Please refer to Accounting For Not For Profit Organisation Class 12 Accountancy Important Questions with solutions provided below. These questions and answers have been provided for Class 12 Accountancy based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these problem solutions as it will help them to gain more marks in examinations. We have provided Important Questions for Class 12 Accountancy for all chapters in your book. These Board exam questions have been designed by expert teachers of Standard 12.

Class 12 Accountancy Important Questions Accounting For Not For Profit Organisation

Short Answer Questions

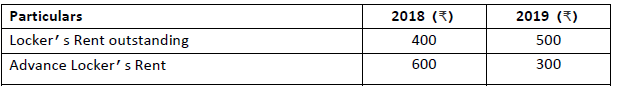

Question: Show how will you deal with the following items while preparing financial statements of a club for the year ending 31st March. 2020:

i. Tournament Expenses Rs.12,000.

ii. Tournament Expenses Rs.12,000, Tournament Receipts Rs.15,000.

iii. Tournament Expenses Rs.18,000, Tournament Receipts Rs.5,000, Tournament Fund Rs.15,000.

Answer: *In case of Specific Fund – Liabilities side

*In case of No Specific Fund – Income & Expenditure A/c

Question: Prepare Receipts & Payments account for the year ended 31st March, 2020.

Opening cash Rs.6,000; Subscriptions received Rs.25,000; Prize Fund Rs.12,000, Entrance fees Rs.4,000; Sale of newspaper Rs.700, Electricity charges Rs.4,000, Municipal taxes Rs.3,000; Salaries Rs.36,000, Repairs Rs.2,000, Match expenses Rs.2,500; Furniture purchased Rs.6,000.

Answer: Cash in hand on 31.03.2020 – Rs.24,200 (Balancing figure)

Question: Differentiate between Receipts & payments account and Cash book.

Answer: Basis of distinction- Basis of preparation, Period, Institutions & Ledger folio.

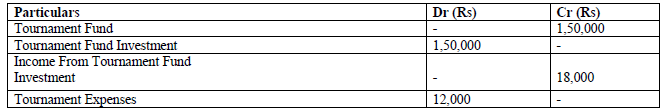

Question: How will you deal with the following items while preparing Income & Expenditure account of a club for the year ending 31st Dec. 2019

Locker’s rent received during the year Rs.9,500.

Answer: Income from locker’ rent – Rs.9,900

Question: Give any four differences between Not-for-profit organisations and Profit earning organisations.

Answer: Basis of distinction- Objective, Capital contribution, Financial statements, Results.

Question: From the following particulars, calculate the amount of subscriptions to be credited to the Income and Expenditure Account for the year ended 31st March, 2020.

(a) Subscriptions in arrears on 31st March 2019 – Rs.500

(b) Subscriptions received in advance on 31st March, for the year ended on 31st March 2019 – Rs.1,100

(c) Total subscriptions received during 2019-20 – Rs.35,400

(including Rs.400 for 2019, Rs.1,200 for 2020-21 and Rs.300 for 2021-22)

(d) Subscriptions outstanding for 2019-20 – Rs.400

Answer: Amount to be credited to the Income and Expenditure Account Rs.35,000.

Question: Show how will you deal with the following cases while preparing financial statements of a club for the year ending 31st March. 2020:

a. Furniture as on 31.03.2019 Rs.1,80,000; A new furniture was purchased on 01.07.2019 for Rs.60,000; Furniture of book value of Rs.20,000 on 01.04.2019 was sold at a profit of 20% on 30.06.2019; Furniture is to be depreciated @ 10% p.a.

b. Furniture as on 31.03.2019 Rs.4,00,000; Furniture of book value of Rs.40,000 on 01.04.2019 was sold at a loss of 10% on 30.09.2019; A new furniture was purchased on 01.01.2020 for Rs.50,000; Furniture is to be depreciated @ 10% p.a.

c. Furniture as on 01.04.2019 Rs.3,00,000; Furniture of book value of Rs.80,000 on 01.04.2019 was sold at a profit of 20% on 30.09.2019; A new furniture was purchased on 31.12.2019 for Rs.50,000; Furniture is to be depreciated @ 10% p.a.

Answer: a. Total Depreciation for 2019-20 – Rs.15,000

b. Total Depreciation for 2019-20 – Rs.39,250

c. Total Depreciation for 2019-20 – Rs.27,250

Question. Show the following information in the Balance Sheet of the Cosmos club as on 31st March 2007:-

Additional Information:-

Interest accrued on Tournament Fund Investment Rs. 6000.

Answer :

Question. How would you account for ‘subscription due to be received’ in the current year in the books of a non trading organisation?

Answer : Subscription due to be received is added with subscription received during the year in Income and Expenditure A/C and shown as an asset in the closing balance sheet.

