Please refer to Forms of Business Organisation Class 11 Business Studies Important Questions with solutions provided below. These questions and answers have been provided for Class 11 Business Studies based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these problem solutions as it will help them to gain more marks in examinations. We have provided Important Questions for Class 11 Business Studies for all chapters in your book. These Board exam questions have been designed by expert teachers of Standard 11.

Class 11 Business Studies Important Questions Forms of Business Organisation

Very Short Answer Type Questions

Question. Who elects B.O.D of Joint Stock Company?

Answer : The Board of Director of Joint Stock Company is elected by shareholders

Question. Where a business act as an artificial person what act as an official signature

Answer : The common seal with the name of the company engraved on it, is used as a substitute of its signature

Question. Enumerate the two conditions necessary for formation of Joint Hindu Family business

Answer :

1. Atleast two member in the family

2. Ancestral property to be inherited by them

Question. Explain the meaning of unlimited liability.

Answer : Unlimited liability refers to Indefinite extent of liability to pay a firm’s debts or obligations, extending beyond the investments of the firm’s owner(s), partners, or shareholder(s) to their personal assets. This extent of liability is assumed in an unlimited liability company such as a sole-proprietorship or a general partnership.

Question. Name two types of business in which sole proprietorship is very suitable.

Answer : Tutorial classes, Small Cell phone repair shop is very suitable examples of business for sole proprietorship

Question. Name the person who manages a Joint Hindu Family business

Answer : Karta is the person who manages a Joint Hindu family business

Short Answer type Questions :

Question. Yasin started a catering business 5 years back. Due to perpetual losses in business he has now decided to shut down his business. He owes ₹ 5 lakhs to a supplier from whom he had been procuring goods on credit. His business funds are insufficient to repay the debt. Can supplier recover his dues from the personal assets of Yasin since the business assets are insufficient. Why or why not? Give a suitable reason in support of your answer?

Answer. Yes, the supplier can surely recover his dues from the personal assets of Yasin since the business assets are insufficient. This is due to the fact that the liability of a sole proprietor is unlimited. In the eyes of law, the sole proprietor and his business are same.

Question. Name any three forms of business organisation which do not require legal formalities and registration.

Answer. (a) Sole proprietorship. (b) Joint Hindu Family Business. (c) Partnership.

Question. Mohit was born and brought up in Punjabi Bagh, Delhi. He wanted to start a garments manufacturing unit in Rohini. His father suggested to go for sole-proprietorship. But he want to start a company. But his father did not approve of his idea, as according to him one person cannot open a company. But Mohit insisted that he want to form a company by raising funds from public.

(a) Can Mohit form a company?

(b) What kind of a company can be formed by him?

(c) Who are eligible to incorporate this kind of company?

(d) What are the restrictions on the business carried on by these companies?

Answer. (a) Yes.

(b) ONE PERSON COMPANY (OPC).

(c) A natural person, who is an Indian Citizen and resident of India can incorporate OPC.

(d) An OPC cannot carry out Non-Banking Financial Investments activities.

Question. Sanya is a sole proprietor running a boutique in West Delhi. She has been offered a contract by a trader for manufacturing fashionable garments. She immediately took the decision and accepted the offer. She takes maximum efforts to make her business successful as she is the sole recipient of all profits.

(a) I dentify the two merits of sole proprietorship form of business organisation highlighted above by quoting the lines.

(b) Also explain three other merits of sole proprietorship.

Answer. (a) (i) Quick Decision Making ‘She immediately took the decision and accepted the offer.’

(ii) Direct Incentive ‘She takes maximum efforts to make her business successful as she is the sole

Question. Identify the type of partner highlighted in the following statements:

(a) This partner takes active part in carrying out business of the firm.

(b) His connection with the firm is not disclosed to the general public.

(c) He allows the use of his goodwill to benefit the firm and can be represented as a partner.

(d) He gives an impression of his being partner to others by his words or conduct.

(e) This partner does not take active part in the day-to-day activities of the business.

Answer. (a) Active partner.

(b) Secret partner.

(c) Nominal partner.

(d) Partner by estoppel.

(e) Sleeping partner.

