Please refer to the Accounting for Partnership Basic Concepts Revision Notes given below. These revision notes have been designed as per the latest NCERT, CBSE and KVS books issued for the current academic year. Students will be able to understand the entire chapter in your class 12th Accountancy book. We have provided chapter wise Notes for Class 12 Accountancyas per the latest examination pattern.

Revision Notes Chapter 2 Accounting for Partnership Basic Concepts

Students of Class 12 Accountancy will be able to revise the entire chapter and also learn all important concepts based on the topic wise notes given below. Our best teachers for Grade 12 have prepared these to help you get better marks in upcoming examinations. These revision notes cover all important topics given in this chapter.

Meaning

Section 4 of the Indian Partnership Act 1932 defines partnership as the ‘relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all’.

Nature of Partnership

• From Legal Point of View – Not a separate legal entity (Unlimited Liability of Partners)

• From Accounting Point of View – Separate Business Entity

Essential Features of Partnership

•Two or More Persons:

Minimum – 2

Maximum – 50 [Section 464 of the Companies Act 2013 read with Companies(Miscellaneous) Rules, 2014]

• Agreement – Oral or Written

• Lawful Business

• Sharing of Profits (sharing of loss is implied) – It is not essential that all partners mustshare losses.

• Mutual Agency – Principal & Agent relation (True Test of Partnership)

• Liability of Partners – Unlimited, jointly and severally

1.If partner carries on business in competition with firm and earns profit fromit, then _______________________________________________________

2.If partner earns profit for himself from any transaction of the firm (or fromfirm’s property), the profit so earned ______________________________

Partnership Deed

• It is a written partnership agreement which is signed by all partners, and containsvarious terms of partnership.

• Contents:

♦Names and Addresses of the firm and its main business;

♦Names and Addresses of all partners;

♦ Amount of capital to be contributed by each partner;

♦The accounting period of the firm;

♦ The date of commencement of partnership;

♦ Rules regarding operation of Bank Accounts;

♦ Profit and loss sharing ratio;

♦ Rate of interest on capital, loan, drawings, etc;

♦ Mode of auditor’s appointment, if any;

♦ Salaries, commission, etc, if payable to any partner;

♦The rights, duties and liabilities of each partner;

♦Treatment of loss arising out of insolvency of one or more partners;

♦ Settlement of accounts on dissolution of the firm;

♦ Method of settlement of disputes among the partners;

♦ Rules to be followed in case of admission, retirement, death of a partner; and ♦Any other matter relating to the conduct of business.

• Partnership Deed is useful because:

1. It governs the rights, duties and liabilities of each Partner

2. In case of disputes, settlement can be easily made.

• Important provisions of Indian Partnership Act, 1932, if Partnership Deed is silent / non-existing:

♦ Profit-sharing ratio – Equal

♦ Interest on Capital – not to be allowed

♦ Interest on Drawings – not to be charged

♦Interest on Loan Advanced by Partner to Firm – allowed @ 6% p.a. ♦ Remuneration to Partner – not to be allowed

♦ Interest on Loan Advanced by Firm to Partner – Not to be charged

♦ Can Minor become Partner?

_______________________________________________________________________________________________.

Interest on Capital

• It is allowed to partners to compensate them for their capital investment

• Two situations in which Interest on Capital is generally allowed: When profit-sharing ratio is equal but capital contribution is unequal. When profit-sharing ratio is unequal, but capital contributed by partners are equal.

MCQ Questions Accounting for Partnership Basic Concepts Class 12 Accountancy

Question: A, B and C are partners sharing profits equally. A drew regularly Rs. 4,000 in the beginning of every month for six months ended 30th September, 2020. Calculate interest of A’s drawing @ 5% p.a.

a) Rs. 200

b) Rs. 1,200

c) Rs. 350

d) Rs. 700

Answer

C

Question: If a partner withdraws equal amount at the end of each quarter then average period for calculation of interest on drawings will be …………………..

a) 5.5 months

b) 6 months

c) 4.5 months

d) 7.5 months

Answer

C

Question: Ram, Raghav and Raghu are partners in a firm sharing profits in the ratio of 5:3:2. As per Partnership Deed, Raghu is to get a minimum amount of Rs. 10,000 as profit. Net profit for the year is Rs. 40,000.

Find the deficiency amount in the above case.

a) Rs. 750

b) Rs. 1,000

c) Rs. 1,500

d) Rs. 2,000

Answer

D

Question: Which of the following is not a right of a partner?

a) Right to inspect the books of accounts

b) Right to take part in the management of the firm

c) Right to share the profits/losses with other partners in agreed ratio

d) Right to receive salary at the end of every year.

