Please refer to Assignments Class 12 Accountancy Financial Statements of a Company Chapter 3 with solved questions and answers. We have provided Class 12 Accountancy Assignments for all chapters on our website. These problems and solutions for Chapter 3 Financial Statements of a Company Class 12 Accountancy have been prepared as per the latest syllabus and books issued for the current academic year. Learn these solved important questions to get more marks in your class tests and examinations.

Financial Statements of a Company Assignments Class 12 Accountancy

Question. From the following information, you are required to compute profit after tax.

(i) Revenue from operation = ₹ 80,00,000

(ii) Cost of material consumed = ₹ 10,00,000

(iii) Purchase of stock-in-trade = ₹ 30,00,000

(iv) Employees salary = ₹ 4,00,000

(v) Tax rate = 50%

(a) ₹ 20,00,000

(b) ₹ 24,00,000

(c) ₹ 15,00,000

(d) ₹ 18,00,000

Answer

D

Question. Financial statements include balance sheet, statement of profit and loss, cash flow statement, etc. Besides these statements, a special statement is also included in financial statements if applicable on company. You are required to find that statement.

(a) Statement of cash inflow and outflow

(b) Statement of changes in equity

(c) Statement of incomes and expenses

(d) Statement of assets and liabilities

Answer

B

Question. Financial statements are presented by directors to shareholders at every

(a) board meeting

(b) special (extraordinary) general meeting

(c) annual general meeting

(d) None of the above

Answer

C

Question. Compute cost of material consumed from following.

Opening inventory = ₹ 5,00,000;

Materials purchased = ₹ 40,00,000;

Closing inventory = ₹ 6,00,000;

(a) ₹ 40,00,000

(b) ₹ 39,00,000

(c) ₹ 38,00,000

(d) ₹ 41,00,000

Answer

B

Question. Assertion (A) Bills receivable are shown as trade receivables in the balance sheet of the company.

Reason (R) Debtors and bills receivable forms the part of trade receivables.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

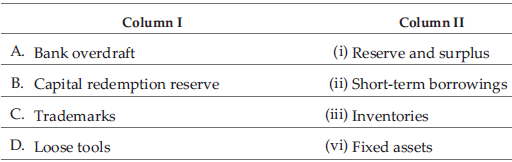

Question. Match the following.

Codes

A B C D

(a) (iii) (ii) (i) (iv)

(b) (iii) (ii) (iv) (i)

(c) (ii) (i) (iv) (iii)

(d) (i) (ii) (iv) (iii)

Answer

C

Question. From following information, calculate other incomes.

Sales of product = ₹ 54,000;

Sale of services = ₹ 60,000

Commission received = ₹ 1,20,000;

Excise duty paid = ₹ 3,00,000

Dividend from investment = ₹ 20,000

(a) ₹ 1,40,000

(b) ₹ 2,54,000

(c) ₹ (46,000) loss

(d) None of these

Answer

A

Question. A company took a loan of ₹ 1,00,000 and paid interest of ₹ 10,000 for this year @ 10% on loan amount. This interest will be shown under ………. head.

(a) finance cost

(b) employee benefit expense

(c) revenue from operations

(d) None of the above

Answer

A

ASSERTION- REASON BASED QUESTIONS

Question: Assertion: Financial statements reflect a combination of recorded facts, accounting principles and personal judgements”.

Reason: Personal opinion, judgements and estimates are made while preparing the financial statements to avoid any possibility of over statement of assets and liabilities, income and expenditure, keeping in mind the convention of conservatism

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

B

Question: Assertion: Financial statements need to be arranged in a proper form with suitable contents so that the shareholders and other users of financial statements can easily understand and use them in their economic decisions in a meaningful way.

Reason: The financial statements are the outcome of the summarizing process of accounting and are, therefore, the sources of information on the basis of which conclusions are drawn about the profitability and the financial position of a company

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

A

Question: Assertion: Money received against share warrants’ to be disclosed as a separate line item under ‘shareholder’s fund’.

Reason: It is the amount received by the company which are converted into shares at a specified date on a specified rate

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

A

Question: Assertion: Amount received by the company as share application and against which the company will certainly allot shares should be shown under the head Share application money pending allotment

Reason: The application money is received before the Balance sheet date and allotment will be made after the Balance sheet date.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

A

Question: Assertion: Financial statements are the basic sources of information to the shareholders and other external parties for understanding the profitability and financial position of any business concern

Reason: the primary objective of financial statements is to assist the users in their decision-making.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

A

Question: Assertion: Since declaration of proposed (final) dividend is contingent upon shareholders’ approval, Proposed dividend is shown as contingent liability.