Long Answer Type Questions

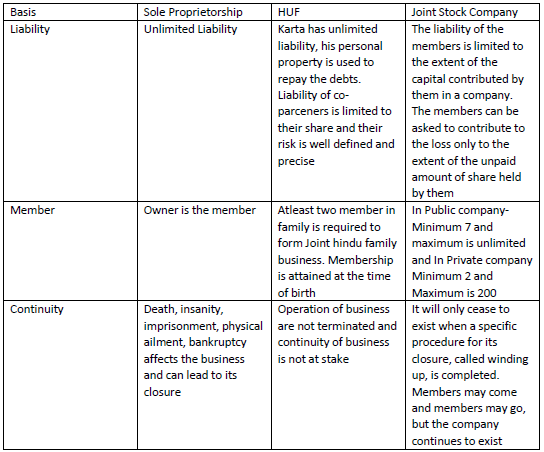

Question. Explain the forms: sole proprietorship, H.U.F & Joint stock company on the basis of following points:

Liability, members & Continuity

Answer :

Question. What is meant by partner by estoppel

OR

Mr. Singh is in ‘lighting’ business for the post 15 years. To help his friend, Mr Yadav, a beginner he projected himself as a partner before Mohd. Abdul, a whole sale dealer of fancy lights. Mohd. Abdul gave Mr. Yadav the stock without asking for payment and gave him credit limit of one month.

Will Mr. Singh be liable to Md. Abdul if Mr. Yadav does not pay him on time ?

Classify Mr. Singh’s role here along with an explanation

Answer : Partner by Estoppel refers to Legally binding partnership that may arise where, in fact, no formal

partnership agreement is in effect. A person who by conduct or words represents, or allows him/herself

to be represented, as a partner in a firm is liable for the credit or loans obtained by firm on the basis of

such representation. Also called presumption of partnership.

The partner does not contribute to capital nor does he participate in management but his liability is

unlimited

Question. Write a short note on producer co-operative society

Answer : Producer’s Cooperative Societies is set up to protect the interest of small producer. The members comprise of producers desirous of procuring inputs for production of goods to meet the demands of consumers. Profits are distributed on the basis of their contributions to the total pool of goods produced or sold by the society.

Question. Shiv, Anandi & John were partners John died in a car accident Both Shiv & Anandi decided to admit his son Ryan who was 16 years old as partner. Can they do so? Justify.

Answer : Yes they can admit Ryan as partner to benefits of partnership firm with mutual consent of partners.

A minor is a person who has not attained the age of 18 years. Since a minor is not capable of enlarging into a valid agreement. He cannot become partner of a firm. However a minor can be admitted to the benefits of an existing partnership firm with the mutual consent of all other partners. He cannot be asked to bear the losses. His liability will be limited to the extent of the capital contributed by him. He will not be eligible to take an active part in the management of the firm.

Question. Akriti, Sonam & Supreeti were friends who started a partnership business. They did not get their firm registered as it was optional. Soon, Sonam & Supreeti started having conflicts. Sonam wanted to approach a lawyer. If you were a lawyer than how would you guide her ?

OR

Mangal, Sazia & Suqhbeer Singh wish to start a business in partnership. They want to make a

partnership deed, Suggest what aspects of the deed should be included in it ?

Answer : Partnership refers to the relation between persons who have agreed to share the profit of the business carried on by all or any one of them acting for all. Although registration of firm is optional, in order to avoid conflicts between partners partnership deed can be prepared.

The written agreement which specifies the terms and conditions that govern the partnership is called

the partnership deed.

The partnership deed generally includes the following aspect:

• Name of firm

• Nature of business and location of business

• Duration of business

• Investment made by each partner

• Distribution of profits and losses

• Duties and obligations of the partners

• Salaries and withdrawals of the partners

• Terms governing admission, retirement and expulsion of a partner

• Interest on capital and interest on drawings

• Procedure for dissolution of the firm

• Preparation of accounts and their auditing

• Method of solving disputes

Question. Which form of business is suitable for following types of business and why ?

(a) Beauty Parlour

(b) Coaching Centre for science students

(c) Hotel

(d) Shopping mall

(e) Restaurant

(f) Small repair business

Answer :

(a) Beauty Parlour- Sole Proprietorship.

Simple and inexpensive to create and operate. Owner reports profit or loss on his or her personal tax

return

(b) Coaching Centre for science students- Partnership.

Simple and inexpensive to create and operate Partners report their share of profit or loss on their

personal tax returns

(c) Hotel-Joint Stock Companies.

The main feature of LLCs and corporations that attracts small businesses is the limit they provide on

their owners’ personal liability for business debts and court judgments against the business. Another

factor might be income taxes: You can set up an LLC or a corporation in a way that lets you enjoy more

favorable tax rates. In addition, an LLC or corporation may be able to provide a range of fringe benefits

to employees (including the owners) and deduct the cost as a business expense.

(d) Shopping mall-Joint Stock Companies.

Owners have limited personal liability for business debts

(e) Restaurant-Sole Proprietorship.

Simple and inexpensive to create and operate. Owner reports profit or loss on his or her personal tax return

(f) Small repair business- Sole Proprietorship.

Simple and inexpensive to create and operate. Owner reports profit or loss on his or her personal tax return.

