Please refer to Assignments Class 12 Accountancy Accounting Ratios Chapter 5 with solved questions and answers. We have provided Class 12 Accountancy Assignments for all chapters on our website. These problems and solutions for Chapter 5 Accounting Ratios Class 12 Accountancy have been prepared as per the latest syllabus and books issued for the current academic year. Learn these solved important questions to get more marks in your class tests and examinations.

Accounting Ratios Assignments Class 12 Accountancy

Question. If inventory is ₹ 1,00,000, current assets ₹ 8,00,000 and current liabilities ₹ 4,00,000, then what will be the liquid ratio?

(a) 1.75 : 1

(b) 2 : 1

(c) 2 : 3

(d) 3 : 1

Answer

A

Question. Calculate operating ratio, if cost of revenue from operations ₹ 50,000, Revenue from operations ₹ 1,50,000 and Operating expenses ₹ 20,000.

(a) 45%

(b) 46.7%

(c) 48.1%

(d) 42.2%

Answer

B

Question. A firm’s current assets are ₹ 1,60,000, current ratio is 2 : 1, cost of revenue from operations is ₹ 2,40,000, its working capital turnover ratio will be

(a) 3 times

(b) 2 times

(c) 4 times

(d) 8 times

Answer

A

Question. Which of the following statement(s) is/are incorrect?

(i) The liquidity of business firm is measured by its ability to satisfy its short-term obligations as they become due.

(ii) The inventory turnover measures the activity of a firm’s inventory.

(iii) Lenders and suppliers are especially interested in the average payment period, since it provides them with a sense of the bill-paying patterns of the firm.

(iv) Debt ratios are a measure of the speed with which various accounts are converted into revenue from operations or cash.

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i), (iii) and (iv)

(d) Only (iv)

Answer

D

Question. Which of the following transactions will improve the quick ratio?

(a) Purchase of inventory for cash

(b) Cash collected from debtors

(c) Sale of goods (costing ₹ 10,000 for ₹ 50,000)

(d) None of the above

Answer

C

Question. The credit sale of M/s Dinesh & Sons is ₹ 21,00,000, it’s debtors and bills receivables at the end of the accounting period amounted to ₹ 2,00,000 and ₹ 1,50,000 respectively. What will be the debtor’s turnover ratio?

(a) 4 times

(b) 5 times

(c) 6 times

(d) 7 times

Answer

C

Question. Consider the following information.

Long-term borrowings ₹ 2,00,000

Long-term provision ₹ 1,00,000

Current liabilities ₹ 50,000

Non-current assets ₹ 3,60,000

Current assets ₹ 90,000

Proprietary ratio will be

(a) 22.2%

(b) 21.8%

(c) 36%

(d) None of these

Answer

A

Question. Assuming that debt to equity ratio is 2 : 1, then which of the following transaction will have no effect on it?

(a) Purchase of a fixed assets by taking loan

(b) Sale of fixed assets (book value ₹ 40,000) at loss of ₹ 15,000

(c) Issue of bonus shares

(d) Declaration of final dividend

Answer

C

ASSERTION REASON QUESTIONS

Question: Assertion (A): When there is a change in profit sharing ratio of existing partners then the assets and liabilities of the firm are revalue D.

Reason (R): They are revalued because if there is any change in the value of assets and liabilities then such change belongs to the period prior to change in profit sharing ratio

A. Both A and R are correct

B. Both A and R are incorrect

C. A is true but R is not correct explanation of A

D. A is incorrect but R is correct

Answer

A

Question: Assertion (A): Increase in Accrued Income is Credited to Revaluation Account.

Reason (R): Accrued Income is a liability.

a) Both Assertion and Reason are correct

b) Both Assertion and Reason are incorrect

c) Assertion is correct but Reason is wrong

d) Assertion is wrong but Reason is correct

Answer

C

Question: Assertion (A): Any change in existing agreement among partners brings a reconstitution of partnership firm

Reason(R): Whenever there is any change in partnership agreement, then the existing agreement comes to an end and a new agreement comes to an existence.

