Please refer to Assignments Class 12 Accountancy Accounting for Share Capital Chapter 1 with solved questions and answers. We have provided Class 12 Accountancy Assignments for all chapters on our website. These problems and solutions for Chapter 1 Accounting for Share Capital Class 12 Accountancy have been prepared as per the latest syllabus and books issued for the current academic year. Learn these solved important questions to get more marks in your class tests and examinations.

Accounting for Share Capital Assignments Class 12 Accountancy

Question. Amox Ltd is registered with a capital of 10,00,000 equity shares of ₹ 10 each. 6,00,000 equity shares were offered for subscription to public. Applications were received for 6,00,000 shares. All calls were made and amount was duly received except final call of ₹ 2 on 80,000 shares. What will be the amount of share capital shown in the balance sheet?

(a) ₹ 60,00,000

(b) ₹ 58,40,000

(c) ₹ 5,84,000

(d) ₹ 6,00,000

Answer

B

Question. Pass the journal entry for amount of first call, ₹ 90,000 received after deducting calls-in-arrear of ₹ 6,000.

(a) Bank A/c Dr 90,000

Calls-in-arrears A/c Dr 6,000

To Share First Call A/c 96,000

(b) Share First Call A/c Dr 96,000

To Bank A/c 90,000

To Calls-in-arrear A/c 6,000

(c) Bank A/c Dr 96,000

To Share First Call A/c 96,000

(d) None of the above

Answer

A

Question. What will be the journal entry for shares re-issued at discount?

(a) Bank A/c Dr

To Share Capital A/c

To Securities Premium Reserve A/c

(b) Bank A/c Dr

Share Forfeiture A/c Dr

To Share Capital A/c

(c) Share Capital A/c Dr

To Bank A/c

To Share Forfeiture A/c

(d) Share Capital A/c Dr

Securities Premium Reserve A/c Dr

To Bank A/c

Answer

B

Question. Assertion (A) At the time of forfeiture of shares, amount of securities premium received will not be debited to securities premium reserve account.

Reason (R) Amount of securities premium received will be debited while writing-off various types of capital losses or expenditures.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

Question. Vijay Ltd is registered with 1,00,000 shares and invited public to apply for the complete registered capital. Per share value is ₹ 10 which is payable as ₹ 2 on application, ₹ 5 on allotment and rest on first and final call. What will be the amount that the company will receive till allotment?

(a) ₹ 2,00,000

(b) ₹ 5,00,000

(c) ₹ 10,00,000

(d) ₹ 7,00,000

Answer

D

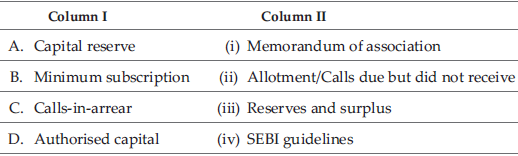

Question. Match the columns with reference to share capital of a company.

Codes

A B C D

(a) (iii) (iv) (ii) (i)

(b) (iii) (ii) (iv) (i)

(c) (ii) (i) (iv) (iii)

(d) (i) (ii) (iv) (iii)

Answer

A

Question. Capital reserve is the reserve which is not readily available for distribution of dividend. It is mandatory to create capital reserve in case of

(a) capital profits earned by the company

(b) loss generated by the company

(c) gain made by company

(d) None of these

Answer

A

Question. Shares offered to a specific group of people or to an organisation is called

(a) Pubic issue

(b) Public offer

(c) Private placement

(d) None of these

Answer

C

ASSERTION-REASON TYPE QUESTIONS

Read the following statements – Assertion (A) and Reason (R). Choose one of the correct alternatives given below :

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(B) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

(C) Assertion (A) is true but Reason (R) is false.

(D) Assertion (A) is false but Reason (R) is true.

Read the following text. Based on the information given, Akhil Ltd purchased a running business from Sunny Ltd for a sum of Rs 22,00,000 by issuing 20,000 fully paid equity shares of Rs 100 each at a premium of 10%. The assets and liabilities consisted of the following : Machinery Rs 7,00,000, debtors Rs 2,50,000, stock Rs 5,00,000, building Rs 11,50,000 and bills payable Rs 2,50,000.

Question: Assertion (A): Akhil Ltd issued equity shares to Sunny Ltd for consideration other than cash.