Question. Calculate the amount medicines to be debited in the Income and Expenditure Account of a Hospital on the basis of the following information:-

Amount paid for medicines during the year was Rs. 6,79000.

Answer :

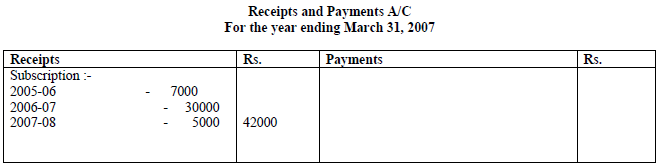

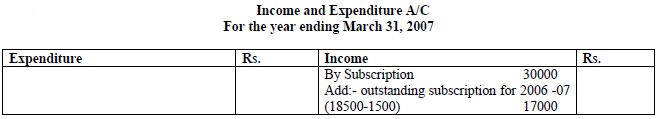

Question. From the following extracts of Receipts and Payments Account and the additional information given below, compute the amount of income from subscriptions and show us how they would appear in the Income and Expenditure Account for the year ending March 31, 2007and the Balance sheet on that date:-

Additional information:-

(i) Subscription outstanding on March 31, 2006 Rs. 8500.

(ii) Total subscriptions outstanding on March 31, 2007 Rs. 18,500.

(iii) Subscriptions received in advance as on March 31, 2006 Rs. 4000.

Answer :

Question. State any two characteristics of Receipt and Payment Account.

Answer : (i) Receipts and Payments Account is a summary of Cash Book.

(ii) Non- cash expenses such as depreciation and outstanding expenses are not shown in Receipts and Payments Account.

Question. What is meant by fund based accounting?

Answer : Fund based accounting is a book peeping technique where by separate self-balancing sets of assets, liability, income, expenses and fund balance accounts are maintained for each contribution for a specific purpose.

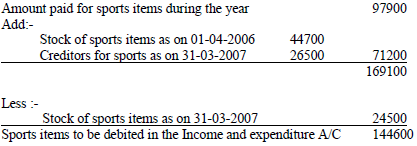

Question. Calculate the amount to be debited to Income and Expenditure account under the heading sports items for the year 2006-07 in respect of the Osmosis club:-

Stock of sports items on 01-04-2006 Rs. 44,700

Stock of sports items on 31-03-2007 Rs. 24,500

Paid for sports items during the year Rs. 97,900

Creditors for supplies of sports items 31-03-2007 Rs. 26,500.

Answer :

Question. Give to main sources of income of a ‘Not for profit organisation’.

Answer : (i) Subscription

(ii) Donation.

Question. Tournament fund appears in the books Rs. 15,000 and expenses on tournament during the year were Rs. 18000.

How will you show this in format while preparing financial statement of a not-for-profit organisation?

Answer :

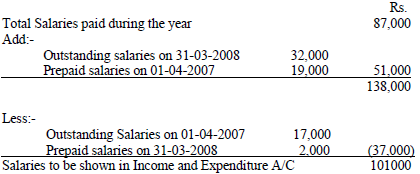

Question. From the following particulars of a club, calculate the amount of salaries to be shown in Income and expenditure account for the year ended 31 March, 2008:-

Total salaries paid during the year 2007-08 Rs. 87,000

Outstanding salaries on 01-04-2007 Rs. 17,000

Prepaid salaries on 01-04-2007 Rs. 19,000

Outstanding salaries on 31-03-2008 Rs. 32,000

Prepaid salaries on 31-03-2008 Rs 20,000

Answer : Calculation of salaries to be shown in Income and Expenditure A/C for the year ended March 31, 2008:-

Question. Distinguish between Receipts and Payments A/C and Income and expenditure A/C.

Answer :

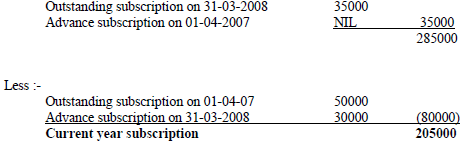

Question. As per Receipt and Payments account for the year ended on March 31, 2008, the subscription received were Rs. 2,50,000. Addition information given is as follows:-

(i) Subscriptions outstanding on 01-04-2007 Rs. 50,000.

(ii) Subscription outstanding on 31-03-2008 Rs. 35,000.

(iii) Subscription Received in advance as on 31-03-2008 Rs. 30000.

Ascertain the amount of income from subscription for the year 2007-08.

Answer : Calculation of current year subscription to be shown in Income and Expenditure A/C for the year ended March 31, 2008 :-

Total subscription received during the year 250000

Add:-

Question. How would you account for ‘subscription received in advance’ in the current year in the books of a non trading organisation?

