Please refer to the Financial Markets Revision Notes given below. These revision notes have been designed as per the latest NCERT, CBSE and KVS books issued for the current academic year. Students will be able to understand the entire chapter in your class 12th Business Studies book. We have provided chapter wise Notes for Class 12 Business Studies as per the latest examination pattern.

Revision Notes Chapter 9 Financial Markets

Students of Class 12 Business Studies will be able to revise the entire chapter and also learn all important concepts based on the topic wise notes given below. Our best teachers for Grade 12 have prepared these to help you get better marks in upcoming examinations. These revision notes cover all important topics given in this chapter.

CONCEPT OF FINANCIAL MARKET:

A business is a part of an economic system that consists of two main sectors – households which save funds and business firms which invest these funds. A financial market helps to link the savers and the investors by mobilizing funds between them.

It allocates funds available for investment into their most productive investment opportunity. Households can deposit their surplus funds with banks, who in turn could lend these funds to business firms. Alternately, households can buy the shares and debentures offered by a business using financial markets. The process by which allocation of funds is done is called financial intermediation.

FUNCTIONS OF FINANCIAL MARKET:

1. Mobilisation of Savings and Channeling them into the most Productive Uses: A financial market facilitates the transfer of savings from savers to investors.

2. Facilitating Price Discovery: In the financial market, the households are suppliers of funds and business firms represent the demand. The interaction between them helps to establish a price for the financial asset.

3. Providing Liquidity to Financial Assets: Financial markets facilitate easy purchase and sale of financial assets. In doing so they provide liquidity to financial assets, so that they can be easily converted into cash whenever required.

4. Reducing the Cost of Transactions: Financial markets provide valuable information about securities being traded in the market. It helps to save time, effort and money that both buyers and sellers of a financial asset would have to otherwise spend to try and find each other.

5. Financial markets are classified: on the basis of the maturity of financial instruments traded in them. Instruments with a maturity of less than one year are traded in the money market. Instruments with longer maturity are traded in the capital market.

MONEY MARKET

The money market is a market for short term funds which deals in monetary assets whose period of maturity is upto one year. It is a market where low risk, unsecured and short term debt instruments that are highly liquid are issued and actively traded everyday.

The major participants in the market are the Reserve Bank of India ,Commercial Banks, Non-Banking Finance Companies, State Governments, Large Corporate Houses and Mutual Funds.

MONEY MARKET INSTRUMENTS

1. Treasury Bill: A Treasury bill is basically an instrument of short-term borrowing by the Government of India maturing in less than one year. They are also known as Zero Coupon Bonds issued by the Reserve Bank of India on behalf of the Central Government to meet its short-term requirement of funds. They are issued at a price which is lower than their face value and repaid at par. Treasury bills are available for a minimum amount of Rs 25,000 and in multiples thereof.

2. Commercial Paper: Commercial paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued by large and creditworthy companies to raise short-term funds at lower rates of interest than market rates. It usually has a maturity period of 15 days to one year. It is sold at a discount and redeemed at par. The original purpose of commercial paper was to provide short-terms funds for seasonal and working capital needs. Funds raised through commercial paper are used to meet the floatation costs. This is known as Bridge Financing.

3. Call Money: Call money is short term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Commercial banks have to maintain a minimum cash balance known as cash reserve ratio. Call money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio. The interest rate paid on call money loans is known as the call rate.

4. Certificate of Deposit: Certificates of deposit (CD) are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and development financial institutions. They can be issued to individuals, corporations and companies during periods of tight liquidity when the deposit growth of banks is slow but the demand for credit is high.

5. Commercial Bill: A commercial bill is a bill of exchange used to finance the working capital requirements of business firms. When goods are sold on credit, the buyer becomes liable to make payment on a specific date in future. The seller could wait till the specified date or make use of a bill of exchange. The seller (drawer) of the goods draws the bill and the buyer (drawee) accepts it. On being accepted, the bill becomes a marketable instrument and is called a trade bill. These bills can be discounted with a bank if the seller needs funds before the bill matures. When a trade bill is accepted by a commercial bank it is known as a commercial bill.