Reason (R): Akhil Ltd did not receive cash from Sunny Ltd for issue of shares on purchase of running business.

Answer

A

Question: Assertion (A): The net assets purchased from Sunny Ltd was Rs.23,50,000 and Akhil Ltd issued in return its equity shares at a premium of 10% for a sum of Rs.22,00,000, the difference being capital profit.

Reason (R): The difference Rs.1,50,000 is credited to statement of Profit &Loss.

Read the following text.

Starplus Ltd issued for public subscription 1,50,000 shares of the value of Rs.100 each at a premium of Rs.20 per share payable as follows.

On application -Rs.20(including premium of Rs.5 per share)

On allotment -Rs.60(including premium of Rs.15 per share)

On First & final call- The balance.

The company received applications for 3,00,000 shares and allotment was made as follows.

a) To the applicants of 30,000 shares -10,000 shares.

b) To the applicants of 1,40,000 shares -80,000 shares.

c) To the remaining applicants -60,000 shares.

Hari, a shareholder who had applied for 7,000 shares of group (b) failed to pay allotment and call money. Rohan, a shareholder, who was allotted 1,000 shares of group (a) paid the full amount along with allotment.

Hari’s shares were forfeited after the call has been made. Of these 3,000 shares were reissued to Suman for Rs.150 per share as fully paid.

Answer

C

Question: Assertion (A): Star plus Ltd can use Securities Premium received is capital profit and can be transferred to Capital Reserve.

Reason (R): Companies Act, 2013 specified the specific purposes for which securities premium reserve can be utilised.

Answer

D

Question: Assertion (A): Hari got allotment of 4000 shares on pro-rata basis under group (b)

Reason (R): Hari failed to pay Rs.24,000(=Rs.60×4000) on allotment

Answer

C

Question: Assertion (A): Rohan need not to pay when First & final call made.

Reason (R): Rohan paid full amount of Rs.60000 along with allotment .

Answer

A

Question: Assertion (A): Amount forfeited on Hari’s shares is Rs.1,20,000

Reason (R): Profit on reissue of Hari’s shares is transferred to capital reserve.

Read the following text.

Zocon Ltd. issued a prospectus inviting applications for 5,00,000 equity shares of Rs.10 each issued at a premium of 10% payable as:

Rs.3 on Application

Rs.5 on Allotment (including premium)

and Rs.3 on call.

Applications were received for 6, 60,000 shares.

Allotment was made as follows:

(a) Applicants of 4, 00,000 shares were allotted in full.

(b) Applicants of 2, 00,000 shares were allotted 50% on pro rata basis.

(c) Applicants of 60,000 shares were issued letters of regret.

A shareholder to whom 500 shares were allotted under category (a) paid full amount on shares allotted to him along with allotment money. Another shareholder to whom 1,000 shares were allotted under category (b) failed to pay the amount due on allotment. His shares were immediately forfeited. These shares were then reissued at Rs.14 per share as Rs.7 paid up. Call has not yet been made.

Answer

B

Question: Assertion (A): There was oversubscription for shares of the company.

Reason (R):The applicants for 1,60,000 shares were not allotted and their application money refunded.

Answer

C

Question: Assertion (A): Amount unpaid on allotment is Rs.2,000.

Reason (R): Excess application money under category (b) was adjusted towards allotment.

Answer

A

Question: Assertion (A):The forfeited shares were reissued at a premium of Rs.4 per share.

Reason (R):The total of forfeited amount was transferred to capital reserve.

Answer

D

Question: Assertion (A):The amount credited to calls in advance was Rs.1,500

Reason (R): If authorized by Articles of Association, A Company may accept call in advance from its shareholders.

Answer

B

Question: Assertion: Underwriters usually agrees for commission to take shares not subscribed by the public.

Reason: The cash / shares paid to the underwriters should be written off in the year from Securities premium Reserve or Statement of Profit and loss.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct.

Answer

A

Question: Assertion: According to Sec 39(2) of the Companies Act, 2013, minimum application money should be 5% of the nominal (face) value of the share or such other percentage or amount as may be prescribed by Securities Exchange Board of India(SEBI)

Reason: SEBI prescribes that application money should not be less than 25% of the issue price.

