Sources of Business Finance Class 11 Notes are accessible in PDF format to assist students with reiterating the recently studied lessons before CBSE Board Exam. These Notes on Sources of Business finance class 11 pdf are prepared by our expert teachers who have long periods of teaching experience.

Class 11 Sources of Business Finance Notes PDF is one of the most favored revision notes for students thinking that they are powerful to the point of getting higher marks in an Exam.

Sources of Business Finance Class 11 Notes is assimilated with appropriate diagrams and compacted in such a way to make certain every detail is covered. You can easily download the Class 11 Sources of Business Finance Notes to improve your preparation before taking the board exam.

Please see Sources of Business Finance Class 11 Business Studies Revision Notes provided below. These revision notes have been prepared as per the latest syllabus and books for Class 11 Business Studies issues by CBSE, NCERT, and KVS. Students should revise these notes for Chapter 8 Sources of Business Finance daily and also prior to examinations for understanding all topics and to get better marks in exams. We have provided Class 11 Business Studies Notes for all chapters on our website.

Chapter 8 Sources of Business Finance Class 11 Business Studies Revision Notes

Life is a unique, complex organization of molecules, expressing through chemical reactions which lead to growth, development, responsiveness, adaptation & reproduction.

SOURCES OF BUSINESS FINANCE

CONCEPT OF BUSINESS FINANCE

The term finance means money or fund. The requirements of funds by business to carry out its various activities is called business finance.

Finance is needed at every stage in the life of a business.

A business can not function unless adequate funds are made available to it.

NEED OF BUSINESS FINANCE

1. Fixed Capital Requirement :- In order to start a business funds. are needed m to purchase fixed assets like land and building,plant and machinery.

2. Working Capital Requirement :- A business needs funds for its day to day operation. This is known as working Capital requirements. Working capital is required for purchase of raw materials, to pay salaries, wages, rent and taxes.

3. Diversification :- A company needs more funds to diversify its operation to become a multi-product company e.g. ITC.

4. Technology up gradation :- Finance is needed to adopt modern technology for example uses of computers in business.

5. Growth and expansion :- Higher growth of a business enterprise requires higher investment in fixed assets. So finance is needed for growth and expansion. State two factors that affect the ‘Fixed capital’ requirements of a company.

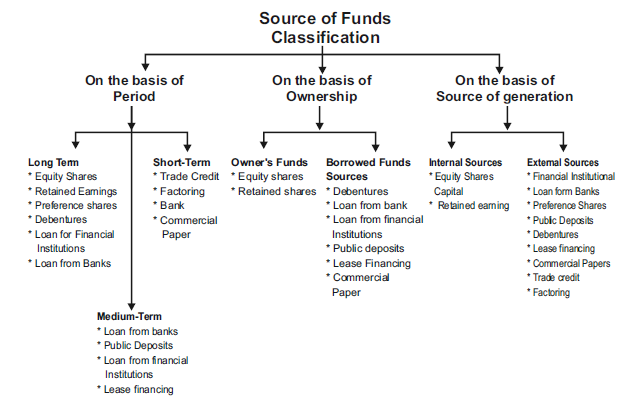

CLASSIFICATION OF SOURCE OF FUNDS

METHODS OF RAISING FINANCE :-

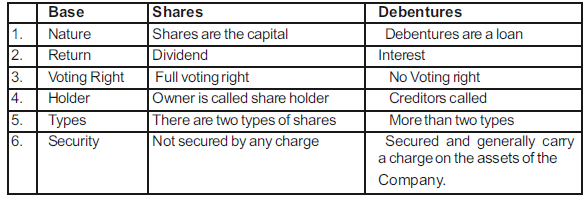

Issue of Share :- The capital obtained by issue of shares is known as share capital. The capital of a company is divided into small units called share. If a company issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (11) preference share.

(a) Equity Share :- Equity shares represent the ownership of a company. They have right to vote and right to participate in the management because.

