Please refer to the Reconstitution of a Partnership Firm – Admission of a Partner Revision Notes given below. These revision notes have been designed as per the latest NCERT, CBSE and KVS books issued for the current academic year. Students will be able to understand the entire chapter in your class 12th Accountancy book. We have provided chapter wise Notes for Class 12 Accountancyas per the latest examination pattern.

Revision Notes Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner

Students of Class 12 Accountancy will be able to revise the entire chapter and also learn all important concepts based on the topic wise notes given below. Our best teachers for Grade 12 have prepared these to help you get better marks in upcoming examinations. These revision notes cover all important topics given in this chapter.

Meaning

Goodwill is the value of the reputation of a firm in respect of the profits expected in future over and above the normal profits. It is an intangible asset, which reflects value of reputation of a business.

Features of Goodwill

1. It is an intangible asset

2. It is not Fictitious asset

3. It helps in earning higher profits.

4. Its value is subjective matter.

Factors Affecting Value of Goodwill

♦ Nature of business

♦ Location of business

♦ Efficiency of management

♦ Market situation (eg: monopoly condition, limited competition)

♦ Quality of goods/services.

♦ Customer relations & loyalty

♦ Special advantages (Import licenses, long term contracts, assured supply of electricity etc)

Need for Valuation of Goodwill (for a Partnership Firm)

♦ Change in the profit-sharing ratio amongst the existing partners;

♦ Admission of new partner;

♦ Retirement of a partner;

♦ Death of a partner; and

♦ Dissolution of a firm involving sale of business as a going concern.

♦ Amalgamation of partnership firms.

Types of Goodwill

(A) Purchased Goodwill

Goodwill for which an agreed consideration (price) is paid in cash or kind. For eg: at the time of purchase/acquisition of another business.

(B) Self-generated Goodwill

It is an internally generated goodwill, for which no separate consideration has been paid.

Note: As per recognition criteria laid down in AS-26, self-generated goodwill is not recorded in the Books of Accounts.

Reconstitution of Partnership Firm or Reconstitution of Partnership

♦ It means any change in existing agreement between partners.

♦ It is also known as “Dissolution of Partnership since existing agreement comes to an end, and new agreement comes into agreement.

♦ Reconstitution happens in following cases:

• Change in profit-sharing ratio

• Admission of partner

• Retirement/death of partner

• Amalgamation of two or more firms

♦ Reconstitution of partnership firm always leads to change in profit sharing ratio.

♦ Change in PSR leads to Dissolution of Partnership

♦ Change in PSR Does Not Leads to Dissolution of Partnership Firm

Important Introductory Points w.r.t. Admission of Partner

A new partner (or incoming partner) can be admitted: (Section 31)

♦ as per terms of Partnership Deed; or if no partnership deed or deed is silent –

♦ if ALL the existing partners agree to such admission

♦ Thus, all the existing partners decide the share of new partner’s profit with mutual consent.

♦ Incoming partner brings in cash:

agreed capital on admission

share in goodwill of the firm – known as premium for goodwill

♦ Two important rights of incoming partner Right to share future profits of business Right to share in the assets of the firm

♦ New partner also becomes liable for liabilities of the firm.

♦ Incoming partner gets his/her share from existing partners (i.e. existing or old partners sacrifice their share in favour of the incoming partner). Sometimes, one or more existing partner may also gain on admission of new partner.

Effects of Admission of a Partner

(a) Old partnership comes to an end and new partnership comes into existence – RECONSTITUTION OF PARTNERSHIP.

(b) New partner becomes entitled to share future profits.

(c) New partner acquires right in the assets of firm.

(d) Necessary adjustments (Goodwill, Reserves, Fictitious assets, Revaluation etc) to be made.

Need for Revaluation of Assets & Liabilities at the Time of Admission

It is necessary to revalue assets & liabilities of a firm in case of admission of a partner so that the incoming partner is neither put to an advantage nor to disadvantage due to change in the market value of assets and liabilities.

Two Major Reasons for Preparing Revaluation A/c in Case of Admission

(i) To record the effect of revaluation of assets & liabilities.

(ii) To ensure that the gain (profits) or loss on revaluation of assets & liabilities may be divided among the old partners (in their old ratio).

MCQs Questions Reconstitution of a Partnership Firm – Admission of a Partner Class 12 Accountancy

Question: Increase in the value of assets at the time of admission of a D partner is:

(A) Debited to Revaluation A/c

(B) Credited to Partners’ capital A/c

(C) Credited to Revaluation A/c

(D) Debited to Profit and Loss Appropriation A/c

Answer

C

Question: Share of goodwill brought by new partner in cash is shared by old partners in”

(A) Ratio of sacrifice

(B) Old profit sharing ratio

(C) New profit sharing ratio

(D) None of these

Answer

A

Question: A new partner can be admitted only when:

(A) Majority decision

(B) Consent of managing partner

(C) Approval of Registrar of firm

(D) Existing partners unanimously agree for it

Answer

D

Question: Admission of a partner results in:

(A) Revaluation of partnership

(B) Realization of partnership

(C) Reconstitution of partnership

(D) None of these

Answer

C

Question: A and B are partners of partnership firm sharing profits in the ratio of 3:2 respectively. C was admitted for 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs.80,000) and building would be depreciate by 20%( Rs.2,00,000). Unrecorded debtors of Rs.1,250 would be brought into books now and a creditor amounting to Rs.2,750 died and need not part anything on this account. What will be profit/loss on revaluation?

(A) Loss Rs.28,000

(B) Loss Rs.40,000

(C) Profits Rs.28,000

(D) Profits Rs.40,000

Answer

A

Question: If, at the time of admission , the revaluation A/c shows a profit, it should be credited to :

(A) Old partners capital account in the old profit sharing ratio.