(A) Both A and R are correct

(B) (B)Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct.

Answer

C

Question: Assertion: Reserve capital is part of issued share capital that a company resolves not to call except in the event of it being wound up.

Reason: Reserve capital is the part of issued capital which is shown in the Balance Sheet of the company.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is incorrect

(D) A is incorrect by R is correct.

Answer

C

Question: Assertion Sec2(62) of the Companies Act, 2013 defines One person company as “One person company means a company which has only one person as member”

Reason: It can be formed for charitable purpose also.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct.

Answer

C

Question: Assertion: if a shareholder does not pay the call amount due on allotment or on any calls according to the terms, the amount so not received is called call in arrears.

Reason: Table F of the companies Act, shall apply which provides for interest on calls in arrears 10% p.a.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct

(D) A is incorrect by R is correct.

Answer

A

Question: Assertion: SEBI the Regulatory authority for listed companies prescribes that the company must receive minimum subscription of 90% of the shares issued for subscription before it allots the shares.

Reason: If minimum subscription is not received within the specified period, application money shall be refunded with 14 days from the closure of the issue.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct

(D) A is incorrect by R is correct.

Answer

C

Question: Assertion: When some of the forfeited shares are reissued, gain(profit) on reissued shares is transferred to Capital Reserve.

Reason: Gain or profit on re issued shares is calculated as follows:

= total amount forfeited x no. of shares re issued-reissue discount No. of shares forfeited

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct

Answer

A

Question: Assertion: According to sec 42 of the companies act, 2013, private placement means any offer of securities or invitation to subscribe to a selected group of persons.

Reason: Employees Stock Option Plan is also a type of private placement of shares.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct

(D) A is incorrect by R is correct

Answer

C

Question: Assertion: Pro rata allotment is a type of allotment of shares in which the excess application money received over and above the actual application money is adjusted towards allotment money due.

Reason: Pro rata ratio enable to find out the actual applications made and actual shares allotted.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct

Answer

D

Question: Assertion: Section 52(2) of the Companies Act,2013 restricts the use of the amounts received as share premium on securities for specified purposes.

Reason: Securities premium reserve can be used to write off preliminary expenses of the company.

(A) Both A and R are correct

(B) Both A and R are in correct

(C) A is correct but R is not correct explanation of A

(D) A is incorrect by R is correct

Answer

A

CASE STUDY QUESTIONS

Janta Ltd. had an authorized capital of 2,00,000 equity shares of Rs. 10 each. The company offered to the public for subscription 1,00,000 shares. Applications were received for 97,000 shares. The amount was payable as follows on application was Rs. 2 per share, Rs. 4 was payable each on allotment and first and final call. Shankar, a shareholder holding 600 shares failed to pay the allotment money. His shares were forfeited The company did not make the first and final call.

Question: The amount forfeited on forfeiture of Shankar’s shares is —

(A) Rs.6,000

(B) Rs.1,200

(C) Rs.3,600

(D) Rs.2,400

Answer:

B

Question: Name the type of share capital which is shown in the Memorandum of Association of the company-

(A) Issued capital

(B) Subscribed Capital

(C) Authorised Capital

(D) Paid up capital

Answer:

C

Question: When shares are forfeited, the Share Capital Account is debited with ___________ and the

Share Forfeiture Account is credited with ____________.

(A) Paid up capital of shares forfeited; Called up capital of shares forfeited

(B) Called up capital of shares forfeited; Calls in arrear of shares forfeited

(C) Called up capital of shares forfeited; Amount received on shares forfeited

(D) Calls in arrears of shares forfeited; Amount received on shares forfeited

Answer:

C

Question: Janta Ltd is—

(A)Private Company

(B)Public Company

(C)Government Company

(D)Public Corporation

Answer:

B

X Ltd. invited applications for issuing 80,000 equity shares of Rs. 10 each at a premium of 20%. The amount was payable as follows:

On application Rs. 6 (including premium) per share.

On allotment Rs. 3 per share and The balance on first and final call.

Applications for 90,000 shares were received Applications for 5,000 shares were rejected and pro-rata allotment was made to the remaining applicants. Over payments received on application was adjusted towards sums due on allotment. All Calls were made and were duly received except the allotment and first and final call on 1,600 shares allotted to Vijay. These shares were forfeited and the forfeited shares were re-issued for Rs. 18,400 fully paid up.