ADVANTAGES/MERITS :-

1. Permanent Capital :- Equity share capital is important source of finance for a long term.

2. No charge on assets :- For raising funds by issue of equity shares a company does not need to mortgage its assets.

3. Higher returns :- Equity share holder get higher returns in the years of high profits.

4. Control : They have right to vote and right to participate in the management.

5. No burden on company :- Payment of equity dividend is not compulsory

LIMITATIONS/DEMERITS

1. Risk :- Equity shareholder bear higher risk because payment of equity dividend is not compulsory.

2. Higher Cost :- Cost of equity shares is greater than the cost of preference share.

3. Delays :- Issue of Equity shares is time consuming.

4. Issue depends on Share Market Conditions :- Equity Shareholders are the primary risk bearer therefore the demand of equity shares is more in the boom time.

B. Preference Share – Preference shares are considered safer in investment. (as compare to equity shares) They receive dividend at a fixed rate. Preference shareholder are like creditors. They have no voting right.

Types of preference shares. :-

1. Cumulative preference shares.

2. Non cumulative preference shares.

3. Participating preference shares.

4. Non participating preference shares.

5. Convertible preference shares

6. Non Convertible preference shares.

MERITS OF PREFERENCE SHARES :-

1. Investment is safe :- Preference shareholders investment is safe. They have preferential right to claim dividend and capital.

2. No Charge on assets :- The company does not need to mortgage its assets for issue of preference shares.

3. Control :- It does not affect the control of equity share holders because they have no voting right.

4. Fixed dividend :- They get fixed dividend. So, they are useful for those investor who want fixed rate of return.

LIMITATIONS /DEMERITS:-

1. Costly sources of funds :- Rate of preference dividend is greater than rate of interest on debenture, for a company it is costly source of funds than Debentures.

2. No tax saving :- Preference dividend is not deductible from profit for income tax. Therefore there is no tax saving.

3. Not suitable for risk takers :- Preference shares are not suitable for those who are willing to take risk for higher return.

Difference Between Equity Shares And Preference Shares

Debentures :- Debentures are the important debt sources of finance for raising long term finance. Debenture holders get fixed rate of interest on Debentures interest is paid after every six months or one year. They are like Creditors of a company.

Type of Debentures:-

1. Secured Debentures

2. Unsecured Debentures

3. Convertible Debentures.

4. Non Convertible Debentures

5. Redeemable Debentures.

6. Registered Debentures.

MERITS OF DEBENTURES :-

1. Investment is Safe :- Debentures are preferred by those investor who do not want to take risk and interested in fixed income.

2. Control :- Debenture holder do not have voting right.

3. Less Costly :- Debentures are less costly as compared to cost of preference shares.

4. Tax Saving :- Interest on Debentures is a tax deduct able expense. Therefore, there is a tax saving.

LIMITATION OF DEBENTURES :-

1. Fixed Obligation :- There is a greater risk when there is no earning because interest on debentures has to be paid if the company suffers losses.

2. Charge on assets :- The company has to mortgage its assets to issue secured Debentures.

3. Reduction in Credibility :- With the new issue of debentures, the company’s capability to further borrow funds reduces.

DIFFERENCE BETWEEN SHARES AND DEBENTURES

Q. Tax benefit is available only in case of payment of interest of debentures and not on payment of dividends of shares ? Why ?

Q. State one reason why a company earning high profits may choose debentures over equity shares to raise funds.

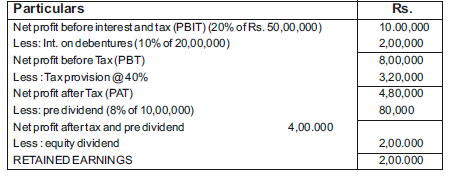

Retained Earning :- A portion of company’s net profit after tax and dividend, Which is not distributed but are retained for reinvestment purpose, is called retained earning. This is also called sources of selffinancing.

For example :-

X Ltd. has total capital of Rs. 50,00,000 which consists of 10% Debt of Rs. 20,00,000, 8°/o preference share capital Rs. 10,00,000, and equity share capital Rs. 20,00,000. Tax rate is 40%, company’s return on total capital is 20%. It was decided to provide 10% div. on equity shares.

MERITS

1. No costs :- No costs in the form of interest. dividend, advertisement arid prospects, to be incurred b’ the company to get it.

2. No charges on assets :- The company does not have to mortgage its assets.

3. Growth and expansion :- Growth and expansion of business is possible by reinvesting the retained profits

4. Goodwill :- The market price of the company share will increase.

DEMERITS

1. Uncertain Source :- It is uncertain source of fund because it is available only when profits are high.

2. Dissatisfaction among shareholder :- Retained profits cause dissatisfaction among the shareholder because they get low dividend.

