether the ratio will improve , decline or will have no change in case bonus shares allotted to equity shareholders by Capitalizing profits.

Answer : Debt equity ratio will not change as the total amount of shareholders funds will remain same.

Question. Quick ratio of a company is 1.5 :1 . state giving reason whether the ratio will improve , decline or Not change on payment of dividend by the company.

Answer : Quick ratio will improve as both the liquid assets and current liabilities will decrease by the same Amount.

Question. Calculate the amount of opening stock and closing stock from the following figures:

Average Debt collection period 4 month stock turnover ratio 3 times. Average Debtors Rs.1,00,000 Cash sales being 25% of total sales Gross profit ratio 25% stock at the end was 3 Times that in the beginning.

Answer : Opening stock Rs. 50,000.

Closing stock Rs. 1,50,000.

Question. A company has a loan of Rs.15,00,000 as part of its capital employed. The interest payable on Loan is 15% and the ROI of the company is 25%. The rate of income tax is 60%.what is the Gain to shareholders due to the loan raised by the company ?

Answer : Net gain to shareholders Rs.60,000.

Question. Why stock is excluded from liquid assets ?

Answer : (i) because there is uncertainty whether it will be sold or not.

(ii) It will take time before it is converted into debtors’ and cash.

Question. Indicate which ratio a shareholders would use who is examining his portfolio and wants to decide Whether he should hold or sell his shareholdings?

Answer : Total Assets to Debt Ratio.

Question. Rs.2,00,000 is the cost of goods sold, inventory turnover 8 times, stock at the beginning is 1.5 Times more than the stock at the end. Calculate the value of opening & closing stock .

Answer : Closing stock = Rs.14,285.

Opening stock = Rs.35,715.