Question: State the total overpayments received on application adjusted towards sums due on allotment-

(A)Rs.60,000

(B) Rs.30,000

(C) Rs.15,000

(D) Rs.50,000

Answer:

B

Question: Name the kind of subscription in the above case.

(A)Minimum subscription

(B)Under subscription

(C)Over subscription

(D)Full subscription

Answer:

C

Question: How much is the share forfeited amount transferred to Capital Reserve?(A) Rs.2,400

(B) Rs.7,000

(C) Rs.6,400

(D) Rs.18,400

Answer:

B

Question: Number of shares applied by Vijay is-

(A) 2000

(B) 1600

(C) 1800

(D) 1700

Answer:

D

J k Ltd invited applications for issuing 50,000 equity shares of Rs.10 each at par. The amount was payable as follows:

On Application: Rs.2 per share

ON Allotment: Rs.4 per share

On First and Final Call: Balance amount

The issue was oversubscribed three times. Applications for 30% shares were rejected and money was refunded Allotment was made to the remaining applicants as follows:

Category I Applicants for 80,000 allotted 40,000

Category II Applicants for 25,000 allotted 10,000

Excess application paid by the applicants who were allotted shares adjusted towards the sums due on allotment.

Deepak a shareholder belonging to category I who had applied for 1,000 shares failed to pay the allotment money. Raju a shareholder holding 100 shares also failed to pay the allotment money, belonged to the category II. Shares of both were forfeited immediately after allotment. Afterwards, First and final call was made and was duly received The forfeited shares of Deepak and Raju were reissued at Rs.11 per share fully paid up.

Question: What is the amount unpaid by Deepak on allotment?

(A)Rs.2000

(B)Rs.4,000

(C)Rs.500

(D)Rs.1,000

Answer:

D

Question: How many shares applied by public were rejected?

(A) 50000

(B) 45000

(C) 55000

(D) 100000

Answer:

B

Question: The total amount received on allotment was-

(A)Rs.2,00,000

(B)Rs.90,000

(C) Rs.88,900

(D) Rs.85,600

Answer:

C

Question: Number of shares applied by Raju was-

(A) 210

(B) 250

(C) 300

(D) 150

Answer:

B

Manvet Ltd. invited applications for issuing 10,00,000 equity shares of 10 each payable as follows :

On application and allotment 4 per share (including premium 1)

On first call 4 per share,

On second and final call 3 per share.

Applications for 15,00,000 shares were received and pro-rata allotment was made to all the applicants. Excess application money was adjusted on the sums due on calls. A shareholder who had applied for 6,000 shares did not pay the first, and the second and final call. His shares were forfeited. 90% of the forfeited shares were reissued at 8 per share fully paid up.

Question: The total amount of calls in arrear is ————

(A) Rs.28,000

(B) Rs.20,000

(C) Rs.8,000

(D) Rs.42,000

Answer:

B

Question: The amount credited to Securities Premium Reserve is—–

(A) Rs.15,00,000

(B) Rs.5,00,000

(C) Rs.10,00,000

(D) Rs.40,00,000

Answer:

C

Question: The balance left in forfeiture account after reissue of shares is ——–

(A) Rs.7,200

(B) Rs.20,000

(C) Rs.10,800

(D) Rs.2,000

Answer:

D

Question: How many shares were reissued?

(A) 4,000

(B) 6,000

(C) 3,600

(D) 3,200

Answer:

C

Rohit Ltd. Invited applications for 30,000 equity shares of Rs.100 each at a premium of Rs.20 per share. The amount was payable as follows :

On Application Rs.40 (including Rs.10 as premium)

On Allotment Rs.40 (including Rs.10 as premium)

On First call Rs.20

On Second and Final call Rs,20

Applications for 40,000 shares received and pro-rata allotment was made on the applications for 35,000 shares. Excess application money is to be utilized towards allotment.

Rohan to whom 600 shares were allotted failed to pay the allotment money and his shares were forfeited after allotment,Aman who applied for 1,050 shares failed to pay the first call and his shares were forfeited after first call.

The second and final call was not yet made. Of the shares forfeited 1,000 shares were reissued as fully paid for Rs.80 per share which included whole of Rohan’s shares.