(B) All partners capital accounts in the new profit sharing ratio.

(C) Old partners capital accounts in the new profit sharing ratio.

(D) Old partners capital accounts in the sacrificing ratio.

Answer

A

Question: At the time of admission existing Profit and Loss A/c is distributed among the partners in the:

(A) Sacrificing ratio

(B) Gaining ratio

(C) Old profit sharing ratio

(D) New profit sharing ratio

Answer

C

Question: A and B are in partnership sharing profits in the ratio of 3: 2. They take a new partner. Goodwill of the firm is valued at Rs. 3,00,000 and C bring Rs.30,000 as his share of goodwill in cash which is entirely credited to Capital Account of A. New Profit sharing ratio will be:

(A) 3 : 2: 1

(B) 6 : 3 :1

(C ) 5 : 4 : 1

(D) 4 : 5 : 1

Answer

C

Question: A, B and C are partners sharing profits in ratio of 3 : 2 : 1. They agree to admit D into the firm. A , B and C agreed to give 1/3rd , 1/6th ,1/9th share of their profit. The share of profit of D will be :

(A) 1/10

(B) 11/54

(C) 12/54

(D) 13/5

Answer

D

Question: 1. A and B are partners sharing profits and losses in the ratio of 5 : 3 . On admission, C brings Rs.70,000 as cash and Rs.43,000 against Goodwill. New profit ratio between A, B and C is 7 : 5 : 4. The sacrificing ratio of A and B is :

(A) 3 : 1

(B) 1 : 3

(C ) 4 : 5

(D) 5 : 9

Answer

A

Question: At the time of admission profit on revaluation of assets and reassessment of liabilities is transferred to:

(A) Capital A/c of all partners

(B) Capital A/c of old partners

(C) Capital A/c of new partners

(D) Liability side of balance sheet

Answer

B

Question: Arrange in correct sequence the treatment of admission of a partner.

i) Preparation of partners’ capital A/c

ii) Calculation of sacrificing ratio

iii) Adjustment of goodwill

iv) preparation of revaluation A/c

(A) iii , I , ii , iv

(B) ii , iii , iv , i

(C) I , ii, iv, iii

Answer

C

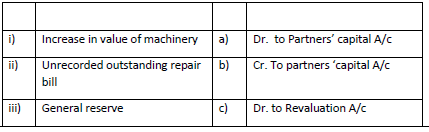

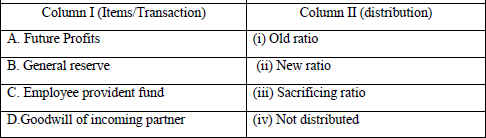

Question: Match the following items at the time of admission:

Answer

C

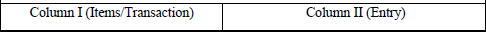

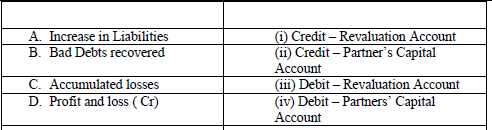

Question: 10. Match the following items :

(A) a- iii) b- i) c- ii) d – iv)

(B) a- iv) b –iii) c – i) d – ii)

(C) a – iv ) b –iii) c – ii) d – i)

(D) a – ii) b –iv) c – i) d – iii)

Answer

B

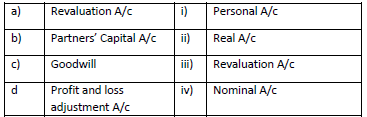

Question: 1. Match the following items :

(A) a-ii) b- iv) c – i) d – iii)

(B) a- iv) b – iii) c – i) d – i)

(C) a – iv) b – i) c – ii) d – iii)

(D) a- iii) b – i) c – iv) d – ii)

Answer

C

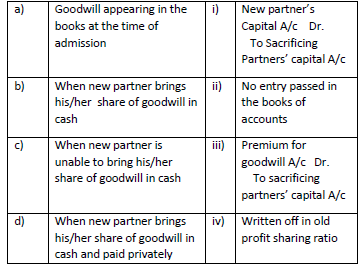

Question: Match the columns for situations at the time of admission of new partners.

A B C D

a. (i) (ii) (iii) (iv)

b. (i) (ii) (iv) (iii)

c. (ii) (i) (iv) (iii)

d. (ii) (i) (iii) (iv)

Answer

C

Question: Sacrificing ratio use to distribute –———- in case of admission of a partner

(A) Reserves

(B) Goodwill

(c ) Revaluation profit

(D) Balance in profit and loss account

Answer

B

Question: 1 Match the columns (at the time of admission of partners ituations)

A B C D

(A) (iii) (i) (ii) (iv)

(B) (i) (iii) (iv) (ii)

(C) (i) (iii) (ii) (iv)

(D) (iii) (i) (iv) (ii)

Answer

D

Question: Match the following: for situations at the time of admission of new partners.

(A) i-B, ii-C, iii-A, iv-D

(B) i-D, ii-B iii-A, iv-C

(C) i-D, ii-C, iii-A, iv-B

(D) i-D, ii-C, iii-B, iv-A

Answer

C

Question: Arrange in correct sequence:

Following steps arrange in the sequence for calculation of hidden Goodwill of the firm.

(1) Calculate total capital of the new firm on the basis of capital brought in by new partner.

(2) Existing Partners total capital

(3) Deduct existing total capital of the partners from total capital of the new firm is hidden Goodwill of the firm.

(A) 3 ,1, 2

(B) 1 , 2, 3

(C) 2, 2, 1

(D) 1, 3, 2

Answer

B