Q1. Abhimanyu Ltd. is manufacturing cotton shirts for men. It is planning to expand its business by opening one more unit in another city. It has consistently earning good profits so these are sufficient reserving. State the most appropriate source of finance for the company. Also explain 2 merits & 2 demerits of such source of finance.

Q2. Name the part of owner’s fund which is contributed by profits but not distributed among partners.

PUBLIC DEPOSITS :-

The deposits that are raised by company direct from the public are known as public deposits. The rate of interest offered on public deposits are higher than the rate of interest on bank deposits. This is regulated by the R.B.I. and can not exceed 25% of share capital and reserves.

MERITS:-

1. No charge on assets :- The company does not have to mortgage its assets.

2. Tax Saving :- Interest paid on public deposits is tax deductable hence there is tax saving.

3. Simple procedure :- The procedure for obtaining public deposits is simpler than share and Debenture.

4. Control :- They do not have voting right therefore the control of the company is not diluted.

LIMITATIONS :-

1. For Short Term Finance :- The maturity period is short. The company can not depend on them for long term.

2. Limited fund :- The quantum of public deposit is limited because of legal restrictions 25% of share capital and free reserves.

3. Not Suitable for New Company :- New company generally find difficulty to raise funds through public deposits.

Q1. In India, What is the maximum maturity periods of public deposits?

Q2. ‘Raising funds through public deposits frequently by a company lowers its image in the public. How ?

Q3. In case of a company raising funds in a particular form, it is required to follow the provision set by RBI (Reserve Bank of India). Name the form of Fund.

Trade Credit

Trade Credit is the credit extended by one trader to another for the purchase of goods and service. Trade Credit facilities the purchase of supplies without immediate payment.

Merits

1. Convenient :- It is a convenient and continous source of funds.

2. Purchase without immediate payment :- Trade credit facilities the purchase of goods and service without immediate payment.

3. Readily Available :- Trade Credit may be readily available in case the credit worthiness of the customers is known to the seller.

Demerits

1. More Risk :- Availability of easy and flexible trade credit facilities may induce a firm to indulge in over trading which may add to the risks of the firm.

2. Limited Funds :- Only limited amount of funds can be generated through trade credit.

3. Costly Source :- It is generally a costly source of funds as compared to most other sources of raising money.

Q. State the most important factor that helps in receiving trade credit.

COMMERCIAL BANKS:-

Commercial Banks give loan and advances to business in the form of cash credit, overdraft loans and discounting of Bill. Rate of interest on loan is fixed.

MERITS

1. Timely financial assistance :- Commercial Bank provide timely financial assistance to business.

2. Secrecy :- Secrecy is maintained about loan taken from a Commercial Banks.

3. Easier source of funds :- This is the easier source of funds as there in no need to issue prospectus for raising funds.

LIMITATIONS/DEMERITS

1. Short or Medium term finance : Funds are not available for a long time.

2. Charge on assets : Required source security of assets before a loan is sanctioned

FINANCIAL INSTITUTION

The state and central government have established many financial institutions to provide finance to companies. They are called development Bank. These are IFCI. ICICI, IDBI, LIC and UTI. etc.

MERITS

1. Long term Finance :- Financial Institution provide long term finance which is not provided by Commercial Bank.

2. Managerial Advice :- They provide financial, managerial and technical advice to business firm.

3. Easy installments :- Loan can be made in easy installments. It does not prove to be much of a burden on business.

Limitations DEMERITS:-

1. More time Consuming :- The procedure for granting loan is time consuming due to rigid criteria and many formalities.

2. Restrictions :- Financial Institution place restrictions on the company’s board of Directors.

INTERNATIONAL SOURCE OF BUSINESS FINANCE

1. Commercial Bank :- Commercial Bank provide foreign currency loan for business all-over the world. Standard chartered Bank is an important organisation for foreign currency loan to the Indian industry.

2. International Agencies and Development Bank :- A number of international agencies and development Bank e.g. IFC, ADB, provide long term loan.

3. INTERNATIONAL CAPITAL MARKET

1. GDR :- When the local currency shares of a company are delivered to the depository bank, which issues depository receipt against shares, these receipt denominated in US dollar are caller GDRs.