Question. In what type of business, individuals associate voluntarily for profit, having capital dividend into transferable shares, the ownership of which is the condition of membership? Explain with features

Answer : A Joint stock company is a Voluntarily association of persons formed for carrying out business activities for profit and has a legal status independent of its members, having capital divided into transferable shares. A company can be described as an artificial person having a separate legal entity, perpetual succession and a common seal The shareholders are the owners of the company while the Board of Directors is the chief managing body elected by the shareholders The capital of the company is divided into smaller parts called ‘shares’ which can be transferred freely from one shareholder to another person (except in a private company).

Features of Joint Stock Company are as follows:

• A company is an artificial person. It is creation of law and exists independent of its members

• A company acquires a seperate legal identity. The law does not recognise the business and owners to be one and the same.

• The formation of a company is a time consuming, expensive and complicated process.

Incorporation of companies is compulsory

• It will only cease to exist when a specific procedure for its closure, called winding up, is completed. Members may come and members may go, but the company continues to exist.

• The management and control of the affairs of the company is undertaken by the Board of Directors, which appoints the top management for running of business

• A company may or may not have a common seal.

• The risk of losses in a company is borne by all the share holders.

Question. Who have equal ownership right over the property of an ancestor? Highlight with its essential characteristics

Answer : Joint Hindu Family is a form of organisation wherein the business is owned and carried by the members of the Hindu Undivided Family (HUF). The basis of membership in the business is birth in a particular family and three successive generations can be members. The business is controlled by the head of the family who is the eldest member and is called karta.

Members of Joint Hindu Family Business have equal ownership right over the property of an ancestor and they are known as co-parceners.

Characteristics of Joint Hindu Family Business are as follows:

• Business does not require any agreement as membership is by birth.

• There should be at least two members in the family and ancestral property to be inherited by them

• The liability of all members except the karta is limited to their share of co-parcenery property of the business. The karta has unlimited liability.

• Karta controls the family business and his decision are binding to all

• Business continues even after the death of karta, next eldest becomes karta

• Minors are also member of the business

Question. Dhirubhai Chaurasiya operates a textile business. His family is joint and has a lot of ancestoral property. All the 15 family members are a part of this business. He is the eldest male member in the family so he heads the business. He is liable to all the creditors of the business as he is the decision maker. Dhirubhai’s grandson has just born a few days ago and he is also the member of the business.

(a) Which form of business is being undertaken by Dhirubhai Chaurasiya ?

(b) Identify the features of this form of business based on the information given.

(c) Textile business is part of which type of industry according to you ?

Answer :

a) Joint Hindu Family form of Business is undertaken by Dhirubhai Chaurasiya

b) Characteristics of Joint Hindu Family Business based on above information are as follows:

• Business does not require any agreement as membership is by birth as Dhirubhair grandson who is just born is member by birth

• There should be at least two members in the family and ancestral property to be inherited by them as 15 family member are part of business and have lot of ancestral property

• The liability of all members except the karta is limited to their share of co-parcenery property of the business. The karta has unlimited liability as he is the decision maker he is liable to all creditors of business

• Karta controls the family business and his decision are binding to all as he is the eldest male member and he heads the business

• Minors are also member of the business as his grandson who is just born is member of business.

Question. Ravi, Pradeep, Satyender and Dharmender are partners in a partnership firm. Ravi and Satyender take active part in the operation of business whereas Pradeep has contributed in Capital but do not take part in day to day activities of the business. Dharmender is a nominal partner. All four make partnership for a specified time period and also make written agreement to govern the partnership but they does not get the firm registered.

a. What is meant by nominal partner?

b. Which type of partnership is there between the partners in above?

c. What is written agreement between the partners called?

d. What type of partners Pradeep and Ravi are?

e. Give two merits of getting firm registered.

Answer :

a) Nominal Partner is a Partner who allows the use of his/her name by a firm. He does not contribute to capital nor he participate in the management. He generally does not share profit/losses and have unlimited liability

b) General Partnership is there between the partners. In general partnership the liability of partners is unlimited and joint. The partners enjoy the right to participate in the management of the firm and their acts are binding on each other as well as on the firm

c) Written agreement between the partners is called partnership deed. The written agreement which specifies the terms and conditions that govern the partnership is called the partnership deed.

d) Ravi is active partner. Active partner are those Partners who take actual part in carrying out business of the firm on behalf of other partners. They contribute capital and takes part in the management. He shares the profit and loss of the partnership. His liability is unlimited.

Pradeep is sleeping partner. Sleeping partner are those Partners who do not take part in day to day activities of business. They contribute capital and does not takes part in the management. He shares the profit and loss of the partnership. His liability is unlimited.

e) Two merits of getting firm registered are as follows:

• A partner of an unregistered firm cannot file a suit against the firm or other partners

• The firm cannot file a suit against third parties