Please refer to MCQ Questions Chapter 10 Financial Statements – II Class 11 Accountancy with answers provided below. These multiple-choice questions have been developed based on the latest NCERT book for class 11 Accountancy issued for the current academic year. We have provided MCQ Questions for Class 11 Accountancy for all chapters on our website. Students should learn the objective based questions for Chapter 10 Financial Statements – II in Class 11 Accountancy provided below to get more marks in exams.

Chapter 10 Financial Statements – II MCQ Questions

Please refer to the following Chapter 10 Financial Statements – II MCQ Questions Class 11 Accountancy with solutions for all important topics in the chapter.

MCQ Questions Answers for Chapter 10 Financial Statements – II Class 11 Accountancy

Question. Manager’s commission is always treated as ……. expense.

(a) outstanding

(b) accrued

(c) unearned

(d) prepaid

Answer

A

Question. If the rent of one month is still to be paid, the adjustment entry will be

(a) debit outstanding rent account and credit rent account

(b) debit profit and loss account and credit rent account

(c) debit rent account and credit profit and loss account

(d) debit rent account and credit outstanding rent account

Answer

D

Question. ABC limited has taken a loan worth ₹ 5,50,000 from Vishal @ 10% per annum for the whole year. Which of the following journal entries will be passed in books of ABC limited to incorprote above adjustment?

(i) Interest on Loan A/c Dr 55,000

To Loan A/c 55,000

(ii) Profit and Loss A/c Dr 55,000

To interest on Loan A/c 55,000

(iii) Trading A/c Dr 55,000

To Interest on Loan A/c 55,000

Alternatives

(a) Only (ii)

(b) Only (iii)

(c) Both (i) and (ii)

(d) Both (i) and (iii)

Answer

C

Question. In case of sole proprietor business, income tax is considered as

(a) business expense

(b) proprietor’s expense

(c) capital expense

(d) All of these

Answer

B

Question. Loan from bank @ 12% per annum is ₹ 8,00,000. Interest on loan is due for the whole year. Amount shown on liabilities side of balance sheet will be

(a) ₹ 8,00,000

(b) ₹ 8,12,000

(c) ₹ 8,90,000

(d) ₹ 8,96,000

Answer

D

Question. If the rent received in advance is ₹ 2,000, the adjustment entry will be

(a) debit profit and loss account and credit rent account

(b) debit rent account and credit rent received in advance account

(c) debit rent received in advance account and credit rent account

(d) None of the above

Answer

B

Question. Entries which need to be accounted for in the books of accounts at the time of preparing final accounts are called ……… .

(a) Opening entries

(b) Closing entries

(c) Adjustment entries

(d) Final account entry

Answer

C

Question. On 20th March, 2020 stock worth ₹ 80,000 was destroyed by fire. The stock was insured and the insurance company admitted full claim.

Which of the following journal entry/entries will be passed for above situation?

(i) Loss by Fire A/c Dr 80,000

To Trading A/c 80,000

(ii) Insurance Company Dr 80,000

To Loss by Fire A/c 80,000

(iii) Profit and Loss A/c Dr 80,000

To Loss by Fire A/c 80,000

Alternatives

(a) Only (i)

(b) Only (ii)

(c) Both (i) and (ii)

(d) Both (ii) and (iii)

Answer

C

Question. Consider the following information.

Cost of New Machine Purchased = ₹ 1,20,000 Installation Expenses = ₹ 30,000

Estimated Life of Machine = 5 years Residual Value after 5 years = ₹ 25,000

Company started the production with this machine from 1st October, 2020. Assuming that the firm closes its accounts on 31st December every year, find the adjusted value of machine on 31st December, 2020?

(a) ₹ 1,43,750

(b) ₹ 1,25,000

(c) ₹ 1,75,000

(d) None of these

Answer

A

Question. Match the following.

Codes

A B C D

(a) (iii) (iv) (ii) (i)

(b) (iii) (i) (iv) (ii)

(c) (iii) (iv) (i) (ii)

(d) (iii) (ii) (i) (iv)

Answer

B

Question. Need or objective for adjustments in preparation of final accounts is ……… .