A. Assertion is correct and reason is also correct

B. Assertion is correct but reason is not correct

C. Assertion is wrong but reason is correct

D. Assertion and reason both are Incorrect

Answer

A

Question: Assertion (A): At time of change in profit sharing ratio goodwill appears in the books is written off among existing partners in their old profit sharing ratio

Reason (R): Goodwill Cannot be raised in the books of the firm unless no consideration in money has been paid for it

A. Both A and R are correct

B. Both A and R are incorrect

C. A is true but R is not correct explanation of A

D. A is incorrect but R is correct

Answer

C

Question: Assertion (A): At time of change in profit sharing ratio among partners goodwill is not recognised in the book of the firm.

Reason (R): As per AS- 26, intangible assets should be recognised in the books only when consideration in money or money’s worth has been paid for it.

A. Both A and R are correct and R is the correct explanation of A.

B. Both A and R are correct but R is not the correct explanation of A.

C. A is correct but R is wrong

D. A is wrong but R is correct.

Answer

A

Question: Assertion (A): Accumulated profits appearing in the balance sheet on date of change in profit sharing ratio is to be distributed among existing partners in their old ratio.

Reason (R): Accumulated profits had been owned before the reconstitution of the firm by the partners

A. Both A and R are correct

B. Both A and R are incorrect

C. A is true but R is not correct explanation of A

D. A is incorrect but R is correct

Answer

A

Question: Assertion (A): Gaining ratio is calculated to determine the amount of compensation to be paid by gaining partner to the sacrificing partner.

Reason (R): Gaining ratio is excess of old ratio over new ratio

a) Both Assertion and Reason are correct

b) Both Assertion and Reason are incorrect

c) Assertion is correct but Reason is wrong

d) Assertion is wrong but Reason is correct

Answer

C

Question: Assertion (A): Advertisement suspense existing in Assets side of Balance Sheet should be debited to partners’ capital a/C.

Reason (R): Advertisement suspense a/c is Accumulated profit.

A. Both A and R are correct and R is the correct explanation of A.

B. Both A and R are correct but R is not the correct explanation of A.

C. A is correct but R is wrong

D. A is wrong but R is correct.

Answer

C

Question: Assertion(A): Assets and liabilities are revalued when there is change in profit sharing ratio of existing partners

Reason (R): It is to ensure that no partner is at an advantage or disadvantage due to change in the value of assets and liabilities

A. Both A and R are correct and R is the correct explanation of A.

B. Both A and R are correct but R is not the correct explanation of A.

C. A is correct but R is wrong

D. A is wrong but R is correct.

Answer

A

Question: Assertion (A): Workmen compensation reserve is credited to partners’ capital or current accounts in their old profit sharing ratio.

Reason (R): Reserves exist in the books of firm, transferred to Partners’ Capital Accounts only.

A. Both A and R are correct and R is the correct explanation of A.

B. Both A and R are correct but R is not the correct explanation of A.

C. A is correct but R is wrong

D. A is wrong but R is correct.

Answer

C

CASE STUDY BASED QUESTIONS

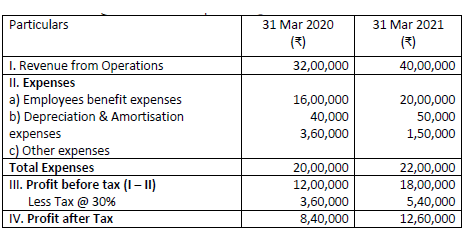

Read the following and answer the questions give below

Question: Net profit ratio for the year 31st March 2020 is

A. 28.25%

B. 26.25%

C. 26%

D. 26.50%

Answer:

B

Question: Operating Ratio for the year 31st March 2021 is

A. 55%

B. 52%

C. 55.05%

D. 54.85

Answer:

A

Question: If the operating ratio is 50%, which of the following will lead to increase in ratio?

A. Building sold for Rs. 2,00,000

B. Payment to creditors Rs. 500

C. Purchase return Rs. 200

D. Office expenses paid Rs. 5000

Answer:

D

Question: State True or False. A higher Operating Profit Ratio is better for the firm.