CAPITAL MARKET

The term capital market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested.

The Capital Market can be divided into two parts:

a. Primary Market

b. Secondary Market

Distinction between Capital Market and Money Market

(i) Participants: The participants in the capital market are financial institutions, banks, corporate entities, foreign investors and ordinary retail investors from members of the public.

Participation in the money market is by and large undertaken by institutional participants such as the RBI, banks, financial institutions and finance companies.

(ii) Instruments: The main instruments traded in the capital market are – equity shares, debentures, bonds, preference shares etc. The main instruments traded in the money market are short term debt instruments such as T-bills, trade bills reports, commercial paper and certificates of deposit.

(iii) Investment Outlay: Capital market securities does not necessarily require a huge financial outlay. In the money market, transactions entail huge sums of money as the instruments are quite expensive.

(iv) Duration: The capital market deals in medium and long term securities such as equity shares and debentures. Money market instruments have a maximum tenure of one year, and may even be issued for a single day.

(v) Liquidity: Capital market securities are considered liquid investments because they are marketable on the stock exchanges. Money market instruments on the other hand, enjoy a

higher degree of liquidity.

(vi) Safety: Capital market instruments are riskier both with respect to returns and principal repayment. But the money market is generally much safer with a minimum risk of default.

(vii) Expected return: The investment in capital markets generally yield a higher return for investors than the money markets.

PRIMARY MARKET : The primary market is also known as the new issues market. It deals with new securities being issued for the first time. The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals. A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits.

Methods of Floatation:

1. Offer through Prospectus: This involves inviting subscription from the public through issue of prospectus. A prospectus makes a direct appeal to investors to raise capital, through an advertisement in newspapers and magazines.

2. Offer for Sale: Under this method securities are not issued directly to the public but are offered for sale through intermediaries like issuing houses or stock brokers

3. Private Placement: Private placement is the allotment of securities by a company to institutional investors and some selected individuals

4. Rights Issue: This is a privilege given to existing shareholders. The shareholders are offered the ‘right’ to buy new shares in proportion to the number of shares they already possess.

5. e-IPOs: A company proposing to issue capital to the public through the on-line system of the stock exchange has to enter into an agreement with the stock exchange. This is called an Initial Public Offer (IPO). SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company.

SECONDARY MARKET:

The secondary market is also known as the stock market or stock exchange. It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities. It also contributes to economic growth by channelising funds towards the most productive investments through the process of disinvestment and reinvestment.

STOCK EXCHANGE: A stock exchange is an institution which provides a platform for buying and selling of existing securities.

According to Securities Contracts (Regulation) Act 1956, stock exchange means any body of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying and selling or dealing in securities.

Functions of a Stock Exchange

1. Providing Liquidity and Marketability to Existing Securities: The basic function of a stock exchange is the creation of a continuous market where securities are bought and sold. This provides both liquidity and easy marketability to already existing securities in the market.

2. Pricing of Securities: Share prices on a stock exchange are determined by the forces of demand and supply. A stock exchange is a mechanism of constant valuation through which the prices of securities are determined. Such a valuation provides important instant information to both buyers and sellers in the market.

3. Safety of Transaction: The membership of a stock exchange is well regulated and its dealings are well defined according to the existing legal framework.

4. Contributes to Economic Growth: A stock exchange is a market in which existing securities are resold or traded. This leads to capital formation and economic growth.

5. Spreading of Equity Cult: The stock exchange can play a vital role in ensuring wider share ownership by regulating new issues, better trading practices and taking effective steps in educating the public about investments.

6. Providing Scope for Speculation: The stock exchange provides sufficient scope within the provisions of law for speculative activity in a restricted and controlled manner.

Trading Procedure on a Stock Exchange:

The Trading procedure involves the following steps:

1. Selection of a broker:

The buying and selling of securities can only be done through SEBI registered brokers who are members of the Stock Exchange. The broker can be an individual, partnership firms or corporate bodies. So the first step is to select a broker who will buy/sell securities on behalf of the investor or speculator.