(a) to know the correct financial position

(b) to provide for all losses

(c) to reduce the liability

(d) to increase the assets

Answer

A

Question. If the insurance premium paid ₹ 1,000 and prepaid insurance ₹ 300, the amount of insurance premium shown in profit and loss account will be

(a) ₹ 1,300

(b) ₹ 1,000

(c) ₹ 300

(d) ₹ 700

Answer

D

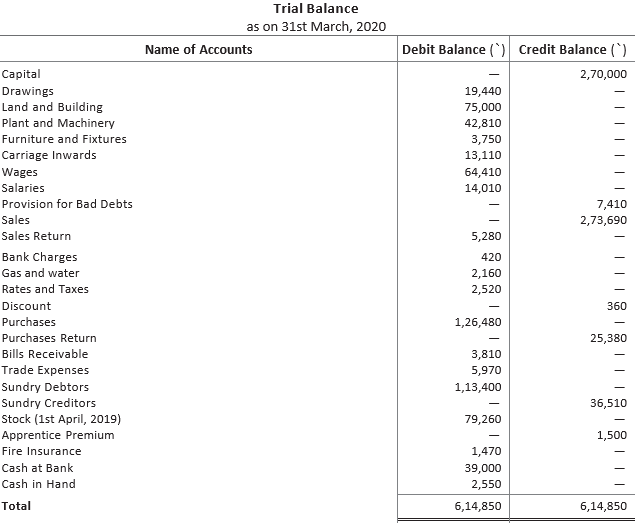

QuestionRahul’s trial balance provide you the following information.

Debtors ₹ 80,000

Bad Debts ₹ 2,000

Provision for Doubtful Debts ₹ 4,000

It is desired to maintain a provision for bad debts of ₹ 1,000. State the amount to be debited/credited in profit and loss account.

(a) ₹ 5,000 (Debit)

(b) ₹ 3,000 (Debit)

(c) ₹ 1,000 (Credit)

(d) None of these

Answer

C

Question. Goods distributed as free samples. The effect of this entry will be

(a) It is the proprietor’s drawings

(b) It is deducted from purchases in the trading account

(c) It will be shown on the debit side of the profit and loss account

(d) Both (b) and (c)

Answer

A

Question. Consider the following statement.

(i) Interest on capital is an expense for the proprietor.

(ii) Interest on capital is shown on the debit side of profit and loss account.

(iii) It is added to the capital in the balance sheet.

Alternatives

(a) (i), (ii), (iii) are correct

(b) Both (i) and (ii) are correct

(c) Both (ii) and (iii) are correct

(d) (i), (ii), (iii) are incorrect

Answer

C

Assertion-Reasoning MCQs :

There are two statements marked as Assertion (A) and Reason (R). Read the statements and choose the appropriate option from the options given below.

(a) Assertion (A) is correct, but Reason (R) is false

(b) Both Assertion (A) and Reason (R) are true

(c) Both Assertion (A) and Reason (R) are false

(d) Assertion (A) is false, but Reason (R) is true

Question. Assertion (A) Bad debts stated in adjustment are debited to trading account and shown on assets side by deducting them from debtors.

Reason (R) Bad debts is an indirect expense which is irrecoverable from debtors.

Answer

D

Question. Assertion (A) Outstanding salary given in adjustment is added to salary account on debit side of profit and loss account and exhibited on liability side of balance sheet.

Reason (R) Outstanding salary is provided as per accrual concept of accounting.

Answer

B

Question. Assertion (A) Provision for doubtful debts is shown on asset side of balance sheet by way of deduction from sundry debtors.

Reason (R) It is created in accordance to convention of full disclosure.

Answer

A

Question. Assertion (A) Goods distributed as free samples are recorded at purchase cost.

Reason (R) Goods distributed as sample is not a sale, but advertisement expense.

Answer

B

Question. Assertion (A) Depreciation specified in adjustment is shown on debit side of trading account and on asset side by way of substraction from value of fixed assets.

Reason (R) Depreciation is a direct and non-cash expense which leads to decrease in value of assets.

Answer

C

Question. Assertion (A) Accrued income given in adjustment is added to respective income on the credit side of profit and loss account and also shown on asset side of balance sheet.