Answer : Subscription received in advance is subtracted from subscription received during the year in Income and Expenditure A/C and shown as a liability in the closing Balance sheet.

Long Answer Questions

Question: a) From the following particulars, calculate the amount of subscription received in advance during 2019-20.

I. Subscription received during the year 2019-20 Rs.52,500

II. There were 200 members paying subscription at the rate of Rs.250 p.a. each

III. Some members have paid their annual subscription in advance during the year

IV. As on 1-4-2019 no subscription had been received in advance but subscriptions were outstanding to the extent of Rs.1,000 as on 31-3- 2019

V. Subscription accrued as on 31-3-2020 Rs.1,500

b) Calculate the stock of books consumed during the year 2019-20 and show the treatment in balance sheet on dated 31-3-2019 and 31-3- 2020:

Stock of books on 1-4-2019 Rs.6,200; Stock of books on 1-4-2020 Rs.4,800; Creditors for books on 1-4-2019 Rs.9;800 ;Creditors for books on 1-4-2020 Rs.7,200 ;Advance to supplier on 1-4-2019 Rs.11,000 ;Advance to supplier on 1-4-2020 Rs.19,000; Purchase of books during the year Rs.91,400.

Answer: a) Advance Subscription- Rs.3000

b) Books consumed- Rs.92,800

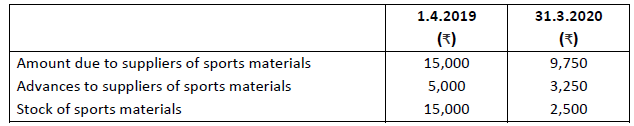

Question: How will you deal with the following items while preparing the Income & Expenditure A/c for the year ending on 31st March, 2020 and a Balance Sheet as on that date:

During 2019-20, the payment made to the suppliers of sports materials was Rs. 54,000. Cash purchases of sports material during the year- Rs.8,000

Answer: Cost of sports material consumed – Rs.71,000

Question: From the following trial balance and information, prepare Income and Expenditure account for the year ending 31st Dec. 2019:

Additional information:

i. Tuition fees due Rs.9,000

ii. Salaries unpaid Rs.3,000

iii. Depreciate Furniture by 10% and Books by 15%.

Answer: Surplus- Rs.1,16,430 (General Fund is same as Capital Fund)

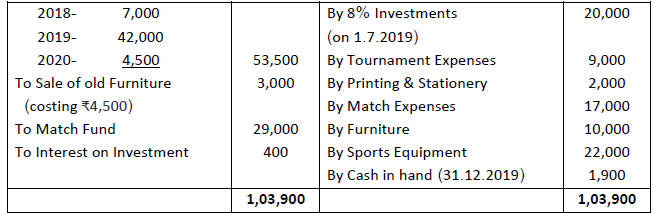

Question: From the following Receipts and Payments Account of Krish Fitness and wellness Club for the year ended 31st March 2020, prepare Income and Expenditure Account.

Additional information:

i. Subscription outstanding during the year 2018 was Rs. 8,000 and Subscription still outstanding for the year 2019 was Rs.6,000.

ii. Salaries was paid for 10 months.

iii. Rent is paid upto March 2020.

iv. The club owned Furniture Rs.16,000 and Sports Equipment Rs.10,000.

v. Depreciate Furniture and Sports Equipment by 10%.

Prepare Income and expenditure Account of the club for the year ended 31st December, 2019 and Balance Sheet as at that date.

Answer: Surplus- Rs.24,150; Capital Fund- Rs.42,000; Balance sheet Total- Rs.84,650

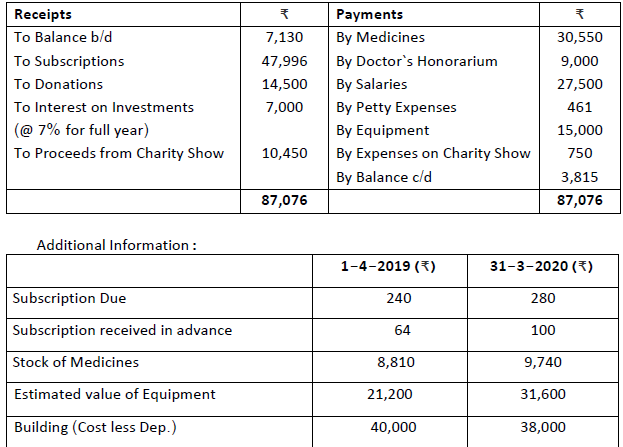

Question: From the following particulars relating to the Ramakrishna Mission Charitable Hospital, prepare Income and expenditure Account for the year ended 31st March 2020 and Balance Sheet as at that date:

Answer: Capital Fund- Rs.1,77,316 Surplus- Rs.6,019 Balance Sheet- Rs.1,83,435.