Please refer to Account Reconstitution Of A Partnership Firm – Retirement/Death Of A Partner Class 12 Accountancy Important Questions with solutions provided below. These questions and answers have been provided for Class 12 Accountancy based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these problem solutions as it will help them to gain more marks in examinations. We have provided Important Questions for Class 12 Accountancy for all chapters in your book. These Board exam questions have been designed by expert teachers of Standard 12.

Class 12 Accountancy Important Questions Reconstitution Of A Partnership Firm – Retirement/Death Of A Partner

Question. A, B and C are partners in a firm sharing profits in the ration of 2:2:1. B retires and his share is acquired by A and C equally. Calculate new profit sharing ratio of A and C.

Answer : A’s gaining share = 2/5 X ½ = 1/5

A’s new share = 2/5 + 1/5 = 3/5

C’s gaining share = 2/5 X ½ = 1/5

C’s New share = 1/5 + 1/5 = 2/5

New ratio of A and C = 3:2

Question. A, B and C were partners in a firm sharing profits in the ratio of 2:2:1. C dies on 31st July, 2007. Sales during the previous year upto 31st march, 2007 were Rs. 6,00,000 and profits were Rs. 150000. Sales for the current year upto 31st July were Rs. 250000. Calculate C’s share of profits upto the date of his death and pass necessary journal entry.

Answer : Profit & Loss suspense A/C Dr. Rs. 12,500

To C’s capital A/C Rs. 12,500

Question. Ramesh, Naresh and Suresh were partners in a firm sharing profits in the ratio of 5:3:2. Naresh retired and the new profit sharing ratio between Ramesh and Suresh was 2:3. On Naresh retirement the goodwill of the firm was valued at Rs. 120000. Pass necessary journal entry for the treat.

Answer : Suresh capital A/C Dr. 48000

To Ramesh’s capital A/C 12000

To Naresh capital A/C 36000

(Goodwill adjusted among the gaining partner in gaining ratio.)

Question. X, Y and Z are partners sharing profits in the ratio of 4/9, 1/3 and 2/9. X retires and surrenders 2/3rd of his share in favour of Y and remaining in favour of Z. Calculate new profit sharing ratio and gaining ratio.

Answer : Y’s gaining share = 4/9 X 2/3 = 8/27

Z’s gaining share = 4/9 – 8/27 = 4/27

Y’s new share = Old share + gain

= 1/3 + 8/27 = 17/27

Z’s new share = 2/9 + 4/27 = 10/27

New Ratio = 17:10

Gaining ratio = 8/27 : 4/27 or 2:1

Question. X, Y and Z were partners in a firm sharing profits and losses in the ratio of 3:2:1. The profit of the firm for the year ended 31st March, 2007 was Rs. 3,00000. Y dies on 1st July 2007. Calculate Y’s share of profit up to date of death assuming that profits in the year 2007- 2008 have been accured on the same scale as in the year 2006-07 and pass necessary journal entry.

Answer : Total profit for the year ended 31st March 2007 = Rs 300000

Y’s share of profit up to date of death = 300000 X 2/6 X 3/12

= 25000

Profit and Loss suspense A/C Dr. 25000

To Y’s capital A/C 25000

( Y’s share of profit transferred to Y’s capital A/C)

Question. Kamal, Kishore and Kunal are partners in a firm sharing profits equally. Kishore retires from the firm. Kamal and Kunal decide to share the profits in future in the ratio 4:3. Calculate the Gaining Ratio.

Answer : Gaining Ratio = New ratio – Old ratio

Kamal’s Gain = 4/7 – 1/3 = 5/21

Kunal’s Gain = 3/7 – 1/3 = 2/21

Gaining Ratio = 5:2

Question. Mayank, Harshit and Rohit were partners in a firm sharing profits in the ratio of 5:3:2. Harshit retired and goodwill is valued at Rs 60000. Mayank and Rohit decided to share future profits in the ratio 2:3. Pass necessary journal entry for treatment of goodwill.

Answer : Rohit’s capital A/C Dr. 24000

To Mayank’s capital A/C 6000

To harshit’s Capital A/C 18000

(Adjustment Entry for treatment of goodwill in gaining ratio.)

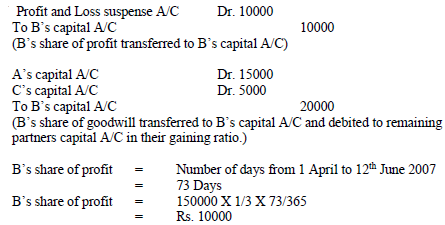

Question. A, B and C were partners in a firm sharing profits in 3:2:1 ratio. The firm closes its books on 31st March every year. B died on 12-06-2007. On B’s death the goodwill of the firm was valued at Rs. 60000. On B’s death his share in the profit of the firm till the time of his death was to be calculated on the basis of previous years which was Rs.150000. Calculate B’s share in the profit of the firm. Pass necessary journal entries for the treatment of goodwill and B’s share of profit at the time of his death.

Answer :

Question. P, Q and R are partners sharing profits in the ratio of 7:2:1. P retires and the new profit sharing ratio between Q and R is 2:1. State the Gaining Ratio.

Answer : Old ratio = P Q R

7 : 2 : 1

New ratio = Q R

2 : 1

Gaining Ratio = New ratio – Old ratio

Q’s gain = 2/3 – 2/10 = 14/30

R’s gain = 1/3 – 1/10 = 7/30

Gaining Ratio = 14:7 or 2:1

Question. P, Q and R were partners in a firm sharing profits in 4:5:6 ratio. On 28-02-2008 Q retired and his share of profits was taken over by P and R in 1:2 ratio. Calculate the new profit sharing ratio of P and R.

Answer : Old ratio = P Q R

= 4:5:6

Q retired

P’s gaining = 1/3 X 5/15 = 1/9

P’s new share = 4/15 + 1/9 = 17/45

R’s Gaining share = 2/3 X 5/15 = 2/9

R’s new share = 6/15 + 2/9 = 28/45

New Ratio = 17:28

Question. L, M and O were partners in a firm sharing profits in the ratio of 1:3:2. L retired and the new profit sharingratio between M and O was 1:2. On L’s retirement the goodwill of the firm was valued Rs. 120000. Pass necessary journal entry for the treatment of goodwill.

Answer : O’s capital A/C Dr. 40000

To C’s capital A/C 20000

To M’s capital A/C 20000

(Adjustment of goodwill in gaining partners in their gaining ratio.)

Question. X, Y and Z have been sharing profits and losses in the ratio of 3:2:1. Z retires. His share is taken over by X and Y in the ratio of 2:1. Calculate the new profit sharing ratio.

Answer : Old Ratio = 3:2:1

Z Retire

X’s Gaining = 1/6 X 2/3 = 2/18

X’s New share = 3/6 + 2/18 = 11/18

Y’s Gaining = 1/6 X 1/3 = 1/18

Y’s new share = 2/6 + 1/18 = 7/18

New Ratio = 11/18, 7/18 Or 11:7

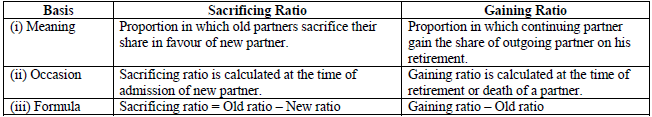

Question. Distinguish between Sacrificing Ratio and Gaining Ratio.

Answer :

Question. State the journal entry for treatment of deceased partners share of profit for his life period in the year of death.

Answer : Profit and loss suspense A/C Dr

To deceased partner’s capital A/C