2. Opening Demat Account with Depository:

Demat (Dematerialized) account refer to an account which an Indian citizen must open with the depository participant (banks or stock brokers) to trade in listed securities in electronic form. Second step in trading procedure is to open a Demat account.

The securities are held in the electronic form by a depository. Depository is an institution or an organization which holds securities (e.g. Shares, Debentures, Bonds, Mutual (Funds, etc.) At present in India there are two depositories: NSDL (National Securities Depository Ltd.) and CDSL (Central Depository Services Ltd.) There is no direct contact between depository and investor. Depository interacts with investors through depository participants only.

Depository participant will maintain securities account balances of investor and intimate investor about the status of their holdings from time to time.

3. Placing the Order:

After opening the Demat Account, the investor can place the order. The order can be placed to the broker either (DP) personally or through phone, email, etc.

ADVERTISEMENTS:

Investor must place the order very clearly specifying the range of price at which securities can be bought or sold. e.g. “Buy 100 equity shares of TATA for not more than Rs 500 per share.”

4.Executing the Order:

As per the Instructions of the investor, the broker executes the order i.e. he buys or sells the securities. Broker prepares a contract note for the order executed. The contract note contains the name and the price of securities, name of parties and brokerage (commission) charged by him. Contract note is signed by the broker.

5. Settlement:

This means actual transfer of securities. This is the last stage in the trading of securities done by the broker on behalf of their clients. There can be two types of settlement.

(a) On the spot settlement:

It means settlement is done immediately and on spot settlement follows. T + 2 rolling settlement. This means any trade taking place on Monday gets settled by Wednesday.

(b) Forward settlement:

It means settlement will take place on some future date. It can be T + 5 or T + 7, etc. All trading in stock exchanges takes place between 9.55 am and 3.30 pm. Monday to Friday

SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI):

The Securities and Exchange Board of India was established by the Government of India on 12 April 1988 as an interim administrative body to promote orderly and healthy growth of securities market and for investor protection.

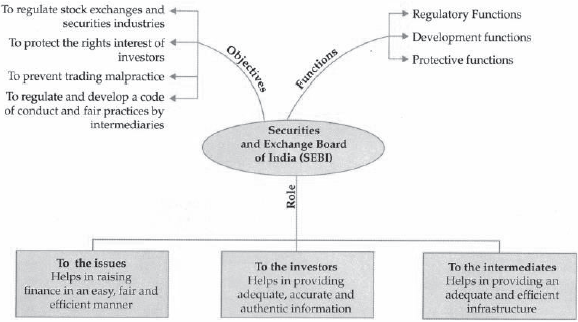

Objectives of SEBI:

The overall objective of SEBI is to protect the interests of investors and to promote the development of, and regulate the securities market.:

1. To regulate stock exchanges and the securities industry to promote their orderly functioning.

2. To protect the rights and interests of investors and to guide and educate them.

3. To prevent trading malpractices.

4. To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc.

Functions of SEBI:

Regulatory Functions

1. Registration of brokers and sub-brokers and other players in the market.

2. Registration of collective investment schemes and Mutual Funds.

3. Regulation of stock brokers, underwriters and merchant bankers

4. Regulation of takeover bids by companies.

5. Calling for information by undertaking inspection, conducting enquiries and audits of stock exchanges and intermediaries.

6. Levying fee or other charges for carrying out the purposes of the Act.

7. Performing and exercising such power under Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

Development Functions:

1. Training of intermediaries of the securities market.

2. Conducting research and publishing information useful to all market participants.

3. Undertaking measures to develop the capital markets by adapting a flexible approach.

Protective Functions:

1. Prohibition of fraudulent and unfair trade practices like making misleading statements, manipulations, price rigging etc.

2. Controlling insider trading and imposing penalties for such practices.

3. Undertaking steps for investor protection.

4. Promotion of fair practices and code of conduct in securities market.