Question: Excess application money utilized towards allotment is ———-

Page 60 of 152

(A) Rs.4,00,000

(B) Rs.2,00,000

(C) Rs.1,50,000

(D) Rs.1,00,000

Answer:

B

Question: Application money transferred to Share Capital A/c is——

(A)Rs.9,00,000

(B)Rs.12,00,000

(C)Rs.16,00,000

(D)Rs.3,00,000

Answer:

A

Question: The amount transferred to Capital Reserve on reissue of is ——–

(A) Rs.24000

(B) Rs.22,000

(C) Rs.10,000

(D) Rs.34000

Answer:

D

Question: The amount debited to securities premium reserve account on forfeiture of Rohan’s shares is ——–

(A) Rs.12,000

(B) Rs.,7,000

(C) Rs.6,000

(D) Rs.3,00,000

Answer:

C

Y Ltd. invited applications tor issuing 15.000 equity shares of Rs. 10 each on which Rs.6 per share were called up which were payable as follows:

On application Rs. 2 per shale

On allotment Rs.1 per share

On first call Rs. 3 per share

The Issue was fully subscribed and the amount was received as follows:

On 10,000 shares Rs. 6 per share

On 3,000 shares Rs. 3 per share

On 2,000 shares Rs. 2 per share

The directors forfeited those shares on which less than Rs.6 per share received The forfeited shares were reissued at Rs.9 per share as Rs.6 per share paid up.

Question: Amount Received on first call is ——

(A) Rs.45,000

(B) Rs.30,000

(C)Rs.39,000

(D) Rs.36,000

Answer:

C

Question: Amount received on allotment is —-

(A) Rs.12,000

(B) Rs.10,000

(C) Rs. 15000

(D)Rs.13,000

Answer:

D

Question: Amount credited to capital reserve on reissue of shares is —–

(A) Rs.7,000

(B) Rs.13,000

(C) Rs.15,000

(D) Rs.6,000

Answer:

B

Question: Number of shares forfeited is —–

(A) 2000

(B) 3000

(C) 5000

(D) 10000

Answer:

C

Khyati Ltd. issued a prospectus inviting applications for 80,000 equity shares of Rs.10 each payable as follows:Rs.2 on application

Rs.3 on allotment

Rs.2 on first call

Rs.3 on final call

Applications were received for 1,20,000 equity shares. It was decided to adjust the excess amount received on account of over subscription till allotment only.

Hence allotment was made as under:

(i) To applicants for 20,000 shares – in full

(ii) To applicants for 40,000 shares – 10,000 shares

(iii) To applicants for 60,000 shares – 50,000 shares

Allotment was made and all shareholders except Tammana, who had applied for 2,400 shares out of the group (iii), could not pay allotment money. Her shares were forfeited immediately, after allotment. Another shareholder Chaya , who was allotted 500 shares out of group (ii), failed to pay first call. 50% of Tamanna’s shares were reissued to Satnaam as Rs. 7 paid up for payment of Rs. 9 per share.

Question: What is the amount unpaid on allotment by Tammana?

(A)Rs.7,200

(B)Rs.6,000

(C) Rs.5,200

(D)Rs.800

Answer:

C

Question: What is the amount of application money refunded?

(A)Rs.30,000

(B) Rs.80,000

(C) Rs.60,000

(D) Nil

Answer:

A

Question: What is the amount due on first call debited to Share first Call A/c?

(A)Rs.1,60,000

(B)Rs.1,56,000

(C)Rs.1,55,200

(D)Rs.1,55,000

Answer:

B

Question: Which account is to be debited on forfeiture of Tammana’s Shares?

(A)Bank A/c

(B)Calls in Arrear

(C) Share capital A/c

(D)Share Forfeiture A/c

Answer:

C

X Ltd. invited applications for issuing 50,000 equity shares of Rs. 10 each. The amount was payable as follows:

On Application: Rs. 2 per share

On Allotment: Rs. 2 per share

On First Call: Rs. 3 per share

On Second and Final Call: Balance amount

Applications for 70,000 shares were received Applications for 10,000 shares were rejected and the application money was refunded Shares were allotted to the remaining applicants on a pro-rata basis and excess money received with applications was transferred towards sums due on allotment and calls, if any.