Reason (R) Accrued income is provided as per accrual concept of accounting.

Answer

B

Case Based MCQs :

CA Rahul Gupta works as a chartered accountant at Netware clothing in Kamla Nagar. Netware clothing deals in Western clothes and dresses. Rahul gupta is working here for the past 8 years.

On 31st March, 2020, Rahul prepared trial balance after preparation of accounts and subsidiary books. His trial balance total also agreed. But CA Rahul, being a diligent CA checked all the books of accounts again and discovered some of the information which were not taken into consideration. Following trial balance was prepared by CA Rahul and additional information found by him.

Adjustments

Charge depreciation on land and building at 2 1/2%, on plant and machinery at 10% and on furniture and fixtures at 10%. Make provision of 5% on debtors for doubtful debts. Carry forward the following unexpired amounts

(a) Fire insurance ₹ 375

(b) Rates and taxes ₹ 720

(c) Apprentice premium₹ 1,200

(d) Closing stock ₹ 88,170

CA Rahul immediately incorporated above adjustments while preparing final accounts of Netware clothings.

Question. Which of the following will be the amount of rates and taxes shown in profit and loss account?

(a) ₹ 1,800

(b) ₹ 2,520

(c) ₹ 3,240

(d) ₹ 720

Answer

A

Question. At what amount, land and building will be shown in balance sheet?

(a) ₹ 75,000

(b) ₹ 76,800

(c) ₹ 73,125

(d) ₹ 76,875

Answer

C

Question. Which of the undermentioned options reflect correct treatment for following adjustment?

Make provision of 5% on debtors for doubtful debts.

(a) ₹ 5,670 debited to profit and loss account and deducted from sundry debtors in balance sheet.

(b) ₹ 13,080 debited to profit and loss account and deducted from sundry debtors in balance sheet.

(c) ₹ 5,670 debited to trading account and deducted from sundry debtors in balance sheet.

(d) ₹ 13,080 debited to trading account and deducted from sundry debtors in balance sheet.

Answer

A

Question. Which of the undermentioned amount is correct answer for apprentice premium to be shown in profit and loss account?

(a) ₹ 300

(b) ₹ 1,500

(c) ₹ 1,200

(d) ₹ 1,800

Answer

A

Aman Mathur recently cleared his final CA exam in his 1st attempt. He is now appointed as a CA in Gopal Das Textiles, Chandni Chowk. On 31st March, 2020, he prepared trial balance whose total also agreed. But later he discovered some additional information which has to be taken into account while preparing final accounts. After taking into account few adjustments, he prepared final accounts of Gopal Das Textiles. Following trial balance was prepared by CA Aman Mathur and undermentioned adjustments were discovered by him.

Additional Information

(a) Written-off ₹ 20,000 as bad debts and provision for doubtful debts is to be maintained at 5% on debtors.

(b) Loan from X was taken on 1st August, 2018. No interest has been paid so far.

(c) Included in general expenses is insurance premium₹12,000, paid for one year ending 30th June, 2020.

(d) 1/3 of wages and salaries is to be charged to trading account and the balance to profit and loss account.

(e) Entire stationery was used by the proprietor for his personal purpose.

(f) Closing stock was valued at ₹ 5,00,000.

Question. Which of the following will be the correct treatment for entire stationery used by proprietor for his personal purpose?

(a) Only shown in balance sheet as drawings.

(b) Shown as expense in profit and loss account and drawings in balance sheet.

(c) Shown as expense in trading account and drawings in balance sheet.

(d) None of the above

Answer

A

Question. Which of the following amount of prepaid insurance premium will be shown in balance sheet?

(a) ₹ 6,000

(b) ₹ 5,000

(c) ₹ 4,000

(d) ₹ 3,000

Answer

D

Question. Which of the following amount of loan will be shown in balance sheet?

(a) ₹ 1,12,000

(b) ₹ 88,000

(c) ₹ 1,00,000

(d) ₹ 1,24,000

Answer

A

Question. Calculate the amount of wages and salaries to be debited to profit and loss account?

(a) ₹ 60,000

(b) ₹ 1,80,000

(c) ₹ 1,20,000

(d) ₹ 3,00,000

Answer

C