Please refer to MCQ Questions Chapter 5 Dissolution of Partnership Firm Class 12 Accountancy with answers provided below. These multiple-choice questions have been developed based on the latest NCERT book for class 12 Accountancy issued for the current academic year. We have provided MCQ Questions for Class 12 Accountancy for all chapters on our website. Students should learn the objective based questions for Chapter 5 Dissolution of Partnership Firm in Class 12 Accountancy provided below to get more marks in exams.

Chapter 5 Dissolution of Partnership Firm MCQ Questions

Please refer to the following Chapter 5 Dissolution of Partnership Firm MCQ Questions Class 12 Accountancy with solutions for all important topics in the chapter.

MCQ Questions Answers for Chapter 5 Dissolution of Partnership Firm Class 12 Accountancy

Question. On firm’s dissolution which of the following account is prepared at the last?

a) Realisation account

b) partners capital account

c) cash account partners

d loan account

Answer

C

Question. On dissolution of a firm in which ratio profit and loss on realisation is distributed among the partners:

a) capital ratio

b) profit sharing ratio

c) equally

d) in the ratio of amount due to each partner.

Answer

B

Question. Choose the correct alternative for the following:

1. New ratio is not to be calculated on:

a)Admission of a partner

b) retirement of a partner

c) death of a partner

d) dissolution of a partnership

Answer

D

Question. On dissolution of a firm fictitious assets are transferred to:

a)credit side of partners capital account

b) debit side of realisation account

c) debit side of partners capital account

d) credit side of realisation account

Answer

C

Question. Realisation account is a :

a) personal account

b) real account

c) nominal account

d) none of the above.

Answer

C

Question. On dissolution of the firm amount received from sale of unrecorded asset is credited to :

a) partner’s capital account:

b) profit and loss account

c) cash account

d) realisation account

Answer

D

Question. At the time of dissolution of partnership an unrecorded asset taken by X a partner is debited to:

a) X capital account

b) realisation account

c)cash account

d) none of the above

Answer

A

Question. On dissolution the balance of partners capital account appearing on the credit side of the balancesheet is transferred to :

a) debit side of realisation account

b) credit side of realisation account

c) debit side of partners capital account

d) credit side of partners capital account.

Answer

D

Question. AB and C are partners. The firm had given a loan of Rs20,000 to B. They decided to dissolve thefirm. In the event of dissolution the loan will be settled by transferring it to the:

a) debit side of realisation account

b) transferring it to the credit side of realisation account

c) transfer it to the debit side of B’s capital account

d) B paying A and C privately

Answer

C

Question. On dissolution of a firm Goodwill appearing in the balance sheet is transferred to:

a) capital account of partners

b) cash account

c) debit side of realisation account

d) credit side of realisation account..

Answer

C

Question. In case of dissolution, total creditors of the firm were Rs40,000; creditors worth Rs10000 were givena piece of furniture costing Rs8000 in full and final settlement. Remaining creditors allowed adiscount of 10%. What will be the the amount with which cash will be credited in the realisation

account for payment to creditors:

a) 28,000

b) 27,000correct.

c) 20,000

d) 25,000

Answer

B

Question. At the time of firm’s dissolution credit balance of profit and loss account is credited to :

a) realisation account

b) partners capital account

c) cash account

d) profit and loss account.

Answer

B

Question. At the time of dissolution total assets are worth Rs3,00,000 and external liabilities are worthRs1,20,000. If assets realised 120% and realisation expenses paid were Rs4,000, then profit/loss onrealisation will be:

a) Profit Rs60,000

b) Loss Rs60,000

c) Loss Rs56,000

d) Profit Rs56,000

Answer

D

Question. Settlement of accounts in case of dissolution of partnership is dealt with which section of partnershipact 1932?

a) Section 45

b) section 46

c) section 47

d) section 48

Answer

D

Question. In case of dissolution of partnership there was no workmen compensation fund and firm had topay Rs3000 as compensation to workers where will be this Rs3000 recorded in the books ofaccounts?

a)debit side of realisation account

b) credit side of realisation account

c) debit side of partners capital account

d) credit side of partners capital account.

Answer

A

Question. Section 41 of partnership act 1932 deals with dissolution of a firm

a) by mutual agreement

b) compulsory dissolution correct

c) by notice

d) by order of court.

Answer

B

Question. Court may order dissolution of partnership firm

a) when a partner has become of unsound mind

b) when a partner is permanently incapacitated

c) when a partner is found guilty of misconduct

d) all of the above.

Answer

D

Question. In case of dissolution A one of the partner was paid only RS5000 for his loan to the firm whichamounted to Rs5500. Rs 500 will be recorded in which account and on which side:

a) Realisation account credit side correct

b) Realisation account debit side

c) loan account debit side

d) A’s capital account credit side.