Feature of GDR:-

1. GDR can be listed and traded on a stock exchange of any foreign count-% other than America.

2. It is negotiable instrument.

3. A holder of GDR can convert it into the shares.

4. Holder of GDR gets dividends.

5. Holder of GDR does not have voting rights.

6. Many Indian companies such as Reliance, Wipro and ICIC1 have GDR.

2. ADR The depository receipt issued by a company in USA are known ADRs (American Depository Receipts)

Feature of ADR :-

1. It can be issued only to American Citizens.

2. It can be listed and traded is American stock exchange.

3. Indian companies such as Infosys, Reliance issued ADR

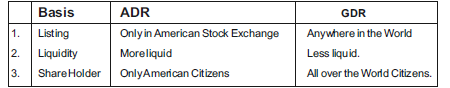

DIFFERENCE BETWEEN ADR & GDR

III. Foreign Currency Convertable Bonds (FCCBs):- The FCCB s are issued in a foreign currency and carry a fixed interest rate.

These are listed and traded in foreign stock exchange and similar to the debenture.

Indian Depository Receipts (IDRS)

IDRs are like GDR or ADR except that the issuer is a foreign company raising funds from Indian Market. IDRS are rupee dominated.

They can be listed on any Indian stock Exchange.

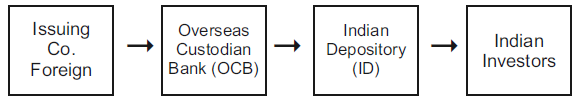

Issue Procedure of IDRS

1. Firstly, a Foreign Co. hands over the shares to OCB (it requires approval from Finance Ministry to act as a custodian)

2. The OCB request ID to issue shares in the form of IDR.

3. The ID converts the issue which are in foreign currency into IDR and into Indian rupee.

4. Lastly the ID issues them to intending investors.

Features of IDRs

1. IDRs are issued by any foreign company

2. The IDRs can be listed on any Indian stock exchange.

3 A single IDR can represent more than one share, such as one IDR , 10 shares.

4. The holders of IDR have no right to vote in the company

5. The IDRS are in rupee denomination

Advantages of IDR

1 It provides an additional investment opportunity to Indian Investors for overseas investment.

2. It satisfies the capital need of foreign companies.

3. It provides listing facility to foreign companies to list on Indian Equity Market.

4. It reduces the risk of Indian Investors who want to take their money abroad.

“The Govt. of India has made provision for issuing a particular type of financial instrument on the pattern of American Depository Receipt.” Name the financial instrument indicated in above statement. Give its two features.

Inter-Corporate Deposits (ICD)

Inter-Corporate Deposits are unsecured short term deposits made by one company with another company. These deposits are essentially brokered deposited, which led the involvement of brokers.The rate of interest on their deposits is higher than that of banks and other markets. The biggest advantage of ICDS is that the transaction is free from legal hassles

Type of ICDS

1. Three Months Deposits :- These deposits are most popular type of ICDS. These deposits are generally considered by borrowers to solve problems of short term capital adequacy. The

annual rate of interest for these deposits is around 12%.

2. Six months Deposits :- It is usually made first class borrowers.The annual rate of interest for these deposits is around 15%

3. Call deposits :- This deposit can be withdrawn by the lender on

a day’s notice. The annual rate of interest on call deposits is around 10%.