Answer

D

Question: On 1st April 2018, a partner introduced additional capital of Rs. 50,000 in the firm but Partnership Deed is silent. The partner demands interest on capital @ 5% p.a. How much interest on capital will be payable to the partner:

a) Rs. 3,000

b) Interest on capital will not be allowed

c) Rs. 2,500

d) Rs. 1,800

Answer

B

Question: In the context of debit side of Profit and Loss Appropriation Account, pick out the odd one:

a) Interest on capital

b) Salary of partner

c) Interest on drawings

d) Commission of partner

Answer

C

Question: Interest on partner’s drawings will be credited to –

a) Profit and Loss Account

b) Profit and Loss Appropriation Account

c) Partner’s Capital Account

d) Partner’s Current Account

Answer

B

Question: Do all partnership firms need a Deed and registration?

a) Yes

b) No

c) It is Compulsory

d) Its optional but it is better to have a registered firm to avoid any kind of conflict

Answer

D

Question: Anil and Vimal are partners in a partnership firm without any agreement. Anil devotes more time for the firm as compared to Vimal. Anil demands that he should be given commission in addition to profit in the firm’s profit. Which one of the following is correct in above case?

a) 6% of profit

b) 4% of profit

c) 5% of profit

d) No commission is to be provided

Answer

D

Question: A, B and C are partners sharing profits in the ratio of 5:3:2. Before B’s salary of Rs. 17,000, firm’s profit is Rs. 97,000. How much in total B will receive from the firm?

a) Rs. 17,000

b) Rs. 40,000

c) Rs. 24,000

d) Rs. 41,000

Answer

D

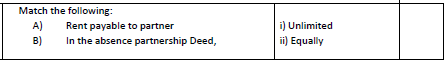

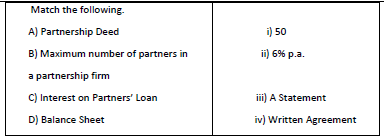

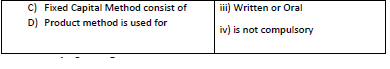

Question: Match the following

A B C D

a) (i) (ii) (iii) (iv)

b) (iv) (i) (ii) (iii)

c) (iii) (ii) (iv) (i)

d) (iv) (iii) (ii) (i)

Answer

B

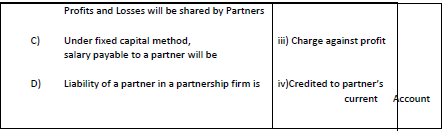

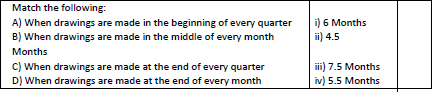

Question: Match the following:

A B C D

a) (i) (ii) (iii) (iv)

b) (i) (iv) (ii) (iii)

c) (ii) (iii) (iv) (i)

d) (iv) (iii) (ii) (i)

Answer

C

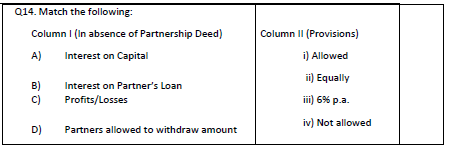

Question: Match the following:

A B C D

a) (i) (ii) (iii) (iv)

b) (iv) (i) (ii) (iii)

c) (iii) (ii) (iv) (i)

d) (iii) (i) (ii) (iv)

Answer

D

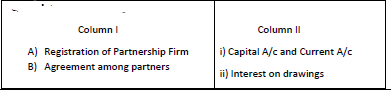

Question: Match the following:

A B C D

a) (i) (ii) (iii) (iv)

b) (i) (iv) (ii) (iii)

c) (ii) (iii) (iv) (i)

d) (iv) (iii) (ii) (i)

Answer

C

Question: Match the following:

A B C D

a) (i) (ii) (iii) (iv)

b) (i) (iv) (ii) (iii)

c) (ii) (iii) (iv) (i)

d) (iv) (iii) (ii) (i)

Answer

D

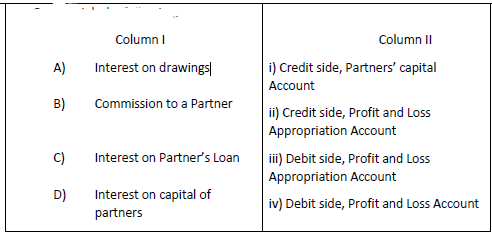

Question:

A B C D

a) (iv) (iii) (i) (ii)

b) (i) (ii) (iii) (iv)

c) (ii) (iii) (iv) (i)

d) (iv) (iii) (ii) (i)

Answer

A

Question: Steps involved in calculation of opening capital of a partner are given below. Select the correct order:

i) Closing Capital

ii) Add: Drawings of the partner

iii) Less: Net Profit

iv) Less: Additional Capital introduced by the partner

a) i) ii) iii) iv)

b) ii) iii) i) iv)

c) iii) iv) ii) i)

d) iv) iii) ii) i)

Answer

A

Question: Steps involved in distribution of profit under minimum guarantee to partner will be………………….

i) Calculate the amount of deficiency

ii) Calculate distributable profit between/among the partners

iii) Distribute the amount of deficiency between/among the partners who have given the guarantee

iv) Calculate the actual share of profit of each partner

a) ii) iv) i) iii)

b) i) ii) iii) iv)

c) iii) ii) iv) i)

d) iv) iii) ii) i)

Answer

A

Question: Steps involved in recording of past adjustment journal entry are given below. Arrange the steps in correct order and select the correct option:

i) Calculation of correct amount to be distributed

ii) Ascertaining the partners to be debited and credited

iii) Calculation of profit already distributed between/among the partners

iv) Pass the adjustment journal entry

a) i) ii) iii) iv)

b) i) iii) ii) iv)

c) iv) iii) ii) i)

d) iv) iii) i) ii)

Answer

B

Question: Which one of the following is the correct order for preparing the Financial Statements of a Partnership Firm?

i) Partners’ Capital Accounts

ii) Profit and Loss Account

iii) Profit and Loss Appropriation Account

iv) Balance Sheet of the firm

a) i) ii) iii) iv)

b) iv) iii) ii) i)

c) ii) iii) i) iv)

d) i) iii) iv) ii)

Answer

C