Answer

A

Question. Which of the following is paid first in case of dissolution of partnership firm?

a) Realisation expenses

b) External liabilities

c) Secured loan

d) Partner’s loan

Answer

A

Question. When realisation expenses are to be borne by a partner, actual realisation expense is credited to:

a) Partners capital a/c

b) Cash a/c

c) Realisation a/c

d) None of the above

Answer

D

Question. Gaining ratio is used to distribute —————— in case of retirement of a partner.

a) Goodwill

b) Revaluation Profit or Loss

c) Profit and Loss Account (Credit Balance)

d) Both b and c

Answer

C

Question. X, Y and Z are partners in a firm. Y retires and his claim including his capital and his share of goodwill is R. 1,20,000. He is paid partly in cash and partly in kind. A vehicle at Rs. 60,000 unrecorded in the books of the firm and the balance in cash is given to him to settle his account. The amount of cash to be paid to Y will be:

a) Rs. 80,000

b) Rs. 60,000

c) Rs. 40,000

d) Rs. 30,000

Answer

A

Question. At the time of retirement of a partner, share of retiring partner’s goodwill will be credited to —————- Capital Account(s).

a) Remaining Partner(s)

b) Retiring Partner’s

c) Both Sacrificing and Gaining Partner(s)

d) Gaining Partner(s)

Answer

B

Question. A and B were partners. They shared profits as A- ½; B- 1/3 and carried to reserve 1/6. B died. The balance of reserve on the date of death was Rs. 30,000. B’s share of reserve will be:

a) Rs. 10,000

b) Rs. 8,000

c) Rs. 12,000

d) Rs. 9,000

Answer

C

Question. P, Q and R are partners sharing profits in the ratio of 8:5:3. P retires. Q takes 3/16th share from P and R takes 5/16th share from P. What will be the new profit sharing ratio?

a) 1:1

b) 10:6

c) 9:7

d) 5:3

Answer

A

Question. X, Y and Z are partners sharing profits and losses in the ratio of 4:3:2. Y retires and surrenders 1/9th of his share in favour of X and the remaining in favour of Z. The new profit sharing ratio will be:

a) 1:8

b) 13:14

c) 8:1

d) 14:13

Answer

B

Question. As per Section 37 of the Indian Partnership Act, 1932, interest @ ———– is payable to the retiring partner if full or part of his dues remain unpaid.

a) 9% p.m.

b) 12% p.m.

c) 6% p.m.

d) None of the above

Answer

D

Question. A, B and C were partners. Their partnership deed provided that they were to share profits as; A 26 per cent; B 34 per cent; C 40 per cent ; and that if a partner retires, his capital should remain in the business for a stated period at a fixed rate of interest, but that the retiring partner’s share should be credited with an amount for Goodwill, based upon one and a half year’s average profits, for the five years prior to his death, but be subject to deduction of 5 per cent from the book debts. C retired, and the profits of the firm for five years were agreed at Rs. 20,000; Rs. 30,000; Rs. 15,000 (loss); Rs. 5,000 (loss); and Rs. 45,000 respectively. Book Debts stood at Rs. 90,000.The share of Goodwill to be credited to C’s Account will be:

a) Rs. 2,700

b) Rs. 6,300

c) Rs. 7,200

d) Rs. 3,600

Answer

C

Question. If goodwill is already appearing in the books of accounts at the time of retirement, then it should be written off in ————-.

a) New Ratio

b) Gaining Ratio

c) Sacrificing Ratio

d) Old Ratio

Answer

D

Question. When the balance sheet is prepared after retirement (subsequent to preparation of Revaluation Account), ————- values are shown in it.

a) Historical

b) Realisable

c) Market

d) Revalued

Answer

D

Question. Anil, Bimal and Chetan are partners sharing their profits and losses in the ratio of 4:3:2. On 1.7.2013, Chetan retired and on that date the capitals of Anil, Bimal and Chetan after all necessary adjustments stood at Rs. 75,000, Rs. 65,000 and Rs. 45,000 respectively. Anil and Bimal continued to carry the business for 6 months without settling Chetan’s account. During the period of six months ending 31st December,2013, a profit of Rs. 50,000 is earned by the firm. Keeping Chetan’s interest in mind, the amount payable to Chetan will be:

a) Rs. 1,350

b) Rs. 13,362

c) Rs. 12,162

d) Rs. 1,362

Answer

C

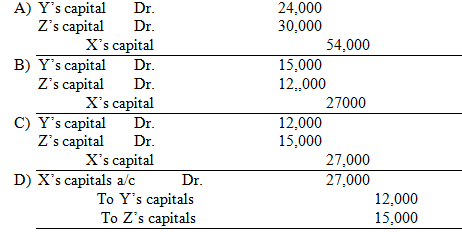

Question. X,Y and Z were partners in a firm sharing profits in ratio of 3:4:1 X retired and new profit sharing ratio between Y and Z will be 5 :4 .On X’s retirement the goodwill of the firm was valued at ₹̈́ 54,000 .journal entry will be:

Answer

C

Question. On retirement of a partner, debtors of Rs. 34,000 were shown in the Balance sheet. Out of this Rs. 4,000 became bad. One debtor became insolvent. 70% were recovered from him out of Rs. 10,000. Full amount is expected from the balance debtors. On account of this item loss in revaluation account will be:

a) Rs. 10,200

b) Rs. 3,000

c) Rs. 7,000

d) Rs. 4,000

Answer

C

Question. As per section ———— of the Indian Partnership Act, a retiring partner becomes entitled to profits after retirement if his dues remain unpaid

a) Section 73

b) Section 26

c) Section 4

d) Section 37

Answer

D

Question. At the time of retirement, amount remaining in Investment Fluctuation Reserve after meeting the fall in value of Investment is:

a) Credited in Sacrificing Ratio

b) Credited in New Profit Sharing Ratio

c) Credited in Old Profit Sharing Ratio

d) Credited in Gaining Ratio

Answer

C

Question. P, Q and R were partners in a firm in the ratio of 5:4:3. They admit S for 1/7 share. It is agreed that Q would retain his original share. ———– will be the sacrificing ratio between P and R.

a) 5:4

b) 1:1

c) 5:3

d) 4:3

Answer

C

Question. If at the time of retirement, there is some unrecorded asset, it will be ————- to ————- Account.

a) Debited, Revaluation

b) Credited, Revaluation

c) Debited, Goodwill

d) Credited, Partners’ Capital

Answer

B

Question. Retiring partner is compensated for parting with the firm’s future profits in favour of remaining partners. The remaining partners contribute to such compensation amount in:

a) Gaining Ratio

b) Sacrificing Ratio

c) Capital Ratio

d) Profit Sharing Ratio

Answer

C

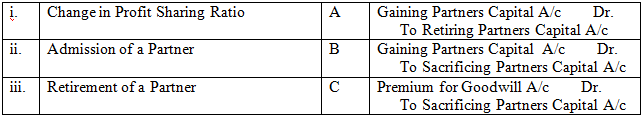

Question. Match the following with respect to the treatment of goodwill:

a) i- C, ii-A, iii-B

b) i- A, ii-B, iii-C

c) i- B, ii-A, iii-C

d) i- B, ii-C, iii-A

Answer

D

Question. All the accounts are settled among partners and creditors at the time of ______________of abusiness.

Answer

Dissolution

Question. First of all____________ of the firms will be settled out of sources of the business.

Answer

Liabilities

Question. When any of the partners agrees to carry out dissolution for an agreed remuneration, including Realisation expenses, ________ Account will be credited.

Answer

Partner’s Capital

Question. Admission of a partner is termination of _____________and not a dissolution of ____________ .

Answer

Agreement,firm

Question. At the time of admission partnership firm is dissolved if business is _____ Discontinuedof___________ mind .

Answer

Files, unsound

Question. Partners are liable to settle the account of accounts payable even from their ___________sources, ifthey are solvent.

Answer

personal

Question. If all partners mutually decide for the dissolution, it will be dissolution of the__________ .

Answer

Firm

Question. ______________of partner will be paid off, before the settlement of partner’s capital.

Answer

Loan

Question. In case of dissolution of firm ______relationship between/among the partners comes to an end

Answer

Economic

Question. Court does not intervene in the Dissolution of Partnership. True

Answer

Question. Partners’ wife’s loan is transferred to Realisation Account.

Answer

True

Question. When a liability is discharge by a partner, it is credited to his account.

Answer

True

Question. At the time of dissolution, balance sheet reveals capital of Rs. 90,000 general reserve Rs.1,00,000, loan of Rs. 50,000. Cash Balance Rs. 1,00,000. Then assets are realised at 30% giving a loss of Rs. 6,60,000.

Answer

False

Question. Debtors of Rs. 50,000 are realized at a loss of2% the amount thus realised is Rs. 49,000.

Answer

True

Question. Raju a partner, bear all Expenses of Realisation, for which he is paid Rs. 4,000 Raju paid Rs. 5,000 as Dissolution Expenses then Realisation Account is debited by Rs. 5,000.

Answer

False

Question. If creditor is Rs. 20,000, loan Rs. 10,000 and capital is of Rs. 1,50,000 cash balance is Rs. 30,000, then Remaining Assets will be Rs. 1,80,000

Answer

False

Question. Creditors of Rs. 80,000 are paid 20% less hence the amount paid is Rs. 64,000.

Answer

True

We hope you liked the above provided MCQ Questions Chapter 5 Dissolution of Partnership Firm Class 12 Accountancy with solutions. If you have any questions please ask us in the comments box below.