Features of ICDS

1. These transactions takes place between two companies.

2. There are short term deposits.

3. These are unsecured deposits.

4. These transactions are generally completed through brokers.

5. These deposits have no organized market.

6. These deposits have no legal formalities.

7. These are risky deposits from the point of view of lenders.

POINTS TO BE REMEMBER

1. Equity shares are the major source of business finance.

2. Debenture, bond and loans are capital having fixed cost.

3. Dividend will be given to preference shareholder at fixed rate of dividend

4. Preference shareholder have no right to participate in management.

5. Trade credit refers to that facility which is extended by one businessman to another.

6. Debenture holders received interest at a fixed rate of interest.

7. ADR is an instrument which is issued to American by a Non US company.

8. GDR is an instrument issued in a foreign country by a company to get US Dollar/foreign capital

9. IDR is an instrument issued by a foreign company to Indians.

10. ICD – Inter Corporate Deposits — are unsecured loans given by a company to another.

Multiple Choice Questions

1. Who is the owner of the company?

(a) Equity share holder

(b) Preference share holder

(c) Debenture holder

(d) Director

2. ICD’s are issued by —

(a) Bank

(b) RBI

(c) company to another

(d) SIDBI

3. ADR’s are issued by

(a) USA

(b) Canada

(c) India

(d) Japan

4. Which of the following is fixed capital?

(a) Equity share

(b) Debenture

(c) Public deposit

(d) Retained earning

5. Which of these is included in Owner’s Fund

(a) Debenture

(b) Loan from SBI

(c) Equity share

(d) Trade credit

6. Trade credit is example of —

(a) Long-term finance

(b) Medium-term finance

(c) Short-term finance

(d) All of the above

7. ADR is issued by a company which is listed in —

(a) India

(b) America

(c) France

(d) Any other company

8. Overdraft facility is provided by —

(a) RBI

(b) Commercial banks

(c) Stock company

(d) Statutory corporation

9. Which share have preferential right in the payment of annual dividend?

(a) Equity share

(b) Preference share

(c) Right share

(d) All of the above

10. Which is internal source of Business Finance?

(a) Loans from commercial banks

(b) Debenture

(c) Retained earning

(d) Equity shares

Answer the following in one or two words

1. The securities which are issued in foreign country are called_________.

2. In which country are IDR issued?

3. Name the source of business finance in which company directly accept deposit from public.

4. What is the main purpose of issuing ADR?

5. Name any two institutions which provide short-term business finance.

6. Who has the right of voting in Annua General Meeting of company?

1 Mark Questions

1. What type of share capital is also called “Risk Capital” ?

2. Name the return given to debenture holders for using their funds?

3. Name the one unique feature of “Retained Earnings” which is not available in any another source of finance ?

4. What is the similarity between ADR and Public Deposits ?

5. Which term is concerned with the acquisition and conservation of capital funds in meeting the financial needs of a business enterprise ?

6. Name the organization which have been set up by the central as well as State governments to provide medium term and long term loans to business sector.

7. Write any one similarity between Equity share capital and Preference share capital.

8. Write the names of 2 Indian companies that have issued G.D.R.s.

9. Preference Share Capital is not suitable for which type of investors ?

10. Name the debt instrument on which investors get income tax relief in specific cases.

3-4 MARKS QUESTIONS

11. Define Share and write any two advantages of it.

12. Write any two differences between share and debentures.

13. Mite any three limitations of equity share capital.

14. Write any three advantages of Retained Earnings.

5-6 MARKS QUESTIONS

15. Write main advantages and disadvantages of Public Deposits

16. What is the difference between ADR and GDR

17. Comment on the following sources of International finance

i) I.D.R. (ii) I.C.D.

18. “Ojas Auto Ltd. ” is a very well known auto company in the industry having more of equity share capital than long term debt in its capital structure. It is willing to expand and establish new unit in the backward region and want to train the tribal women in skill Development to empower them. It has a huge amount of cash reserve of Rs. 1000 crores.

(a) what is the status of capital structure of the above company.

(b) According to you, which source of finance should be used by the company in establishing new units ? Give any two reasons in support of your answer.

[Hints – Sound Capital Structure, Retained Earnings – Optimum Utilization of resources and no dilution of control, Balanced Regional Development]

19. “Avika Ltd.” company, an It giant company registered in India want to top the huge amount of resources for its growth and expansion from U.S.A. for long term needs. It also needs money for a period of less then 3 years to meet its medium cum short term needs. The company is following the practice of educating and giving employment to under privileged youth. 50% of its office electricity is generated through solar power.

(a) Which two sources of finance should be used by the company to meet its requirement. write any two characteristics of each source.

[Hints – ADR and Public Deposits, Employment Generation,Concern for environment]

High Order Thinking Questions (hot)

1. Mohit Ltd. wants to expand its production capacity by modernizing its plant and machinery. This will cost Rs. 4 crores approximately. The company does not have enough reserves to

support expansion plans. Suggest any two sources of finance for the company.

2. As a source of finance, is retained earing a better option than other source? Give one reason to support your answer.

3. Due to festive season , crescent Ltd. decided to expand the business activities by increasing stock of an estimated cost of Rs. 30 lakh. As the finance manager of the company, advise the directors about the 3 sources of finance for this purpose.