A. True

B. False

Answer:

B

Read the following and answer the questions give below:

Question: When current ratio 1 : 1, which of the following will improve the ratio?

A. Sales of goods for Rs. 25,000 (cost Rs. 20,000)

B. Bill payable discharged Rs. 1000.

C. Purchased goods for cash Rs. 3500

D. Cash paid to creditors Rs. 500

Answer:

A

Question: Current ratio for the year ending 31 March 2020 and 31 March 2021.

A. 2.25 : 1 and 2.50 : 1

B. 2.25 : 1 and 2.25 : 1

C. 2.50 : 1 and 2.25 : 1

D. 2.50 : 1 and 2.50 : 1

Answer:

C

Question: Which year has higher quick ratio?

A. 2020

B. 2021

C. Both are equal (neither)

D. Neither 2020 nor 2021

Answer:

A

Question: Find propriety ratio for the year ending 31 March 2020 & 31 March 2021

A. 0.53 : 1 and 0.50 : 1

B. 0.50 : 1 and 0.53 : 1

C. 0.55 ; 1 and 0.50 : 1

D. 0.50 : 1 and 0.50 : 1

Answer:

A

A firm had a Current Assets of Rs. 4,00,000. It then paid a current liability of Rs. 80,000. After this payment the current ratio was 2 :1.

Answer the following

Question: Determine working capital before and after payment of Rs. 80,000?

A. Rs. 3,20,000 and Rs. 1,60,000

B. Rs. 3,20,000 and Rs. 3, 20,000

C. Rs. 1,60,000 and Rs. 1,60,000

D. Rs. 2,40,000 and Rs. 1,60,000

Answer:

C

Question: How much is Current liabilities after payment of Rs. 80,000?

A. Rs. 3,20,000

B. Rs. 1,60,000

C. Rs. 80,000

D. Rs. 2,00,000

Answer:

B

Question: What is the ideal current ratio and quick ratio?

A. 3 : 1 and 2 : 1

B. 2 : 1 and 1 : 1

C. 1 : 1 and 2 : 1

D. 2 : 1 and 2 : 1

Answer:

B

Question: Liquid asset does not include the following

A. Trades receivables

B. Short term loans and advances

C. Inventory and pre-paid expenses

D. Current investments

Answer:

C

Read the following and answer the questions give below:

Question: Find the value of share holders’ fund?

A. Rs. 5,30,000

B. Rs. 3,80,000

C. Rs. 6,40,000

D. Rs. 6,00,000

Answer:

C

Question: How much is the long-term debts?

A. Rs. 8,00,000

B. Rs. 5,00,000

C. Rs. 3,00,000

D. Rs. 8,70,000

Answer:

A

Question: State True or False. In the above case the Debt Equity ratio shows a risky financial position of the company.

A. True

B. False

Answer:

B

Question: What will be Debt Equity ratio?

A. 0.83 : 1

B. 1.33 : 1

C. 1.25 : 1

D. 2 : 1

Answer:

C

Following information is available for the year ending 31st March 2020

Rs.

Cash revenue from operation (cash sales) 3,00,000

Purchases : Cash 1,50,000

: Credit 4,50,000

Carriage inwards 16,000

Salaries 75,000

Decrease in inventory 80,000

Return outwards 20,000

Wages 40,000

Ratio of Cash revenue from operations & credit revenue from operation is 1 ; 4

Question: Find cost of revenue from operations?

A. Rs. 6,36,000

B. Rs. 7,00,000

C. Rs. 6,20,000

D. Rs. 7,16,000

Answer:

C

Question: Find revenue from operation?

A. Rs. 12,00,000

B. Rs. 15,00,000

C. Rs. 16,00,000

D. Rs. 3,00,000

Answer:

B

Question: How much will be the gross profit, if selling price is 25% above cost?

A. Rs. 5,72,800

B. Rs. 8,95,000

C. Rs. 1,79,000

D. Rs. 8,75,000

Answer:

B

Question: Find gross profit ratio?

A. 52.26%

B. 40.33%

C. 48.85%

D. 58.33%

Answer:

A