Gopal, who applied for 600 shares, paid his entire share money with application. Ghosh, who had applied for 6,000 shares, failed to pay the allotment money and his shares were immediately forfeited. These forfeited shares were re-issued to Sultan for Rs. 20,000; Rs. 4 per share paid up. The first call money and the second and final call money was called and duly received.

Question: What is the amount of application money transferred to Calls in Advance (from Gopal)?

(A) Rs.4,800

(B) Rs.4,000

(C) Rs.800

(D) Rs.6000

Answer:

B

Question: Which account is debited when application money refunded?

(A) Bank A/c

(B) Share Capital A/c

(C) Share allotment A/c

(D) Share application A/c

Answer:

D

Question: After reissue of shares , for transfer of balance in Share forfeiture A/c —

(A) Bank a/c is Credited

(B) Share forfeiture is credited

(C) Capital Reserve A/c is credited

(D)Capital Reserve A/c is debited

Answer:

C

Question: For calls in advance adjusted —-

(A) Calls in arrear A/c is debited

(B)Call in advance is debited

(C)Calls in advance A/c is Credited

(D)Bank a/c is debited

Answer:

B

Megha Ltd.invited applications for issuing 90,000 equity shares of Rs. 100 each at a premium of Rs. 60 per share. The amount was payable as follows:

On Application – Rs. 30 per share (including premium Rs. 10)

On Allotment – Rs. 70 per share (including premium Rs. 50)

On First and Final Call – Balance amount

Applications for 1,00,000 shares were received Shares were allotted on pro-rata basis to all the applicants. Excess money received with application was adjusted towards sums due on allotment. Sudha, a shareholder holding 4,500 shares, failed to pay the allotment money. Her shares were forfeited immediately after allotment. Afterwards the first and final call was made. Rajat, a holder of 3,600 shares, failed to pay the first and final call. His shares were also forfeited All the forfeited shares were re-issued for Rs. 90 per share fully paid up.

Question: Amount of application money transferred to securities premium reserve is —

(A) Rs.9,00,000

(B) Rs.10,00,000

(C) Rs.54,00000

(D) Rs.60,00,000

Answer:

A

Question: Amount of application money transferred to share allotment is —

(A) Rs.9,00,000

(B) Rs.30,00,000

(C) Rs.3,00,000

(D) Rs.2,00,000

Answer:

C

Question: Amount due on first and final call is —-

(A) Rs.54,00,000

(B) Rs.60,00,000

(C) Rs.51,30,000

(D) Rs.49,14,000

Answer:

C

Question: Amount debited to securities premium reserve debited on forfeiture of Sudha’s shares is —

(A)Rs.2,70,000

(B) Rs.2,25,000

(C) Rs.45,000

(D) Rs.3,00,000

Answer:

B

Sunstar Ltd. invited applications for issuing 2,00,000 equity shares of Rs. 50 each. The amount was payable as follows :

On Application – Rs. 15 per share

On Allotment – Rs. 10 per share

On First and Final Call – Rs. 25 per share

Applications for 3,00,000 shares were received) Allotment was made to the applicants as follows :

Category No. of Shares Applied No. of Shares Allotted

I 2,00,000 1,50,000

II 1,00,000 50,000

Excess money received with applications was adjusted towards sums due on allotment and calls. Namita, a shareholder of Category I, holding 3,000 shares failed to pay the allotment money. Her shares were forfeited immediately after allotment. Manav, a shareholder of Category II, who had applied for 1,000 shares failed to pay the first and final call. His shares were also forfeited All the forfeited shares were reissued at Rs. 60 per share fully paid up.

Question: Amount unpaid by Namita on allotment is —-

(A) Rs.3,000

(B) Rs.15,000

(C) Rs.30,000

(D)Rs.60,000

Answer:

B

Question: Excess application money adjusted towards allotment is

(A) Rs.5,00,000

(B) Rs.7,50,000

(C) Rs.12,50,000

(D) Rs.15,00,000

Answer:

C

Question: No of shares reissued is —-

(A)3000

(B)1000

(C)4000

(D)3500

Answer:

D

Question: Forfeited Shares were reissued at

(A) par

(B) discount

(C) premium

(D) loss

Answer:

C