4. Rohan has Rs. 1 lakh for investment. Suggest types of securities he should opt. for.

5. Now-a-days, more and more companies are issuing debentures for raising long term debt capital. Give 4 reason why is it becoming popular.

6. You are finance manager of ‘Satya Ltd.’. You have suggested the directors to opt. for long term loan from a financial institution to raise finance needed for company’s expansion. Explain reason to support your answer.

7. Mr. Arun has retired from his Govt. Job. He wants a part of his savings to invest in some company. He want a fixed and regular income without any risks.

i) Name the type of shares in which he should invest.

ii) State 2 merits & 2-demerits of the type of shares suggested above.

8. These type of shares enjoy preferred rights in dividends. Identify the type of shares. Also explain 2-merits & 2 demerits.

9. These type of shares do not enjoy any preferred rights but they are real masters of the company. Identify the type of shares. Also explain 2 merits & 2 demerits of the same.

10. ‘Rudra Limited’ is a successful company dealing in shoe making.Though it has enough reserved yet the directors of the company opted for debentures as a source of finance. Is the decision wise? In your opinion which source the company should opt. for. Give reasons to support your answer.

11. Mr. Manav Sharma is the finance manager of ‘Setu Limited’ company needs Rs. 50 crores. To arrange the capital needed Mr. Sharma has two option. Issue of equality shares or debentures. After consideration of all facts, he decided in favour of issuing debentures. He presented his decision before the CEO who asked why he had opted for debentures Mr. Sharma replied that debentures are fixed charge funds and do not participate in profits of the company.

State more facts that Mr. Sharma must have presented before the CEO about the debentures and equity shares.

12. “Mahindre and Manhindra’ was the first company in India to issue convert able debentures in 1990. Now many more companies have the approval to issue convert able debentures to raise long term debt capital. State & explain the reason of issuing such debentures.

13. Zen Ltd. planning to organize a country wide ‘Sale of its products during festival season. The co. has to build stock of its inventories to be able to meet the increased demand.

a) Name the type of capital co. must have to meet production demands. (Working capital)

b) Advise the sources that the co. may consider to raise required funds. (Trade Cr. , Cash Cr. (O/D).

14. Aryan is running a Travel Agency. The nature of business does not require too many fixed assets. However, he is planning to open another office in Dubai and to meet the financial needs he has applied for a long term loan from a bank. Do you think he will be able to get long term loan from bank ? Give reason.

15. Tania received 1,00,000 from her parents as a gift. She is planning to invest entire amount but wants her money to be safe and secure. Advise her about various options where she can invest her money.

16. The Director of Asia Ltd. are planning to improve its productivity by replacing their plant and machinery by installing new plant and machinery with latest technology at a cost of $5 crores. They can raise funds through issue of shares but is not confident of raising all the money from shares. Suggest the ways of raising finance for the company.

17. Tara Ltd. decided to raise funds through issue of equity shares as the board of Directors know that a company has to pay dividend to equity shareholders only when it earns profits. Board of Directors decided that they record losses for the first 3 years so that they don’t have to pay any dividend to the shareholders.

(a) Are the Boards of Directors right in thinking ?

18. Mr. Pardeep owns a business of toys. At present he sells his product in North and West India, but now planning to sell his products in South India also. For this he applied to the bank for enhancement of his overdraft limit from 50 Lakhs to 75 Lakhs.

Bank manager suggested him to take ‘Term Loan” of $25 Lakh instead of increasing overdraft limit. Do you think he should consider Term Loan instead of overdraft limit ? Give reasons.

19. A foreign company wants to collect money from the capital market of India. The financial manager of the company. Mr. Trump wants to issue such a financial instrument, as instead of being in dollars, shall be denominated in rupees, as it can be listed in any Indian stock Exchange thereafter.

a) Identify the Financial Instrument indicated in above situation.

b) Explain the procedure of issuing this Financial instrument.

At Assignmentbag, we intend to give information to the students in an imaginative way. It is the explanation that we are reliably attempting to carry out more new er methods for learning through our facility.

Our teachers are specialists in their specific subjects, and with their long period of teacher experience, they have customized these revision notes with care. We give the most standard Sources of Business Finance Class 11 Notes PDF to help students to make their preparation better before taking the board exam. The use of basic language and plain portrayal of information permits students to review the detail quicker.