Reason: proposed dividend of previous year will be accounted in the current year before it is declared (approved) by the shareholders in their annual general meeting.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

B

Question: Assertion: A trading company sells its fixed assets through an agent. The agent is to be paid Rs.50,000 as fee which can be shown as Trade payables in the Balance sheet

Reason: Trade payables are defined as the amount payable against purchase of goods or services taken in the normal course of business and includes both sundry creditors and bills payable.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

C

Question: Assertion: financial statements do not reflect current situation:

Reason: Financial statements are prepared on the basis of historical cost. Since the purchasing power of money is changing, the values of assets and liabilities shown in financial statement do not reflect current market situation.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

A

Question: Assertion: Preliminary expenses, discount on issue of debentures, share issue expenses etc are to be written off in the year in which such expenses are incurred first from security premium Reserve and the balance if any, from statement of profit & loss.

Reason: According to Section 52 of Companies Act 2013, securities premium can not be used for the following purposes: For the issue of fully paid bonus share capital. For meeting the preliminary expenses incurred by the company. For meeting the expenses, commission or discount incurred concerning securities previously issued by the company.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

B

Question: Assertion: A Ltd issued 5,00,000, 9% Debentures of Rs.100 each on 1st April 2016,redeemable in 5 equal yearly instalments starting from 31st March2017. Rs.4,00,00,000 Debentures will be shown under Noncurrent liabilities and Rs.1,00,00,000 Debentures will be shown under Current liabilities

Reason: Rs.1,00,00,000 Debentures are to be redeemed after the operating cycle of the company and will be classified as “Current maturities of long term borrowings.

a) Both A and R are correct

b) A is correct, but R is wrong

c) A is wrong, but R is correct

d) Both A and R are wrong

Answer

B

CASE STUDY BASED QUESTIONS

Read the hypothetical text and questions .

Dinakar Ltd was incorporated on 1st April 2015 with an authorised capital of Rs. 50,00,00,000 divided into equity shares of Rs. 100 each. The company was in need of large funds to invest in Plant & Machinery, it invited applications for 4,00,000 shares, applications for 3,80,000 shares were received. All calls were made and duly received except for 5000 shares on which the final call of Rs. 20 was not received. The company forfeited 200 shares on which final call was not received.

Question: The shareholders’ funds to be shown in the face of Balance sheet will be

a) Rs.3,80,00,000

b) Rs.3,79,00,000

c) Rs.50,00,00,000

d) Rs.4,00,00,000

Answer:

B

Question: The minimum subscription on this issue of shares is

a) 3,60,000 shares

b) Rs.3,60,000

c) 4,00,000 shares

d) Rs.4,00,000

Answer:

A

Question: How will you show the Calls in arrears in the Balance sheet of a company?

a) As a deduction from Called up capital in the Notes to Accounts to Share capital

b) As a deduction from Shareholders’ funds in the Balance sheet

c) As a deduction from the Reserves & Surplus

d) As a deduction from the Sundry creditor

Answer:

A

Question: The authorized capital of Dinkar Ltd will be shown in———————–

a) Articles of Association

b) Prospectus

c) Memorandum of Association

d) Table F of Companies Act 2013.

Answer:

C

Amba Ltd is a leading consumer goods chain with a network of 46 stores primarly across Mumbai, Delhi and Pune.The balance sheet of the company as on March 31, 2020 gives you the following Information:8% Debentures 10,00,00,000

Equity share capital 50,00,00,000

Securities premium 2,00,000

Preliminary expenses 4,00,000

Statement of Profit & Loss (cr.) 1,50,000

Loose tools 2,00,000

Bank balance 6,00,000

Cash in hand 38,000

questions based on the above information:

Question: Loose tools will be shown under the heading——————————–

a) Noncurrent assets

b) Current assets

c) Inventories

d) Intangible assets

Answer:

C

Question: The Reserves & surplus of the Company to be shown in the Balance sheet is

a) Rs.(50,000)

b) Rs.2,00,000

c) Rs.1,50,000

d) Rs.4,00,000

Answer:

A

Question: Long term borrowings of the company is

a) Rs.10,00,00,000

b) Rs.50,00,00,000

c) Rs.4,00,000

d) Rs.1,50,000

Answer:

A

Question: Cash & Cash equivalents of the company is——————-

a) Rs.6,00,000

b)Rs.38,000

c) Rs.6,38,000

d) Rs.5,62,000

Answer:

C

Read the following Arun is appointed as Accountant in a leading company manufacturing consumer products. For all these years he served as an accountant in a partnership firm. He come across a company’s Balance sheet and he find to it difficult to understand which item will come in the balance sheet under major head and sub head. He took the format of a balance sheet as per schedule III of the companies Act 2013. He come across some items. You are required to inform him the major heads and sub heads to enter the items in the company’s balance sheet. questions.

Question: The debentures will appear under sub head ——————————-

a) long term borrowings

b) long term provisions

c) other long term liabilities

d) deferred tax liabilities

Answer:

A

Question: The Long term borrowings of the company will appear under the major head ———————–

a) Non -current liabilities

b) current liabilities

c) shareholders’ funds

d)other non-current liabilities

Answer:

A

Question: Current investments will come under the major head_______________

a)current assets

b) fixed assets

c) tangible assets

d) intangible assets

Answer:

A

Question: Goodwill will appear under the sub head___________________

a) Intangible assets

b) Tangible assets

c) Fixed assets

d) Noncurrent assets

Answer:

A

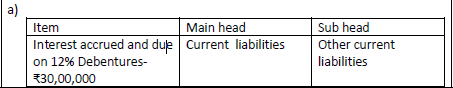

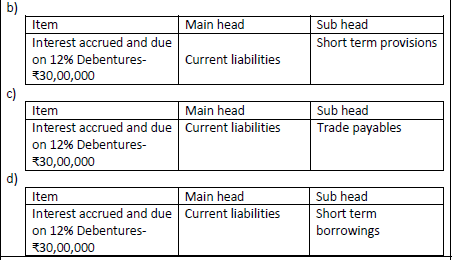

Best Bulbs Pvt. Ltd was manufacturing good quality LED bulbs and catering the needs of local market. The current production of the company is 800 bulbs per day. Sumit, the Marketing manager of the company gives you the following information:The operating cycle of the company is 12 months and Trade Receivables expected to realize within 18 months.

Public Deposits Rs.10,00,00,000

12% Debentures repayable after 4 years- 10,00,00,000

Interest accrued and due on 12% Debentures- Rs.30,00,000

Employee Provident fund payable-Rs.20,00,000

Premium payable on Redemption of Debentures-Rs.10,00,000

Proposed dividend –Rs.25,00,00,000

Computer software-Rs.35,00,00,000

Stores and spares-Rs.5,00,000

Question: Premium payable on Redemption of Debentures-Rs.10,00,000 will be shown under which main head and subhead of the Balance sheet?

Answer:

B

Question: Operating cycle means————————–

a) The time between two balance sheet dates

b) The time between the acquisition of an asset and obsolescence

c) The time between the acquisition of an asset for processing and its realization in to cash & cash equivalents.

d) The time between the disposal of an asset and the realization of its value

Answer:

C

Question: Identify the main head and subhead of the Balance sheet under which Computer software-Rs.35,00,00,000 will be shown

Answer:

A

Question: Interest accrued and due on 12% Debentures- Rs.30,00,000 will be shown under which Main head and subhead of the Balance sheet?

Answer:

A

Moon India Ltd produces and distributes green energy in the backward areas of India. It has also taken up a project of giving vocational training to girls belonging to backward areas of Rajasthan. The company presents you the following statement of Profit & Loss for the year ended 31st March 2021.

On the basis of above information, questions

Question: The total revenue of the company is

a) Rs.52,00,000

b) Rs.50,00,000

c) Rs.2,00,000

d) Rs.26,00,000

Answer:

A

Question: Profit before tax of the company is

a) Rs.34,32,000

b) Rs.30,00,000

Page 81 of 152

c) Rs.17,68,000

d) Rs.26,00,000

Answer:

C

Question: Employee benefit expenses of the company is

a) Rs.31,20,000

b) Rs.30,00,000

c) Rs.1,20,000

d) Rs.15,60,000

Answer:

A

Question: Total expenses of the company is

a) Rs.31,20,000

b) Rs.3,12,000

c) Rs.15,60,000

d) Rs.34,32,000

Answer:

D